New York’s Hudson Valley is known for its artist communities, antique shops and rolling farms. Fast-forward a few years and there may be a new feature: giant offshore wind components floating downriver on barges, with new riverside factories helping to replace lost jobs at the soon-to-close Indian Point nuclear energy plant.

Within the next few months, New York will make a big decision with consequences that may last decades. By the end of 2020, the state will allocate as much as $200 million in public funding toward offshore wind port infrastructure, to be matched by private investment.

While not an enormous sum compared to the $70 billion of estimated investment that will flow into U.S. offshore wind projects by 2030, New York’s port funding — along with a recent change to how the solicitation is structured — will all but guarantee that the chosen sites will play a major role in the rapidly emerging industry on the Atlantic coast.

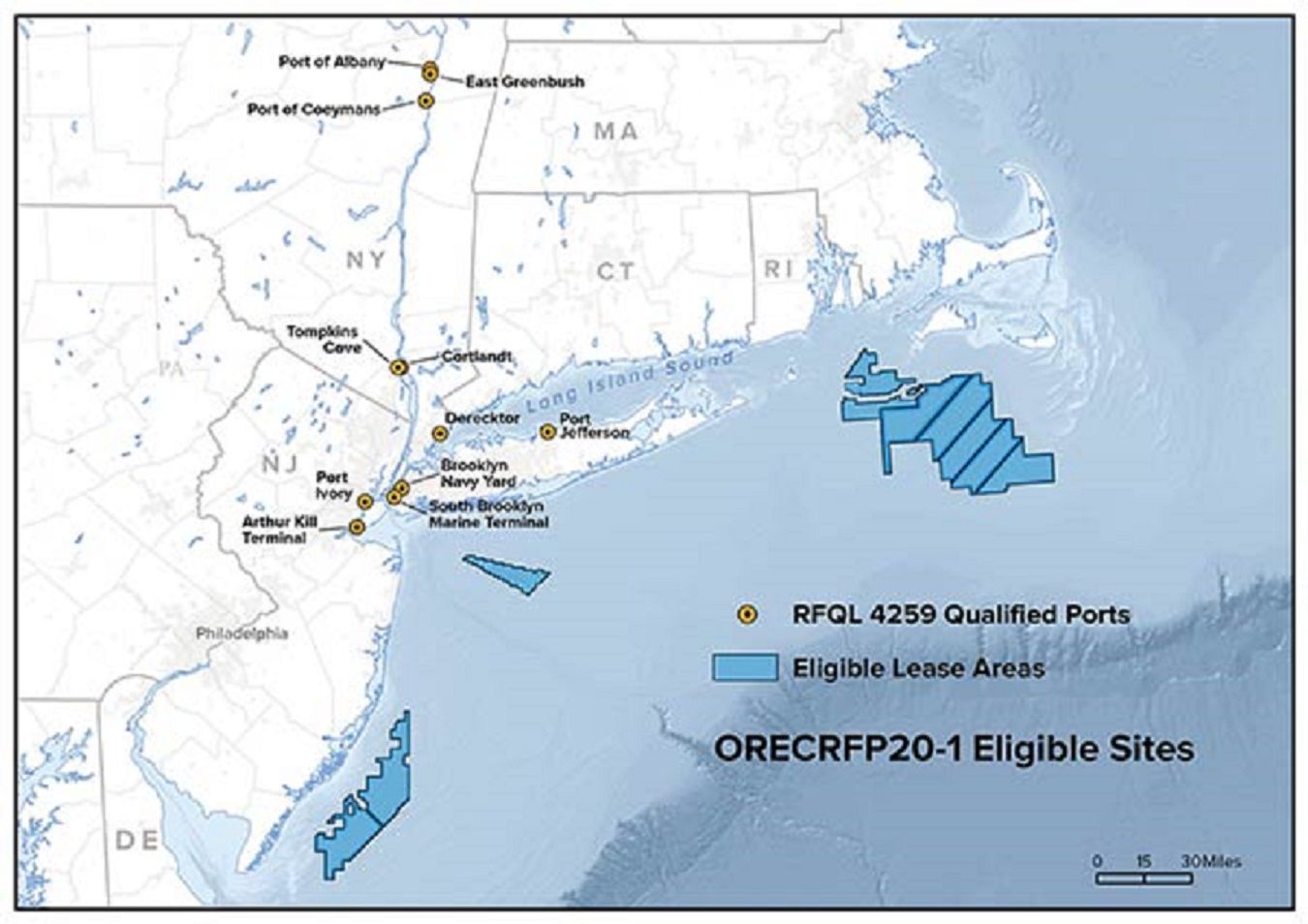

Eleven ports have been prequalified as eligible for the funding, with the winner (or winners) to be announced by the end of 2020.

Very soon, then, the industry will have a much clearer picture of what New York’s future offshore wind supply chain will look like, and which communities will benefit most.

A new neighbor for the Indian Point Energy Center

Many of the ports on the shortlist created by the New York State Energy Research and Development Authority (NYSERDA) have been angling for an offshore wind role for years — places including the South Brooklyn Marine Terminal and Long Island’s Port Jefferson.

But when the final list of prequalified ports was published, one option seemed to appear out of the blue: Port Cortlandt, located roughly 35 miles north of Manhattan along the Hudson River. The site is located next to the Indian Point Energy Center, the closest nuclear plant to New York City.

First opened in the 1960s, Indian Point is something of a landmark along the lower Hudson River Valley. In its heyday, Indian Point generated a quarter of the power consumed by New York City and Westchester County. But Governor Andrew Cuomo has spent years trying to close the nuclear facility, saying New Yorkers will be able to “sleep a little better” once it’s shut down. Following a 2017 agreement with the state, Indian Point has already closed two of its three units, and the final one will cease operating by April 2021 — punching a big hole in the local economy.

The Indian Point Energy Center will close its last generating unit by April 2021. (Photo: Entergy)

Even in its diminished capacity, there are still 750 workers employed at Indian Point, according to plant owner Entergy. An offshore wind hub in Cortlandt would not absorb anywhere near that many people, or at least not at first, but it would make an impact — and the symbolism would be potent in a state that plans to get 70 percent of its power from renewables by 2030.

AKRF, a New York-based engineering consultancy, came upon the Cortlandt site as it scoured the state’s coastline for possible offshore wind hubs and helped get the port onto NYSERDA’s shortlist, says Michael Lee, the firm’s president.

There are 54 acres of waterfront and upland property available today — making it one of the largest ports on NYSERDA’s list — and it could expand to 180 acres, Lee said in an interview.

“Over time, as the Indian Point nuclear power plant decommissions, some of the land immediately adjacent to it could become part of future phases once the port is developed."

Given its size, Port Cortlandt could host factories capable of making the biggest and most valuable offshore wind components: 350-foot blades, house-sized nacelles and the towers that hoist them into the air.

“We’re looking at those largest types of fabrication elements given the dearth of possibilities downstate from us,” Lee says, adding that some of Indian Point’s workforce may have skills that could translate over to such factories.

The Town of Cortlandt owns the site and "is willing to sell" to the right buyer, Lee says. "We have literally multiple meetings a week where we're talking to potential tenants."

Why the Hudson Valley?

It may seem strange to locate offshore wind factories up the Hudson River rather than somewhere closer to the coast. But there are various arguments for doing so, not least the limited supply of sizable sites around New York Harbor and on Long Island.

“We’re really not that far” from future offshore wind project sites, Lee says, suggesting that a “barge network” could bring manufactured components down the Hudson to staging areas closer to open waters.

Storm surges and their huge waves, like those seen in Superstorm Sandy, are a potential concern for facilities closer to the coastline, he says.

New York policymakers may wish to encourage a wider geographic distribution of the economic benefits to come from the imminent offshore wind boom. And there’s already a precedent: In New York’s first solicitation, held last year, Norway’s Equinor pledged to use the Port of Coeymans near Albany — 100 miles north of Cortlandt — for its 816-megawatt Empire Wind project.

Another compelling argument for an upstate hub: cheaper labor.

“The labor market is considerably cheaper upstate than it is downstate,” says Joe Martens, director of the New York Offshore Wind Alliance, an industry group.

“In the process of sharpening their pencils, [offshore wind developers] have to weigh the costs of the additional shipping down the Hudson River against the labor and supply costs in the [NYC] metropolitan area.”

New York has prequalified 11 offshore wind ports as eligible for state investment. (Image: NYSERDA)

Facilities along the Hudson have long played roles in similar industries, Martens notes. “The Port of Coeymans was very involved in building and shipping many of the components that went into the Mario Cuomo Bridge over the Hudson River. They also assembled components for a major substation for a New Jersey power plant that was floated down the Hudson."

"So this has been done before," Martens says. “They move really, really big and heavy stuff down the Hudson, and they’ve proven they can do it competitively.”

The COVID-19 plot twist

There’s a new wrinkle in New York’s offshore wind plan that will impact how things play out.

When Gov. Cuomo first announced the $200 million of funding, the expectation was that there would be a separate, standalone request for proposals (RFP) for ports.

Then COVID-19 hit. New York delayed its second solicitation for offshore wind farms, before ultimately linking that solicitation with the port RFP, creating a consolidated structure that is novel in the U.S. market — and not without its complications.

Under the new structure, offshore wind developers will bid proposed projects into the upcoming solicitation — worth up to 2.5 gigawatts — while including specific plans for using one or more New York ports. The $200 million of state port funding will be allocated based on which offshore wind projects win the solicitation.

The upshot is that for Port Cortland — or any other port — to receive a chunk of the funding, it will need the backing of at least one, and ideally several, offshore wind developers.

There are potential downsides to such a unified RFP structure. Some ports may not like the fact that “they’re sort of at the mercy of the developers; they would like to make their own proposals and control their fate,” Martens says. “I don’t know that that’s a universal feeling, but I’ve certainly heard that.”

But from NYSERDA’s perspective, holding a single solicitation is more efficient than running two of them — no small feat during a pandemic. Further delays could have damaged market confidence and undermined New York’s chances of securing offshore wind factories and jobs.

If nothing else, the consolidated solicitation “forces new ways of thinking,” Martens says. “I’m very optimistic that we’re going to get some really interesting proposals.”

AKRF’s Lee says the unified RFP structure is “challenging but probably the best thing for the industry,” ensuring that the state’s investment goes to ports that will be used in the next round of projects.

“I think it will be to the benefit of the industry to have that sort of security, knowing that their bids are actually tied to real-world infrastructure.”

For Port Cortlandt, the game now is about convincing offshore wind developers and their suppliers that the Hudson Valley can play a key role in their projects. Among the developers expected to bid in New York's upcoming solicitation are Ørsted, Equinor and Atlantic Shores (the latter is a joint venture of Shell and EDF).

“Our goal is to have all five of the major entities that we expect to bid looking at this [site] and seeing it as an asset,” Lee says. “We’re in several layers of conversation with all of them.”