The U.S. solar market is growing. At the same time, it's getting more diverse in terms of project types, relevant policies and related technologies.

The Smart Electric Power Alliance's (SEPA) recently released 2015 Solar Market Snapshot reports that total U.S. solar capacity reached 22.5 gigawatts AC (more than 25 gigawatts DC) last year. The amount of solar on residential rooftops across the country increased 50 percent, and the number of residential solar projects made up 97 percent of installations. However, utility-owned solar projects continue to deliver the most capacity -- nearly 3,500 megawatts AC in 2015, compared to 1,800 megawatts AC for residential.

It comes as no surprise that California's investor-owned utilities led the country in the number of megawatts installed last year. But the list looked quite different with respect to watts installed per customer, where the top five positions were taken by two small Ohio utilities (Village of Minster and Carey Municipal Power & Light), Dominion North Carolina, the City of Palo Alto and the Guam Power Authority.

The Solar Market Snapshot, which is based on market intelligence provided by about 350 utilities, includes several other highlights on the state of the U.S. solar market. Here are three more important takeaways.

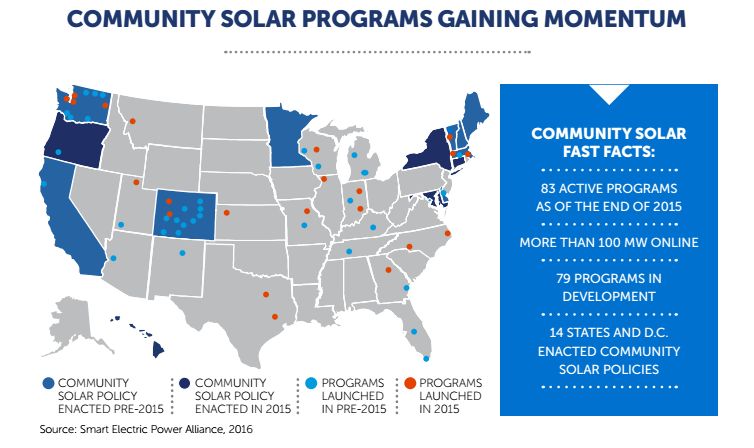

1) Community solar is gaining momentum

At the end of 2015, there were 83 active community solar programs in the U.S. -- an 80 percent increase from the year before. Another 79 programs are scheduled to come on-line in 2016, and a SEPA survey found 89 percent of utilities are already offering or actively considering a community solar program.

The survey found that utilities planning a program preferred for it to be utility-managed rather than run by a third party. However, 60 utilities, or 32 percent of respondents, said they are considering both program designs.

There are currently more than 100 megawatts of community solar on-line (figures would likely have been higher if not for program delays).

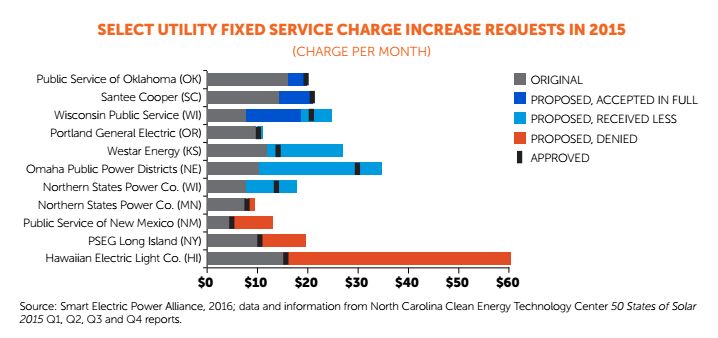

2) Strong interest in rate reform

The report found that 61 utilities from 30 states proposed increasing fixed service charges in 2015. Forty-two rate cases were decided last year -- 25 of which were approved and 17 of which were rejected. About 40 percent of these proposals sought fixed charge increases of 50 percent or greater, while 18 proposed increases of 100 percent or more.

"Utility companies have indicated that raising general fixed service [charges] or adding solar-specific charges improves cost-of-service allocations among fixed, variable and capacity-based costs. The assertion is that removing fixed costs from the variable rate justifies the increases," the report states.

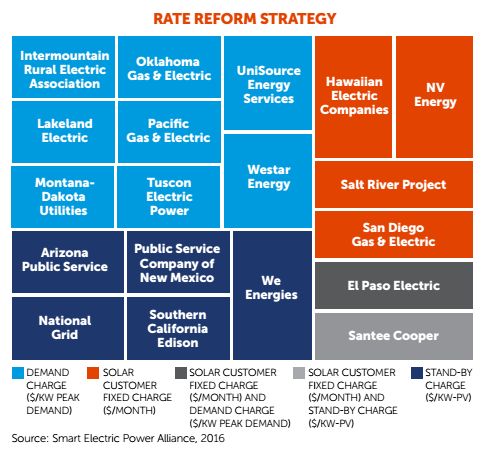

Last year, utilities also proposed several different types of solar-specific rate changes. The main strategies include a standby charge based on a customer's installed solar capacity, an additional fixed fee and a demand charge based on a customer's highest energy usage in a given period of time.

Salt River Project, Intermountain Rural Electric Association, Lakeland Electric, Nevada Power, Sierra Pacific, and We Energies received regulatory approval for either standby or demand charges in 2015. We Energies’ charges were struck down in court.

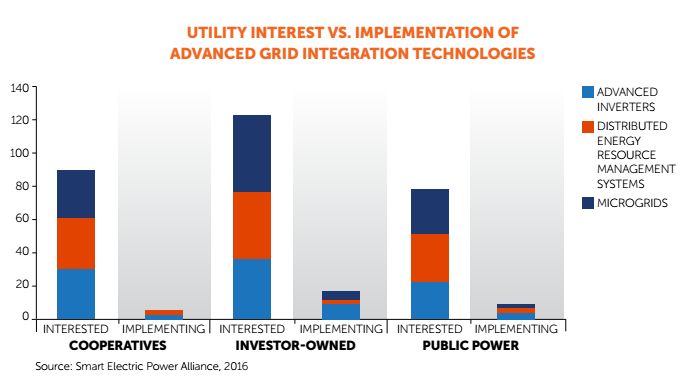

3) Advanced grid technology deployments are underway

As solar penetration increases, utilities have started to test advanced technologies that will allow them to integrate ever-larger amounts of solar and other distributed resources, such as advanced inverter functionality, distributed energy resource management systems (DERMS), and microgrids.

About half of cooperatives and public power utilities surveyed by SEPA expressed interest in advanced grid integration technologies; interest jumped to two-thirds among investor-owned utilities. But while there's a high level of interest, actual technology deployment numbers remain low.