American solar company Suniva is getting caught in the continuing cross-fire of the SolarWorld-led tariff petition against Chinese solar modules.

As Shayle Kann, GTM Research VP, puts it, "If Suniva uses a Chinese wafer, makes its cell in the U.S., ships it to China for module assembly and then back to the U.S., it would be subject to the tariff," according to the terms of a new petition filed by SolarWorld, which broadens the scope of the original ruling.

The Department of Commerce’s 2012 ruling imposed anti-dumping tariffs averaging 31 percent on crystalline silicon cells manufactured in China. The new petition before the U.S. International Trade Commission aims to close a gap in SolarWorld’s initial petition that allows Chinese module manufacturers to avoid the tariff by producing solar wafers in China, shipping them to Taiwan for cell manufacturing, and then back to China for module assembly.

Suniva is objecting to the new petition and has submitted its own filing to the Department of Commerce.

According to the filing, Suniva is looking for a comment period to examine some of the "complications" and the "important and potentially confusing issues raised by the lack of clarity in some of the proposed scope language." Here is an example that tests the meaning of "origin" and "substantial transformation."

GTM Research analysts are currently on the ground quantifying PV production in Jamaica. (This just in: Jamaica was picked at random by Suniva's law firm for use in this example.)

Kann points out, "This petition could significantly impact the U.S. solar market, in large part because of its scope. In contrast to the initial tariffs, which apply only to crystalline silicon PV cells manufactured in China, this petition broadens the scope both geographically (adding Taiwan) and vertically (adding both wafers and modules)." Suniva's law firm, Steptoe, has declined to comment.

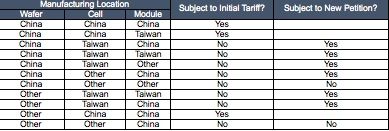

GTM Research provided this distillation of the petition scope:

Kann adds, "Everything hinges on the Department of Commerce’s scope determination and the final determinations regarding subsidies and dumping in both China and Taiwan. Of course, this could all be rendered moot if the U.S. and China were to reach a negotiated solution. This was the result in Europe and might well be the result here as well."

We've written about how tariffs on Chinese solar panels have resulted in collateral damage to small American companies building consumer devices, as well as the ineffectiveness of tariffs in unbending the market. Quaint 20th-century notions like trade tariffs at international borders may lose their meaning in a connected world built on fluid and complex supply chains.

Suniva designs and builds high-efficiency solar cells and modules using ion-implantation technology. The company competes with SunPower, Panasonic, Sanyo, and Silevo. And China. And SolarWorld.

***

GTM Research clients have access to the analyst team’s ongoing coverage and analysis of the AD/CVD petition and its likely market impacts. For more information, contact Justin Freedman at [email protected].