In early December, GTM Research published a comprehensive look at the U.S. downstream PV market, The United States PV Market Through 2013: Project Economics, Policy, Demand and Strategy, in which we predicted that New Mexico would become one of the leading solar demand states over the next few years, rising above 80 MW in annual installations by 2012.

It was a dangerous call given that New Mexico only had one megawatt in total installed at the end of 2008. But since the report came out, we've seen two major announcements in the state that could increase capacity by a combined 135 MW.

First, On December 23 Xcel energy announced completion of a 20-year PPA with SunEdison (or SPSA, as SunEdison likes to call it) for projects totaling 55 MW on five sites in Lea and Eddy Counties in southeastern New Mexico. And then this week PNM, the largest utility in New Mexico, announced that it would re-file its renewable resource plan with a significantly expanded PV procurement component. The new plan will include expanded incentives for customer-owned generation and up to 55 MW of PNM-owned capacity, of which up to 10 MW will be sited on government facilities and other tax-exempt properties.

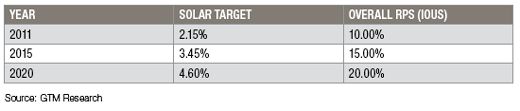

The conditions are right for massive market growth in New Mexico. The state has a renewable portfolio standard of 10 percent by 2011, rising to 15 percent in 2015. An August 2007 ruling by the state's public utilities commission requires utilities to meet the RPS requirement through a "fully diversified" portfolio, which includes a minimum of 20 percent solar power. In addition, 1.5 percent of the requirement must come from distributed generation in 2011, rising to 3 percent in 2015. PV is expected to comprise the vast majority of the distributed target. As a result, solar will reach nearly 4.6 percent in 2020, the most aggressive solar target in the nation.

PV projects in New Mexico also benefit from significant state tax credits. These credits apply to utility-scale projects as well as commercial and residential systems, representing one of the few incentives directed at large commercial and utility-scale projects in the U.S. Finally, the maturity of neighboring state markets Arizona and Colorado will help attract the necessary expertise and infrastructure into New Mexico.

We've long been talking about the rise of utility-owned PV generation, and PNM isn't the first to catch on. Nor is Xcel the first to contract for large-scale distributed PV. But they are among the first in New Mexico. And as the state's solar RPS requirement ramps up, expect to see more announcements and more projects in the early stages of development.