Nevada Governor Brian Sandoval signed Assembly Bill 405 into law on Thursday to the cheers of solar companies and advocates. AB 405 reinstates net metering for rooftop solar customers in Nevada, after utility regulators eliminated the policy in December 2015, throwing the Silver State’s solar market into disarray.

Because the policy change was applied retroactively, it triggered enormous public outcry, and the steep new fees effectively put a freeze on new rooftop solar installations. Nevada saw a 32 percent decline in solar jobs last year after large residential installers chose to pull out of the state. But with the new law now in place, Tesla, Sunrun and Vivint Solar said they plan to resume sales immediately.

Tesla Chief Technical Officer JB Straubel told reporters yesterday that AB 405 would bring Nevada “thousands of jobs and millions of dollars in positive economic benefit.” Local solar installers, many of whom were forced to make layoffs last year, thanked the governor for bringing jobs back to their communities.

"Sol-Up USA greatly appreciates solar compensation coming back to Las Vegas and Nevada, ending two years of dire straits for the solar industry and its employees,” said Frank Rieger, CEO of the Las Vegas-based solar installation company. “We’re glad that our legislation returned to the path of common sense so that Sol-Up USA can continue to provide the best products and services to its clients in the Las Vegas valley.”

Under the new law, new solar customers will immediately begin to be reimbursed for the excess energy they generate at 95 percent of the retail electricity rate. The credit is scheduled to decline in 7 percent increments for every 80 megawatts of rooftop solar deployed, to a floor of 75 percent of the retail rate. The discounted compensation rates are designed to ensure that solar customers pay their fair share to use the power grid as solar penetration increases, but still leave a lot of room for growth.

The 80-megawatt threshold for each credit tier is significant. In Nevada's biggest year, before the net metering policy changed, the state deployed around 100 megawatts of residential solar. Assuming the market booms again, it will likely still take around four years to get to 75 percent of the retail rate. And even at 75 percent, net metering compensation still looks economically appealing.

While this part of the bill serves to revive the Nevada solar industry -- and is getting a lot of attention as a result -- the net metering piece is not even the most exciting part of AB 405, according to Jon Wellinghoff, former chief policy officer at Tesla/SolarCity, who previously served as chairman of the Federal Energy Regulatory Commission.

The right to self-generate

The passage of AB 405 marks the first time in U.S. history that consumers have been statutorily guaranteed the right to self-generate electricity, said Wellinghoff, who helped craft portions of the bill in his new role as an independent policy consultant. Under Section 24 of the bill, consumers are granted the right to generate their own electricity and offset their own internal usage one-for-one at the full retail rate, in the same way they can install energy efficient light bulbs or appliances and save energy at the retail rate. Whatever energy you no longer take from the grid, you don’t have to pay for.

The right to self-generate is particularly advantageous when solar is combined with energy storage, where all of the generated electricity can be now consumed onsite at a home or business and credited at the consumer’s full retail rate, Wellinghoff said.

“The declining [net metering] rate is ultimately irrelevant when you talk about solar-plus-storage, with the right to self-generate,” he said. “You’ve got to make sure that you have this right to self-generate first; otherwise a utility can reach in behind your meter and say, ‘Oh, no. Wait a minute. We have the right to sell you all of your energy and tell you what rate we're going to pay you for anything you generate.’ Even though you might be trying to use that [generation] to offset your own load.”

There’s long been a fear among distributed solar advocates that a utility could take economic control of a technology that a customer has paid for. In a 2015 paper, Wellinghoff and Steven Weissman argued that Americans have the right to self-generate, while remaining connected to the grid, “in common law, supported by implication in state and federal law.”

“You have a right to grow trees in your backyard. If you want to cut them down and burn firewood, you have the right to do that,” said Wellinghoff. “Ultimately, it's just a fundamental right of consumers to be able to produce something on their property and use it for their own use.”

In energy, if customers can self-generate and store electricity at the retail rate, the net metering debate becomes moot, because nothing is being sent to the grid -- assuming that solar plus energy storage is affordable enough for customers to deploy, which is still a big question mark. Wellinghoff is confident that residential storage will be competitive in six to 18 months. “It’s evolving extremely rapidly,” he said.

No discrimination for solar-plus-storage

The right to self-generation isn’t the only other goodie for the solar industry in AB 405. Section 24 also guarantees the right for customers to interconnect rooftop solar or a solar-plus-storage system in a “timely manner,” with little utility interference, provided all health and safety codes are complied with.

It guarantees that excess energy consumers send to the grid will be “given priority in planning and acquisition of energy resources by an electric utility,” meaning that it cannot be curtailed, said Wellinghoff. Excess customer generation must also always be given a fair price -- based on the discounted credit tiers described above.

Furthermore, AB 405 prohibits rooftop solar and solar-plus-storage customers from being treated as a separate rate class, which is a major win for distributed solar. It means utilities cannot charge any additional fees (either fixed charges or demand charges) that are different from what the broader rate class is paying.

When Nevada regulators eliminated net metering in 2015, they also required that rooftop solar customers pay increasing monthly fixed charges, which erased all of the bill savings these customers expected to see. The language in AB 405 prevents this type of fee from being applied again in future. It’s a significant development, given that utilities across the country have made the case -- successfully in some places -- that solar customers should be treated as a distinct group.

In 2015, Arizona’s Salt River Project implemented a solar-specific demand rate that caused solar customers to pay, on average, an additional $30 per month. A year after it was implemented, customers had learned to live with the new rate, although many saw their savings from solar disappear. Meanwhile, the rate complexity caused the number of new solar customers to plummet. A separate regulatory decision in Arizona late last year established that rooftop solar customers in Arizona Public Service and Tucson Electric Power territory are considered to be in a separate rate class, and are subject to specific fees and rate plans, although policy changes to date have had a limited effect on the market.

In Texas, Oncor is currently seeking to implement a complicated mix of a demand charge and a fixed charge that the industry says would be crippling to the budding rooftop solar sector. These types of charges are now prohibited in Nevada. Legislators did call for opening a regulatory proceeding to design a time-variant rate for energy storage, but it's meant to incentivize storage and be optional.

Now that Nevada has enshrined these rights for solar-plus-storage customers in law, it will be interesting to see if other states decide to follow suit.

“I think it's replicable in any state where there is a big net metering debate going on,” said Wellinghoff. He imagined a settlement scenario where solar-plus-storage customers would continue to pay the fixed fees that all other customers pay and accept a reduction in the net metering credit, in exchange for the right to self-generate and protection from discriminatory fees.

Is the utility death spiral back?

It’s difficult to see regulated utilities across the U.S. signing up to let their retail sales go and have hundreds of thousands of mini power plants crop up on their system. But they may not have a choice if there’s legislative action, like in Nevada, or if they can’t ignore the market forces.

In California, some 80 percent of investor-owned utility customers are expected get their electricity from alternative sources in 2025. And there’s a discussion underway on how to reform the state’s electricity sector as a result.

“The retail distribution utilities are going out of the business,” said Wellinghoff. The poles and wires will soon be what’s left, “and that's fine,” he said. “It's not that there will be a utility death spiral. It's just that they'll have a restructured business.”

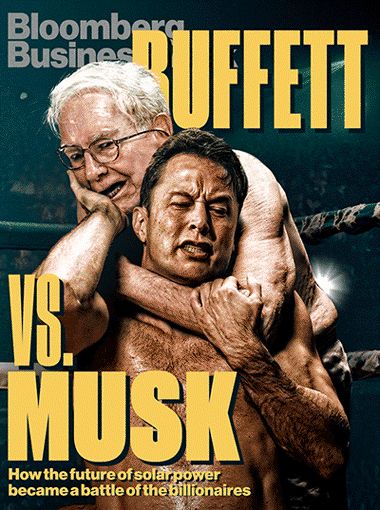

Over the past two years, the Nevada solar drama has been presented as a battle between Elon Musk and Warren Buffett -- and their competing views on the future of the energy system. Through Tesla and SolarCity, Musk is looking to build a distributed, low-carbon grid that uses a lot of batteries made at Tesla's Gigafactory near Reno. While Buffett, who owns NV Energy via Berkshire Hathaway, is committed to the centralized, regulated utility business model. In a letter to investors last year, Buffett outlined the risks that distributed energy resources pose to traditional power companies.

With the AB 405 now law, and a move to deregulate the Nevada electricity market in the works, Wellinghoff doesn’t believe there’s much of a battle to be fought anymore.

“It’s really a very false conflict that's being established here, I think. The utilities are fading into wires companies. That's where they're going,” he said. “People like Warren Buffett will decide which businesses they want to get into. If they want to get into the entrepreneurial energy services business, they'll invest in companies like Tesla. If they want to stay in the wires business, they'll continue to invest in companies like NV Energy.”

“Ultimately, it's going to be the choice of any shareholder and investor to decide where they want to invest their money," he said.