Most utilities are not burying their heads in the sand when it comes to distributed energy resources; instead, they're evaluating how they can fit the technology into their businesses, according to Black & Veatch’s latest annual survey of electric utilities.

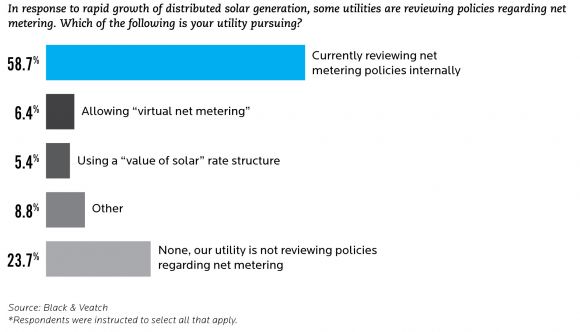

Nearly 60 percent of utilities said they were internally reviewing their net-metering policies. However, only a handful were considering virtual net metering or a "value-of-solar" rate structure. Cooperative utilities were most likely to say net metering was at least somewhat important to their long-term viability.

Just over half of utilities -- a 10 percentage-point increase from last year -- expect distributed generation to make up nearly 10 percent of all generation by 2020.

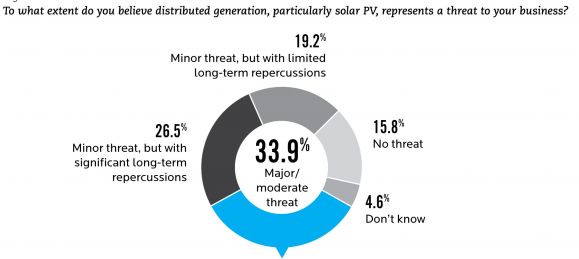

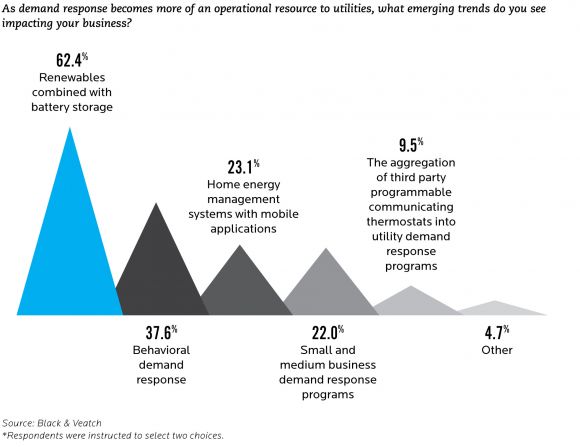

Three-quarters of utilities reported that they are investigating how to make behind-the-meter assets, such as distributed solar, part of their business model. That is because utilities see technology such as renewables combined with storage as key for operational demand response, and also because distributed generation is a growing threat to their near-term business.

Twice the number of utilities see renewables-plus-storage as an asset for operational demand response compared to those that plan to tap smart-home networks. Although bring-your-own-thermostat programs are increasingly popular, more than one-third of utilities said that behavioral demand response would be an important part of future demand response, compared to the less than 10 percent of utilities that said bring-your-own-thermostat programs would be impactful.

Those that want to own and operate behind-the-meter assets will often need regulatory changes to do so. Most utilities acknowledge that the regulatory construct has to change in order for them to survive.

More than half of utilities chose a “balanced treatment between utility and customer” as the most important regulatory shift necessary for their utility to survive in the next five years. Most regulators would argue that balanced treatment is offered today, although many utilities may disagree. About one-third said that unbundling of utility service and rates is also required.

Among electricity providers, independent power producers were most likely to say that the regulatory construct had to change, followed by investor-owned utilities. IPPs were also most likely to support performance-based ratemaking. In the eyes of many utilities, the role of IPPs is expected to grow substantially in coming years. In regions where distributed generation is growing fastest, a substantial amount of utilities said up to 60 percent of capacity could come from IPPs through 2018.