Batteries for grid-scale energy storage are getting cheaper all the time, and could be economically competitive without subsidies for certain key applications by decade’s end. That’s good news for utility customers and the power grid, but bad news for merchant power generators and utilities, Moody’s Investors Service said in a report released last week.

“The reason I decided to write this paper is the likelihood that batteries may also go the way of solar panels, in terms of dramatic price reductions,” lead author Swami Venkataraman said.

“Batteries are still not there without any form of subsidies.” But lithium-ion battery prices are falling faster than even the most rosy government projections, lending credence to claims like Tesla’s that it can reach $100 to $200 per kilowatt-hour by the end of this decade, he said.

That could make many storage applications cost-competitive for key grid and customer-facing applications, said Venkataraman. But cost savings and revenue opportunities for battery owners and operators will come at the expense of power companies like Calpine, NRG Energy and Dynegy, which could see erosion in capacity costs and reduced opportunity to make money on the margins of energy market volatility.

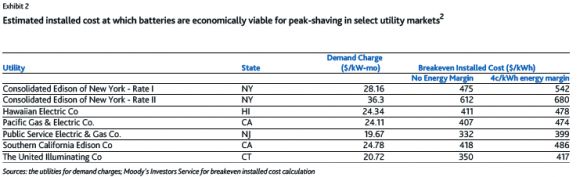

Meanwhile, regulated utilities like Consolidated Edison, Pacific Gas & Electric and Hawaiian Electric could lose the money they’re collecting on commercial and industrial customer demand charges, lowering revenues and increasing pressure to shift costs to other customers -- or reform their tariff structures to take storage into account.

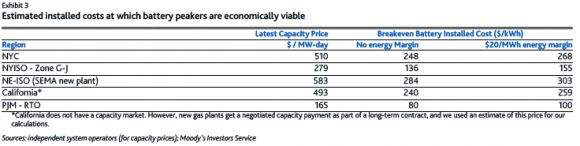

Venkataraman uses real energy-market and demand-charge data to peg the subsidy-free “breakeven” costs at which batteries could be cost-competitive in two select applications -- behind-the-meter demand reduction for buildings, and peak power supply for grid markets. These aren’t economically viable today without subsidies or firm utility contracts, he noted. But they’re also much larger than today’s cost-competitive applications for batteries, such as mid-Atlantic grid operator PJM’s frequency regulation market.

Here’s the chart for demand charges, which are costs paid by commercial and industrial customers based not on how many kilowatt-hours they use in a month, but rather on the kilowatt peak hit during any 15-minute period. Batteries can inject power to prevent those peaks for significant utility-bill savings, and companies like Stem, Green Charge Networks and SolarCity and Tesla are installing megawatts' worth of projects like these in California, New York and Hawaii.

Simply by charging with cheap nighttime power and discharging to mitigate demand charges, batteries can hit subsidy-free breakeven status at about $500 to $600 per kilowatt-hour in New York City, the country’s most lucrative market, Venkataraman said. That’s close to the $700 per kilowatt-hour all-in cost for SolarCity’s behind-the-meter peak-shaving system using Tesla Powerpack batteries, according to the U.S. Energy Storage Monitor report from GTM Research and the Energy Storage Association.

“Another 20 percent decrease in prices, and you could be in the zone of viability in New York,” he said. Other markets, like California, Hawaii and Connecticut, aren’t there yet, but will be if prices drop as expected, he said.

The customer classes used in this calculation make up a significant portion of a utility’s revenues, he noted -- about 10 percent to 15 percent of total revenues for Con Ed, for example. The report didn’t calculate how much batteries could reduce those revenues by shaving demand charges, but it could be significant, he said.

The world of energy markets, capacity procurements and other grid-scale applications represents the second big future market opportunity for batteries, albeit a far more nebulous one. To date, only a handful of projects have taken on the challenge of replacing an equivalent unit of flexible grid generation -- typically natural gas, although demand response and distributed energy resources are also emerging competitors -- with batteries.

The few that have, like AES Energy Storage’s 100-megawatt, 400 megawatt-hour lithium-ion battery complex for Southern California Edison, have been built under power-purchase agreements that guarantee a 20-year price for their services, rather than for competition on the open market. And according to Moody’s analysis, battery prices will have to fall to $100 to $300 per kilowatt-hour to compete against other “capacity” resources,

That means that “battery peakers will initially be based either on power-purchase agreements, or be a part of a utility’s rate base,” the report found. This might appear to give merchant power generators like Dynegy, Calpine and NRG Energy some room to breathe if they’re worried about batteries replacing their peaker plants.

But these merchants are also threatened by cheaper batteries in another way, Moody’s pointed out: the likelihood that more and more customers will use them to shave peaks, smooth loads, and otherwise decrease the cost and price volatility of grid energy.

This is what storage is supposed to do, and it’s why regulators support it as an alternative to more expensive, carbon-intensive resources. But “high peak-pricing is a lucrative and important source of margin for merchant generators,” the report notes, and “as such hours dwindle or as pricing peaks flatten, merchant profitability will also decline.”

To prepare for this future, more merchant generators could follow NRG Energy’s lead and get into the energy storage and behind-the-meter energy management business. But Moody’s predicts that “the potential impact of lower capacity prices and reduced price margins will outweigh the incremental revenue that most large merchant generators will receive from investing in battery plants.”

Overall, the effect will be “credit negative” for these companies, as declines in future revenues lead to reduced expectations of being able to service future debt, pushing agencies like Moody’s to lower their credit ratings. “The timing and magnitude of the credit impact would vary, depending on the extent of battery penetration.”

Regulated utilities also face losses, which could lead them to increase rates for customers that don’t have storage, or impose new fixed charges on battery-equipped customers, much as they’re doing with solar PV-equipped customers in Arizona and potentially in California.

GTM Research analyst Ravi Manghani noted that "there already are several utility rate structures today that calculate demand charges based on non-synchronous peak load. There is no reason why other utilities couldn't move toward different tariff structures."

Venkataraman noted that, if behind-the-meter batteries can cost-competitively substitute for gas-fired peaker plants or other more capital-intensive and polluting alternatives, “even though there are only some customers that are using batteries, the on-peak costs for all customers go down.” Regulated utilities could use this reduction in overall peak power costs to help defray the cost shift to non-battery equipped customers.

And if they can capture the benefits of storage -- say, by getting a piece of the benefits that come from replacing expensive grid upgrades with cheaper storage -- “the costs of running the entire utility grid will also decline,” he said.