Through September of this year, suppliers including major Chinese firms Trina Solar, JinkoSolar and JA Solar announced a total of nearly 6.6 gigawatts of new module-manufacturing capacity to be completed over the next several years.

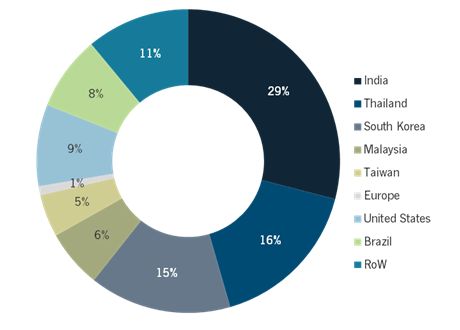

Importantly, all the announcements were for module capacity manufacturing facilities to be sited outside of China in countries including the U.S., India, Thailand, South Korea, Malaysia, Taiwan and Brazil. In the coming years, a combined 77 percent is slated for manufacturing just in India and the rest of Asia.

FIGURE: Global Share of New Module Manufacturing Capacity Announced Year-to-Date (MW)

Source: GTM Research's PVMAX

On what basis are suppliers siting new module manufacturing? To some extent, their decisions are driven by the need to avoid anti-dumping duties against Chinese-manufactured cells and modules. However, with several countries contending for new manufacturing, suppliers are factoring in much more when picking new locations.

Traditionally, the solar industry has focused on cheap input costs to keep manufacturing costs low. The most attractive countries for manufacturing have been those most competitive on all-in costs.

This is now changing. Many companies have more cash, as margins from module sales have improved over the past two years, and many have realized significant returns from downstream project development. Manufacturers are investing in manufacturing automation to achieve cost reductions through efficiency gains. They are also leveraging scale to achieve efficiencies on the procurement of materials and equipment.

As such, low input costs may no longer be the key driving factor in determining manufacturing competitiveness.

They remain an important factor, to be sure, but having ready access to the most sizable demand has become a more pressing priority. Companies are now looking to set up manufacturing in locations that provide the closest proximity to the largest available demand so they can avoid shipping costs and provide better sales service to their customers on the ground. Priority is also being given to shorter lead times, faster turnarounds on replacements, and less product damage from shorter distances traveled and less handling during shipment.

Unsurprisingly, according to GTM Research's newly published PVMAX report, China ranks the highest in module manufacturing attractiveness among a sample of 50 countries. The country is expected to offer close to 18.7 gigawatts of demand on average from 2016-2020 and far surpasses any other market. Other large domestic markets like India and the U.S., with average domestic demand from 2016-2020 of 7 gigawatts and 9 gigawatts, respectively, are also very attractive and secured a place in the top 10.

Importantly, however, countries like Malaysia, Taiwan, Singapore, and South Korea that have little to no domestic demand managed to rank in the top 10. This is because access to demand also includes a country’s access to demand at a regional level, and to some extent, the global level.

The solar industry is international, and modules manufactured in one location can be sold anywhere in the world. Yet countries differ in the extent to which they can access demand globally.

Products made by the manufacturing giants in Asia, for example, have access to many more global markets than products manufactured elsewhere thanks to those countries' dominant position in global trade. Similarly, products manufactured in a country located in a region with high overall solar demand have greater access to markets than those manufactured in countries that are more isolated. Other factors that determine countries’ access to demand are their existing module supply, susceptibility to import duties, and propensity for imposing domestic content requirements or duties.

To an extent, the healthier solar market has freed PV modules from the commodity price cycle. The market now has an appetite for a value proposition that goes beyond price.

Manufacturers have taken notice and are keen to find manufacturing locations that are more broadly attractive. In a global industry with differentiated needs, they want to tailor their product offerings and go beyond just providing value based on lower costs. While access to demand is being considered as a priority, suppliers are seeking locations that also provide benefits across the entire manufacturing ecosystem.

***

GTM Research's PVMAX report ranks 50 countries across 25 distinct manufacturing attractiveness criteria. Stay tuned for the next PVMAX article for more on what suppliers consider when siting new module manufacturing.