While massive energy storage projects might someday reshape the grid, behind-the-meter energy storage is seeing faster growth and more investment, and is potentially having a greater impact today.

Stem, one of the contenders in the behind-the-meter energy storage market, just scored a $12 million C round with a first tranche led by Mitsui. Previous investors in Stem include Angeleno Group, Iberdrola (Inversiones Financieras Perseo), GE Ventures, Constellation New Energy, and Total Energy Ventures. It's another funding event in a modest recent wave of cleantech VC.

Stem's software-controlled energy storage allows businesses to better control energy costs and demand charges, while Stem has the ability to aggregate these distributed storage assets in order to provide capacity and other grid services. Mitsui and Stem are hoping to collaborate on Stem’s entry into new markets.

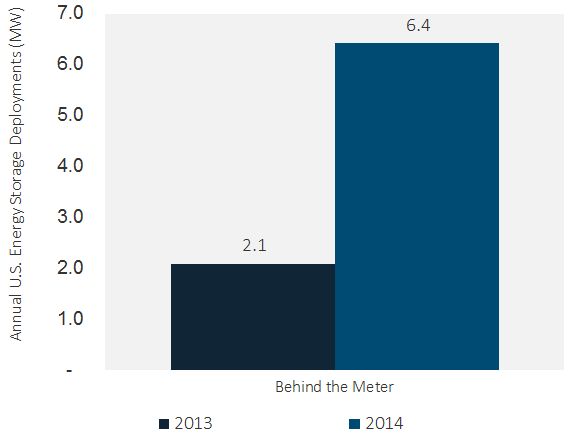

2014 was the biggest year for behind-the-meter (also known as customer-sited) energy storage deployments, according to the inaugural GTM Research and Energy Storage Association U.S. Energy Storage Monitor report. Behind-the-meter deployments increased more than three times, rising from 2.1 megawatts in 2013 to 6.4 megawatts in 2014.

FIGURE: Behind-the-Meter Energy Storage Deployments, 2013 Versus 2014

Source: GTM Research/ESA U.S. Energy Storage Monitor report

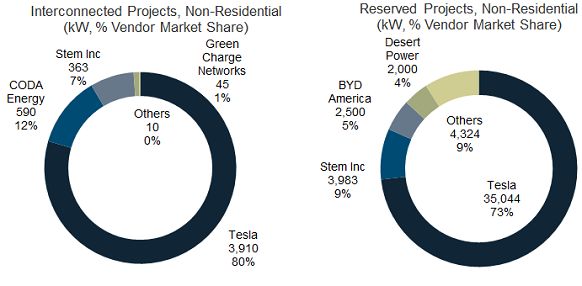

The non-residential segment accounted for most of the behind-the-meter deployments.

California has led the growth in behind-the-meter markets; 5.7 megawatts of energy storage were deployed in the state in 2014. A big driver for economic returns in the state has been the Self-Generation Incentive Program (SGIP), which can cover up to 60 percent of total project costs for eligible storage systems or a maximum of $1.46 per watt of installed capacity. The program is one of the biggest policy pushes for behind-the-meter energy storage deployments in the country.

FIGURE: Non-Residential Projects Under California's SGIP (as of Dec. 31, 2014)

Source: GTM Research/ESA U.S. Energy Storage Monitor report

GTM Research finds that behind-the-meter deployments accounted for 10 percent of total 2014 deployments, but are expected to grow faster than front-of-the-meter storage, growing sixtyfold from 2014 to 2019, and making up 45 percent of the overall 2019 market. GTM Research suggests, "While demand-charge reduction has developed into a bread-and-butter use case for commercial customers, the behind-the-meter market is on the verge of faster growth as a result of its ability to provide different grid services for utilities and system operators."

Stem has secured $100 million to finance installations under a no-money-down program. Green Charge Networks has also raised $56 million for its own shared-savings program, and Coda Energy, the once-bankrupt EV maker bought by investment firm Fortress Investment Group last year, has financed about $6.4 million in installations, with plans to expand that to $25 million.

Stem was recently selected to provide 85 megawatts of distributed storage to serve as flexible capacity in the West Los Angeles Basin. The 85-megawatt local capacity procurement means Stem must identify customers in specific geographies for its behind-the-meter energy storage system.

Southern California Edison’s local capacity requirement procurement is the largest procurement of behind-the-meter storage for utility needs.

***

About the U.S. Energy Storage Monitor

Delivered quarterly, the U.S. Energy Storage Monitor report is the industry’s only comprehensive research on energy storage markets, deployments, policies and financing in the U.S. These in-depth reports provide energy industry professionals, policymakers, government agencies and financiers with consistent, actionable insight into the burgeoning U.S. energy storage market. Learn more at www.energystoragemonitor.com.