Low costs will keep Mexico at the vanguard of the Latin American solar market, a region that will account for 11 percent of global PV demand by 2022.

Latin America made up just 3 percent of global demand last year, but the region’s importance is set to soar, according to GTM Research's Global Solar Demand Monitor.

In the final quarter of 2017 alone, Latin America added a total of 3.4 gigawatts of capacity to country pipelines thanks to five auctions across Argentina, Brazil, Chile and Mexico.

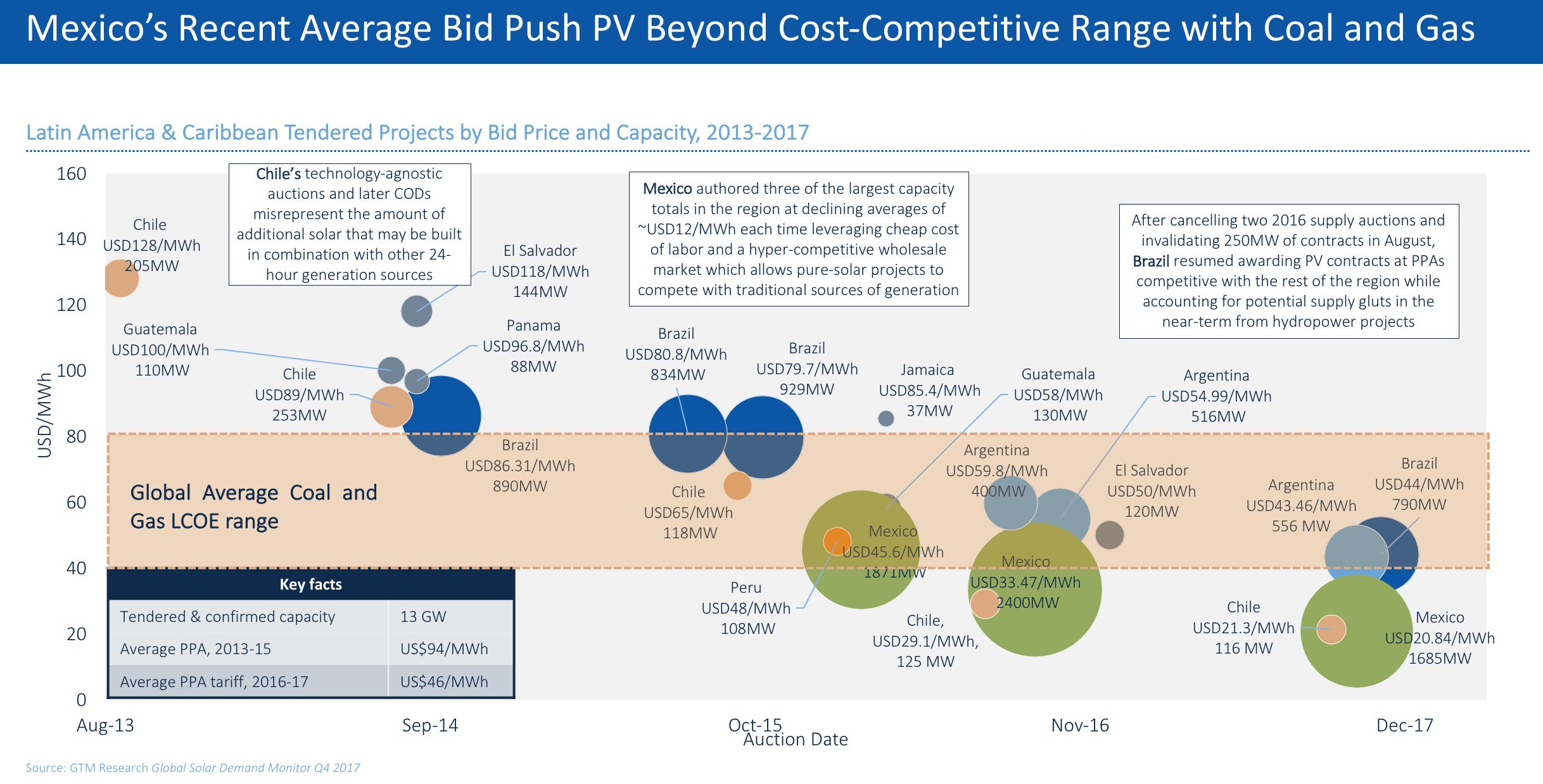

The auction system has seen average power-purchase agreement prices tumbling across the region. In Mexico, prices have dropped 76 percent, from $89 to $20.84 per megawatt-hour.

The average price achieved in Mexico’s latest auction is beneath the global blended levelized cost of energy for gas and coal, which ranges from around $40 to $80 per megawatt-hour. This is not the case with all Latin American markets, though.

Want to learn more about the numbers behind these projects? Come to GTM's Solar Summit Mexico February 13-14 for an in-depth look at the country's rapidly expanding solar market.

Latin America sees some of the highest system-cost variations across markets of any region in the world, according to GTM Research solar analyst Manan Parikh. System costs can vary by as much as $0.35 per watt from one country to another, he said.

These costs will continue dropping. However, because Latin American module prices are dependent on demand dynamics in major markets, such as the U.S. and China, decreases could be uneven.

In the first half of this year, for example, Brazilian and Mexican projects could experience an uptick in system costs with a tightening of module supply.

From the second half of the year, in contrast, an oversupply of panels is likely to lead to further decreases in system costs. Brazil may see system costs breaking through the $1 per watt barrier by 2020.

Mexico is expected to have the lowest forecast system costs out to 2022, said Parikh. In the coming years, Mexico will be “saving up to 50 percent on soft costs relative to other major markets,” he said.

In addition to plummeting costs, Mexican project developers can take advantage of a range of income opportunities to boost the profitability of plants. They can sell any generation in excess of what is required by their power-purchase agreement at nodal prices, for instance.

Alternatively, they can play in Mexico’s capacity market, or sell clean energy certificates (certificados de energía limpia, or CELs) on the secondary market.

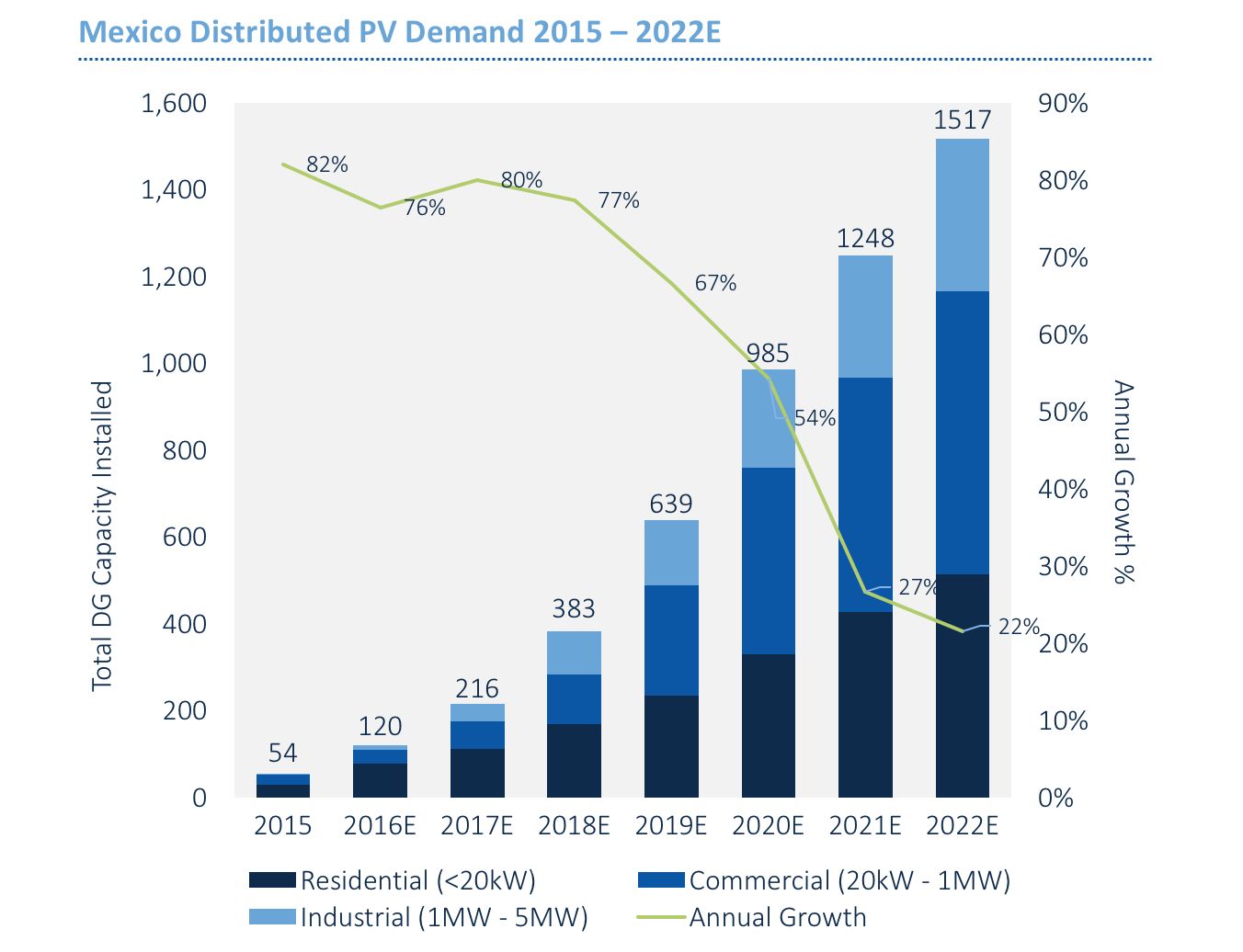

These benefits will help the Mexican market deploy nearly 16 gigawatts of cumulative installed PV capacity by 2022, GTM Research predicts. Much of this, though, will be in the form of distributed generation.

Mexico looks set to become one of Latin America’s leading markets for distributed solar, with the Energy Regulatory Commission predicting the market will be up to 8 gigawatts by 2025.

Looking to ride the wave of growth in Mexico? You'll learn all about the coming surge in distributed generation at GTM's Solar Summit Mexico to be held February 13-14.

The country was set to double distributed generation capacity last year, with more than 300 megawatts of new installations, after the CRE increased the upper limit for net metering plants to 500 kilowatts.

Further growth will come thanks to commercial bank financing for distributed generation portfolios. This gives customers flexibility to choose a range of procurement options, such as leasing, instead of having to always pay for systems upfront.

The total addressable market for distributed generation in Mexico is around 4.5 million unsubsidized retail customers, Parikh said.

Around 10 percent of these customers are on high-consumption domestic tariffs (Tarifa Doméstica de Alto Consumo, or DAC), using more than 3 megawatt-hours of electricity a year or 500 kilowatt-hours every two months for the last year.

The remaining nine out of 10 are commercial and industrial customers. “Distributed generation lags behind utility-scale development in most Latin American regional markets due to a lengthier payback period and a lack of financing schemes,” said Parikh.

But “Mexico and Brazil still account for the majority of distributed solar installations in Latin America,” he commented.

By 2022, residential PV system costs are expected to come down to $1.27 per watt, which is far more competitive than in the U.S., where homeowners will be paying $2.95 per watt.

Join GTM February 13-14 in Mexico City for an in-depth look at the country's rapidly expanding solar market. Solar Summit Mexico will leverage GTM Research’s expertise in Mexico to ensure your company is uniquely positioned to capture specific opportunities while appropriately managing regulatory, political and market risks. Find out more here.