When the numbers are finally tallied, Massachusetts is likely to have had a banner year for non-residential PV installations in 2017. According to the recently released Q4 2017 U.S. Solar Market Insight report, the Bay State is forecast to grow nearly 20 percent over a record-breaking 2016.

But the fanfare may be short-lived. Last year may prove to be the peak for non-residential solar installations in Massachusetts in this decade. Pending regulatory outcomes related to the incentive successor program could make or break the second-largest non-residential market in the U.S. -- and define the tenor of solar deployments through the rest of the decade.

Massachusetts helps lead a record year for non-residential PV

Most non-residential build-out in Massachusetts in 2017 is a demand pull-in effect of closing regulatory deadlines. With over 400 megawatts of systems sitting in the queue eligible for the closing SREC II incentive program, projects must be mechanically complete by March 31, 2018 to receive the current incentive before it steps down.

From there, it’s a race to the finish as developers attempt to complete projects and receive a further reduced incentive under SREC II before the start of the Solar Massachusetts Renewable Target (SMART), which is expected to roll out in Q3 2018.

But what does SMART hold for Massachusetts?

The state’s primary incentive program is transitioning from an SREC market with relative price volatility to a much more predictable declining megawatt block-type program. However, the new incentives will also be based on the average price of accepted bids by utility in a competitive auction.

Given the eligibility requirements to bid into this initial block of the SMART program, there’s considerable concern from developers that the auction may force prices to untenably low levels where behind-the-meter projects won’t pencil out economically.

The birth of a PURPA market?

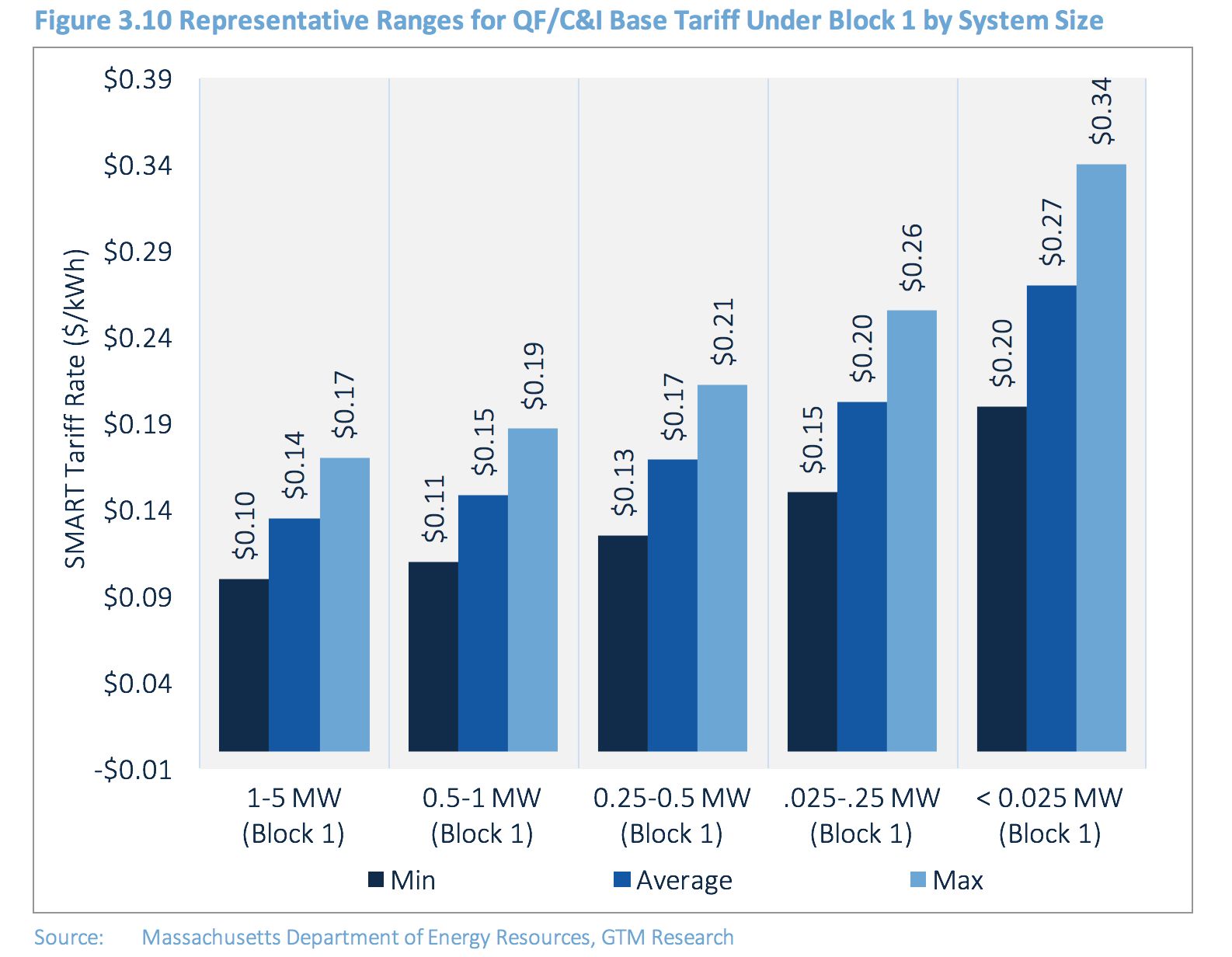

Participation in the initial auction was limited to non-NEM Qualified Facilities between 1-5 megawatts (AC). In other U.S. markets where sub-5 megawatt QFs have flourished, avoided-cost schedules ranged between $0.05 and $0.07 per kilowatt-hour.

Even at these (comparatively) low levels, developers flocked to the market. When you consider that the ceiling price for SMART’s competitive auction is $0.17 per kilowatt-hour, you can imagine small-scale utility developers salivating at the projected return.

So, is the future of Massachusetts market small-scale utility solar?

The risk of QFs flooding the market is real, but not guaranteed

While the comparison to other major QF markets is tempting, it’s important to note that development costs are substantially higher in Massachusetts than in legacy QF markets across the Southeast and Pacific Northwest. Specifically, permitting, labor, interconnection upgrades, different taxation policies, and land acquisition costs make Massachusetts a much more expensive market to scale up QF pipelines.

Given those higher soft costs in Massachusetts, developers note that it would be unrealistic to have bid anything under $0.10 per kilowatt-hour and still be making money. So, despite there being a $0.17 per kilowatt-hour ceiling price for the auction and higher soft costs in the Northeast, we expect bid prices to be 30 percent to 40 percent below that ceiling.

Most importantly, that auction price will determine to what extent additional QFs are a more attractive option to develop than behind-the-meter systems.

Behind-the-meter projects -- especially community solar and solar-plus-storage -- become increasingly attractive if the auction price clears closer to the ceiling price of $0.17 per kilowatt-hour. A higher base rate means a higher probability that incentive adders offset the soft costs of subscriber acquisition and retention for community solar, as well as added hardware costs for energy storage.

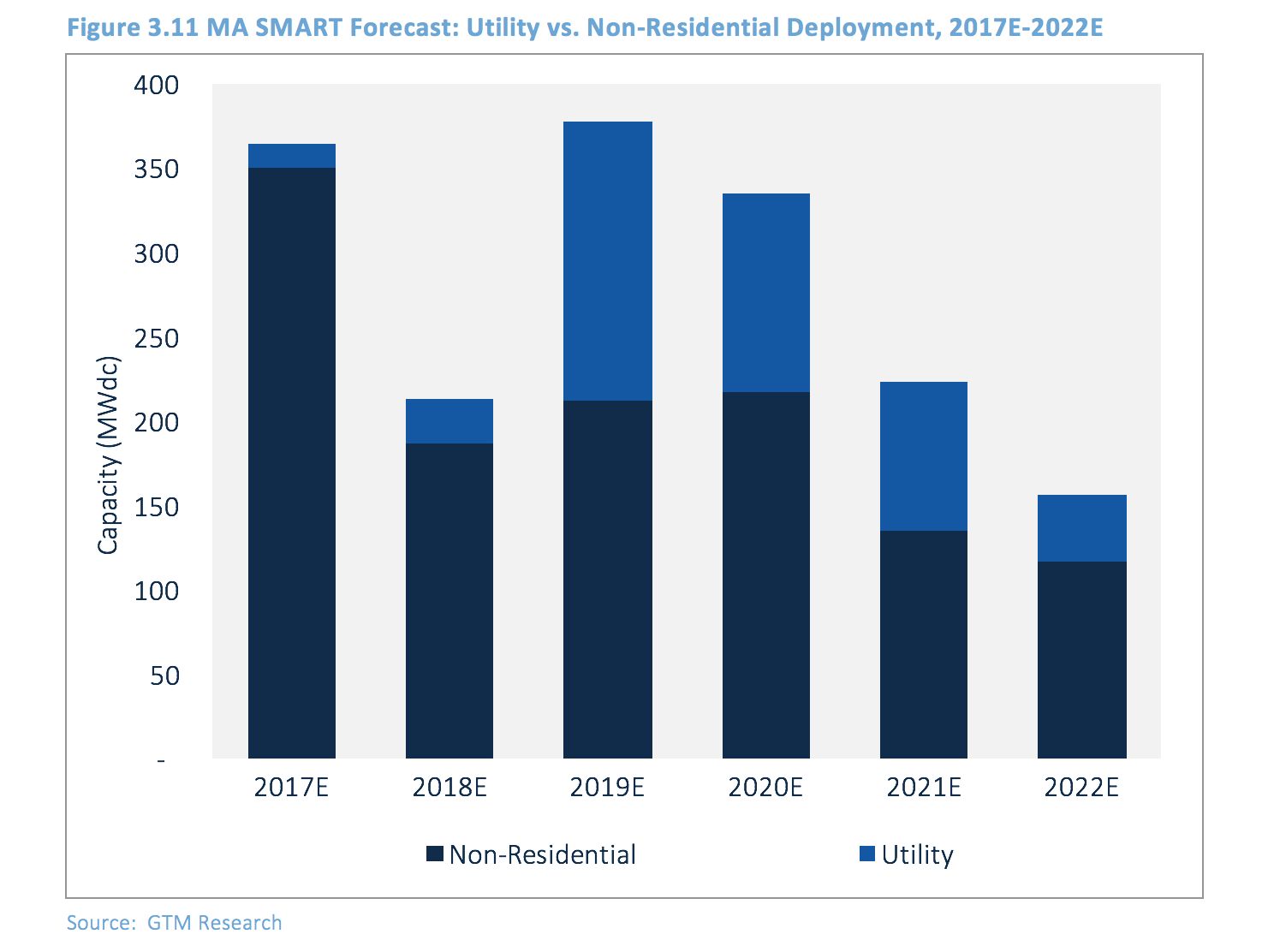

However, if the auction last month does clear 30 percent to 40 percent below the ceiling price, we expect at least 25 percent of the 1,600-megawatt program to be cannibalized by QFs as developers pursue a less complicated, high-volume development strategy that does not require securing offtake.

Looking forward to 2018, GTM Research will be actively monitoring the bid results of the RFP, which are expected to be released on January 11. But given the 4 percent reduction to incentives in each successive block, we anticipate nearly all of the program’s capacity to be subscribed by 2020 with less robust incentives in the later blocks to slow uptake of the program. Consequently, we expect non-residential installations beginning to decline in 2021 absent an extension to the incentive program.

Besides the competitive auction results, there are two other policy updates that pose upside and downside risk to the non-residential PV outlook in Massachusetts.

Upside risk -- additional incentive adder block capacity: Given the interest in both community solar and energy storage, and 80 megawatts of adders allocated to each, these adders are expected to be fully allocated upon program start. Looking forward, we’re monitoring how much capacity the DOER allocates Adder Block 2, as this will impact long-term community solar deployment.

Downside risk -- energy storage NEM eligibility proceeding: In another proceeding, the Department of Public Utilities is seeking to determine whether NEM systems paired with storage are eligible to net-meter and the application of NEM rules to systems participating in forward capacity markets. If systems are deemed ineligible to net-meter, solar-plus-storage demand would be limited to projects with sufficient savings offered via self-consumption.

Looking ahead, we have no doubt that the full 1,600 megawatts of the SMART program will be deployed over the course of the next few years. However, the diversity of project build-out hinges on the results of the competitive auction.

With QFs being the least sensitive to lower base compensation rates under the SMART program, we expect small utility solar to drive more of Massachusetts’ market the closer the market clears at a $0.10 per kilowatt-hour incentive with a current assumption that at least 25 percent of the program’s capacity will be allocated to QFs.

In the meantime, we’re eagerly awaiting the results of the RFP on Thursday.

***

GTM Research tracks and analyzes residential and commercial solar activities by state. Learn more about GTM Research's U.S. Distributed Solar Service here.