This year marks the beginning of an important transition in the U.S. residential solar market, according to the new GTM Research report U.S. Residential Solar Financing, 2014-2018.

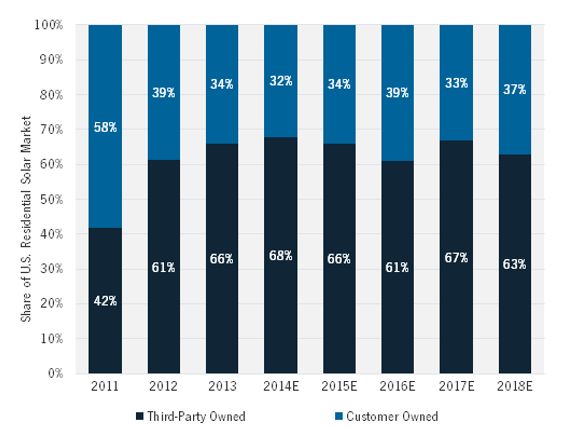

The share of third-party ownership (TPO) of residential solar, which has grown from 42 percent of the market in 2011 to 66 percent in 2013, will peak in 2014 at 68 percent. Beginning in 2015, the expansion of residential solar loan programs and alternate financing mechanisms such as property-assessed clean energy programs will drive the trend line back toward direct ownership, while the share of TPO will fall to 63 percent by 2018.

“Solar loans are becoming widely available with many more options to choose from than in the past, and declining system costs are making direct ownership affordable for more homeowners,” said Nicole Litvak, GTM Research Analyst and the report’s author. “As a result, the share of third-party-owned solar has already begun to come down in leading state markets, including Arizona and Massachusetts.”

All portions of the residential market will experience rapid overall growth, and TPO providers will need to raise more than $26 billion in the period 2014 through 2018 to fund consumer demand for solar leases and power purchase agreements. To date, TPO providers have announced $9.5 billion in project funds.

FIGURE: National Share of Third-Party vs. Customer-Owned Residential Solar

Source: U.S. Residential Solar Financing, 2014-2018

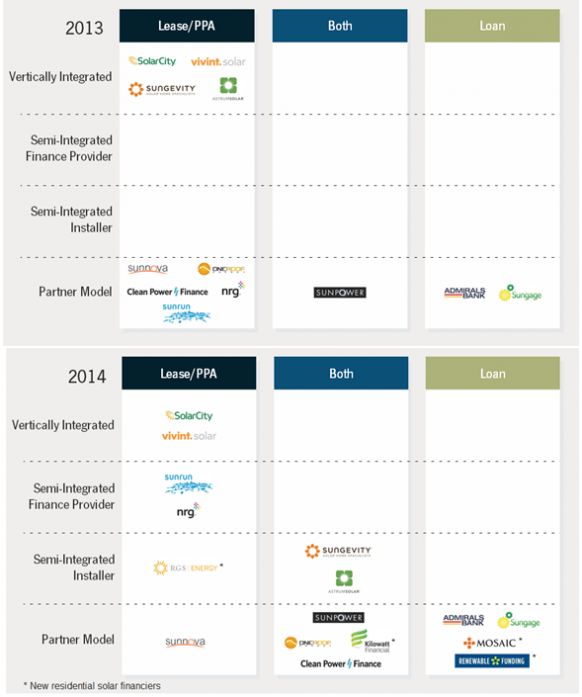

The landscape of residential solar finance providers continues to evolve. Major trends include an increase in vertical integration, with companies such as NRG and Sunrun adding installation to their business models, as well as the addition of loan options to many TPO providers’ portfolios.

FIGURE: Residential PV Financing Landscape, 2013 vs. 2014

Source: U.S. Residential Solar Financing, 2014-2018

“The residential solar financing market remains just as complex as ever,” said Litvak. “The recent trend has clearly been toward vertical integration -- the SolarCity model -- but we expect companies such as Clean Power Finance to retain their pure focus on financing and services for smaller installers.”

According to GTM Research, the U.S. residential PV market will exceed 1 gigawatt for the first time in 2014.

***

For more information on the U.S. Residential Solar Financing, 2014-2018 report, please visit: http://www.greentechmedia.com/research/report/u.s.-residential-solar-financing-2014-2018