Photo: TechCrunch

The first mention of VC investor Vinod Khosla in the pages of GTM occurred almost a decade ago. He said, "Forget plug-ins," during a keynote speech. "They are nice toys. But they will not be material to climate change.”

He did suggest, "They will be great investments.”

We've covered Khosla’s contrarian strategies and tactics in energy investing, and we've published position papers from Khosla Ventures on thin-film solar technologies and biofuels. (Khosla on energy storage is a personal favorite of mine.)

In this GTM Squared piece, we take a look at Khosla’s 60-plus cleantech investments over the last decade. The investments are broken out by sector, without regard to fund.

We’re not looking to examine every investment in detail here (we’ve done that at GTM since 2007), but we are looking for VC returns and more broadly, how the Khosla Ventures cleantech investment thesis has performed and shifted over time.

True story: Years ago, when Khosla was still a partner at Kleiner Perkins, I dropped by the KP offices to visit a friend -- accompanied by Cookie, a border collie. Khosla’s assistant spotted me (actually, the dog) and briskly escorted us to the great one’s office, introduced me to Khosla while transferring possession of the pet, and ushered me out the door. A few minutes later, Cookie was returned intact.

Khosla just needed some quality dog time.

Here’s a look at the KV cleantech portfolio, past and present.

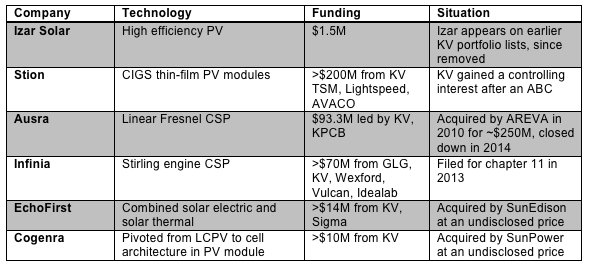

He fell in love with biofuels and they broke his heart

“My real love is cellulosic biofuels.” -- Vinod Khosla, 2007

"You can't be wise and in love at the same time.” -- Bob Dylan, 2005

It was the first time a Silicon Valley investor confronted an incumbent energy market in a full-frontal assault.

The billion-dollar venture capital firm had studied the global fuels industry and saw immense, albeit risk-laden, opportunities for improved and new biofuel pathways across feedstocks and end products. The ability to scale was paramount.

Khosla was optimistic about biofuels in 2006 when he wrote, “I believe we can replace most of our gasoline needs in 25 years with biomass” and suggested that existing energy firms were not “used to innovation and the rate of innovation we are likely to see in this business.”

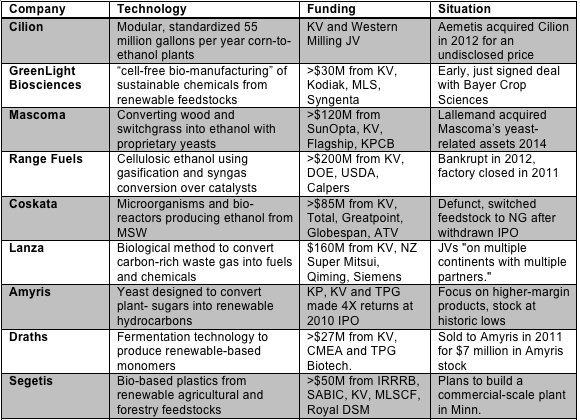

Over the course of a few years, Khosla Ventures invested in 20 biofuel or biofuel-related companies.

Khosla has repeatedly said, "If you're not afraid of failure, it frees you up to succeed." In the case of biofuels, Khosla was extremely unafraid of failure.

At the time, Khosla assumed oil would be $150 to $200 per barrel in the 2015-2020 time frame.

Three of these firms went public, arguably prematurely, with Kior now bankrupt and Amyris and Gevo trading at record-low prices. Coskata, Altra and Cello are defunct. Four firms were acquired at disappointing prices. One firm, HCL, favored by Khosla, was acquired at a good multiple but at a relatively modest price.

Only a few million gallons of cellulosic biofuel were produced in the U.S. last year.

Robert Rapier has some biofuel expertise and has referred to Khosla Ventures' biofuel efforts as "a debacle, with billions of investor dollars and tax dollars flushed down the toilet. What Khosla didn’t appreciate is that he isn’t smarter than the people in the oil industry." Rapier suggests that Khosla has not had a single success in the advanced biofuels arena, defined as "economically producing biofuels at scale."

“Almost everything that appears novel to an outsider like Khosla has almost certainly been investigated by multiple companies,” said Rapier in an article published by GTM.

Some wealth, but little value, was created in these biofuel IPOs. No oil majors have swept in to acquire these biofuel innovations. A few firms in the biofuel portfolio -- Lanza, Segetis and GreenLight Biosciences -- soldier on. But it looks like a confluence of many factors such as oil prices, thermodynamics and the regulatory climate has served to invalidate the Khosla biofuels strategy.

Searching for the black swan in energy storage

Khosla has said that energy storage is the key to better power utilization, a more reliable grid, and not having to hassle consumers with programming their dishwashers.

But Khosla focused on biofuels before energy storage because he thought the rate of improvement would be faster in biofuels. He was wrong. Lithium-ion battery performance and price are following a solar silicon-like path.

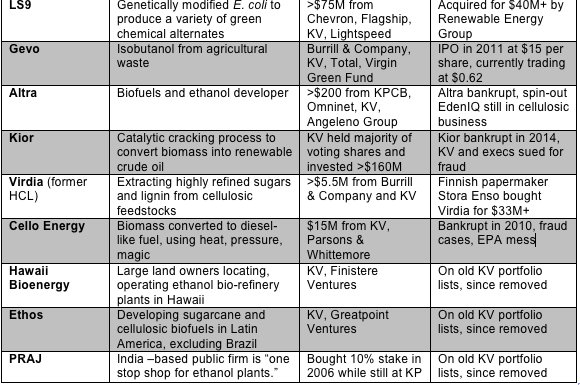

The KV energy storage thesis a few years ago was: lithium-ion batteries are "toys that can't be deployed at scale." Khosla said that lithium-ion was "too volatile" and "too expensive." The market is proving that wrong as well.

Khosla sets the bar for storage as round-trip efficiency better than that of lead-acid batteries with costs below $100 per kilowatt-hour. He also said that batteries for electric cars are going to need a black swan, and his energy storage portfolio reflects that wide-open mentality.

The KV energy storage portfolio has seen two low-return acquisitions and some reductions in force as these startups struggle with a growing storage market very much in transition in terms of technology, price and applications.

Developing a new, ready-for-market electrochemistry from scratch is tough work. Stealthy battery firm QuantumScape with its "all-electron-battery" has had to “go back to the drawing board” and slow its scaling efforts, according to sources close to the firm. Seeo had to pivot on its electrochemistry. Ambri has hit commercialization roadblocks.

Despite its flaws and Khosla’s arguments to the contrary, lithium-ion has become the dominant technology in the energy storage market. GTM Research expects the U.S. to deploy 192 megawatts of energy storage this year, predominantly of the lithium-ion variety.

What really matters in thin-film solar?

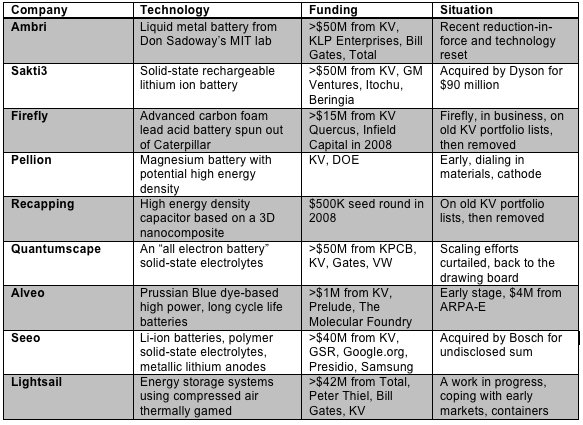

Khosla rightly viewed First Solar and its cadmium telluride cost/efficiency trajectory as the benchmark for thin-film solar aspirants. What he didn't anticipate was that First Solar's progress would accelerate to a still improving 16 percent module efficiency at less than 40 cents per watt. Khosla also expected silicon vendors to "generally start declining rapidly by 2015 unless they reinvent silicon." And he expected some "improbable pyro-nano-quantum-thingamajig technology" to emerge to challenge silicon and thin film.

Early in the technology's existence, KV viewed concentrated solar power (CSP) as a meaningful carbon-reduction solution.

Stion continues to build thin-film CIGS solar panels, although at small scale, while still trailing First Solar on performance and price. The Ausra acquisition created some wealth for equity holders, but its CSP technology ultimately proved uncompetitive. Khosla's firm did not invest in the wave of U.S. residential solar sales or financing startups such as SolarCity or Sunrun, shunning that "velocity-of-money" play.

Utility-scale power, grid control and analytics

According to Khosla, "Automating your meter reader is not the smart grid. The grid really equals smart power electronics. It's not even about the networks." He added, "We need a whole new class of devices and systems. A 50-year-old transformer made of copper wire wound around a ferrite core can't respond to a signal, so we can't control it." He continued, "If we invest in new power electronics devices, things will change radically. The design of existing systems will change based on these new components."

"We need new gallium nitride devices and transistors, and we will bypass Westinghouse's law," according to Khosla.

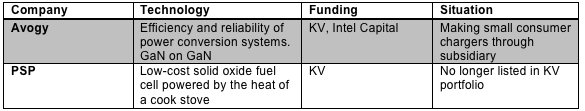

Here's a grouping of utility-scale generation companies with some smart grid startups in the KV stable.

This sector still holds promise for the VC with market traction for Varentec, Bidgely, AltaRock, and GreatPoint, along with Bill Gates as co-investor in Varentec and TerraPower.

Investing in engines and motors with Bill Gates

One expects high failure rates in venture capital -- but the metabolic mismatch between startups and the automotive industry is even more of a stressor.

Here we see Transonic, Pax and Danotek were not able to keep the venture pace.

Investments in lighting and homes

Investments in water technology

Investments in efficiency, etc.

Khosla had this to say about investing in renewables and energy efficiency: “We’re in a crisis, and there is an opportunity to reinvent our energy infrastructure; it would be a folly to waste it.”

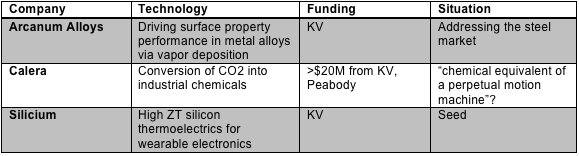

Investments in new materials

Vinod Khosla on innovation: "Only small companies do impressive things."

Khosla is going to continue to take shots on goal

"All progress depends on the unreasonable man" -- A George Bernard Shaw quote Khosla likes to cite

Despite his brilliance, many of Khosla's early assumptions about biofuels, storage and solar have proven wrong or at least mistimed.

Still, the occasional home-run exit in a venture capital portfolio can make up for a multitude of singles and market miscues. That home run hasn't happened yet in the KV cleantech portfolio. The black swan has not yet landed. In the case of Khosla Ventures, the firm invests across a number of sectors, so the home run might come from a lucrative exit for a synthetic meat, payment system, or nontoxic snack company.

Khosla is going to continue to take a lot of shots on goal. He has suggested that 1,000 VC firms in the KV mold would up the odds of solving our climate challenge. Khosla wrote, “To get to the energy-independent future we need, we must continue to try and sometimes fail, but the consequence for not trying is guaranteed failure. We will keep accepting intelligent and selective failure.”

A colleague and former Khosla employee spoke of a phase Khosla went through where he was somewhat fixated on reinventing wood. Not as a mental exercise, but as a potential option for the planet.

Sounds unreasonable, right?