Many utilities across the U.S. are beginning to address stagnating revenue from electricity sales by developing new products and service offerings. In its latest report, Alternate Utility Revenue Streams: Expanding Utility Business Models at the Grid Edge, GTM Research identifies these efforts and quantifies how a combination of certain product offerings could quickly lead to positive revenue growth for regulated investor-owned utilities (IOUs).

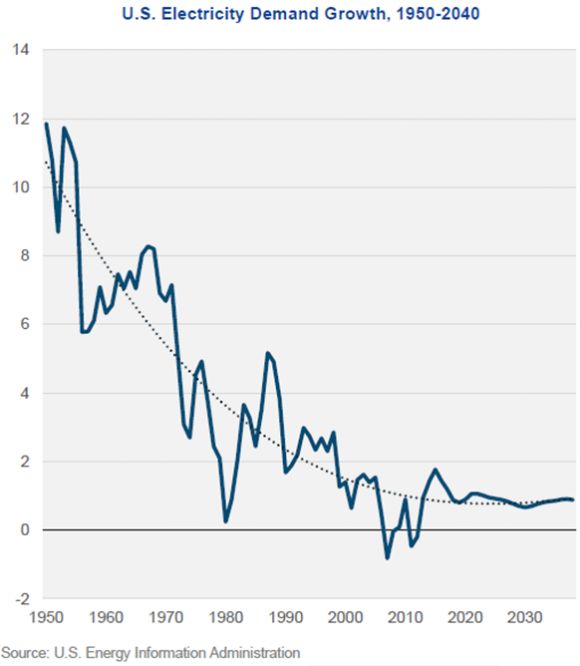

Due in part to improvements in energy efficiency, electricity sales have steadily fallen over the past few decades. With 1 percent annual load growth cited as the “new normal,” and the possibility of negative load growth largely driven by the proliferation of distributed energy resources, utility financial portfolios are beginning to look fragile.

Add the effects of downward pressure on return on equity in rate cases and increased focus on maximizing operational efficiency, and it’s clear why many utilities are looking for opportunities beyond kilowatt-hour sales for growth opportunities.

"Utilities are operationally savvy organizations and understand the likelihood of market headwinds in the coming years,” said Steven Propper, director of GTM Research's Grid Edge program and author of the report. "Many large IOUs have been investing in bolstering their customer relationships, improving customer satisfaction and determining the best mix of offerings in the future.”

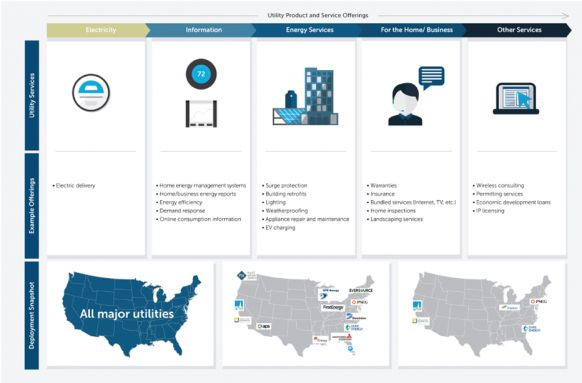

According to the report, some utilities are leveraging assets such as their large in-field workforce and vehicle fleets to offer products such as outdoor lighting, landscaping and weatherization. Others are leveraging their extensive call centers and investments made in new customer communication channels to offer consumer services such as warranties, insurance or appliance and component sales.

FIGURE: Utility Product and Service Offerings

Source: Alternate Utility Revenue Streams: Expanding Utility Business Models at the Grid Edge

These are just a handful of examples outlined in the new report, which also provides six case studies detailing efforts underway at Florida Power & Light, Duke Energy, Pacific Gas & Electric, First Energy, Southern Company and Southern California Edison.

"These are no longer side projects sitting within a siloed product development group," said Propper. "We're seeing utilities really have strategic conversations about products and service offerings and incorporating them into their long-term operational planning. This is exciting, as it opens up opportunities for many applications and analytics providers who can provide utilities with added insight into customer preferences, load management and asset performance.”

For more information on the new report, click here.

***

Grid Edge Executive Council members gain access to all of GTM Research's grid edge analysis, including this report. Learn more about the Council here.