Belectric, a Germany-based solar developer, financier, and construction firm with more than one gigawatt deployed has acquired the assets of bankrupt organic solar cell firm Konarka's German operations, Konarka Technologies GmbH.

The company would not disclose information on the price, terms of the deal, or IP involved. This deal involves a headcount of 16 people according to a company spokesperson. The new Belectric OPV group will be led by Konarka's former Director of European Operations and current CEO Dr. Ralph Pätzold.

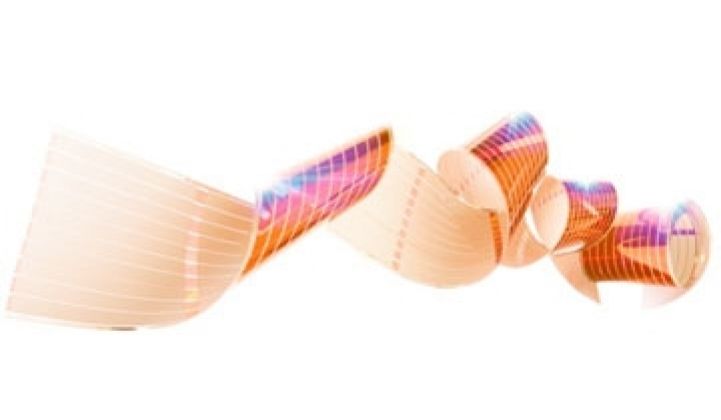

Michael Belschak, CFO of Belectric, said in a statement, “We will use Power Plastic wherever conventional modules aren’t a suitable solution. Particularly in facade construction and in the automotive sector, the highly flexible and pliable material can be used in a variety of ways to save energy cost-effectively." In the same optimistic vein, Belschak said he is expecting the first revenue to be generated as early as the second half of 2013.

Organic solar cells (OSCs), sometimes referred to as third-generation solar after crystalline silicon and thin-film solar technology, can be divided into two categories: polymer-based (large molecules) and oligomer-based (small molecules). Konarka prints large molecule polymers.

Organic solar cells hold the promise of low-cost production, but their efficiencies tend to be very low. Heliatek had a recent world record for organic solar cells -- a champion cell on a small area with 10.7 percent efficiency. Long-term reliability and degradation issues remain with the technology, however. In 2009, GTM Research estimated worldwide capacity of OSCs to be just 5 megawatts.

Konarka's main business for the last decade has been fundraising: the firm has won more than $150M from Chevron, Good Energies, Draper Fisher Jurvetson, Konica Minolta, Total, NEA, The Massachusetts Green Energy Fund, Vanguard Ventures, Mackenzie Financial, Partech, and many more since 2001. Throw in at least $10 million more in DARPA, DOE, NSF, the U.S. Army, bank loans and credit lines in the last ten years.

Organic and dye-sensitized solar cell (DSSC) developers include Dyesol, Heliatek, Solarmer, Plextronics, EPFL, Mitsubishi, Peccell, and G24i. Dyesol, a publicly traded firm, builds equipment to manufacture DSSCs. Eight19 Limited raised $7 million from the Carbon Trust and Rhodia to develop plastic organic solar cells. Ireland's SolarPrint has eliminated the liquid part of DSSC and replaced it with nanomaterials and printing. This means that all of the active elements of SolarPrint's cells are applied through printing. Intel has done some research into OSCs, as well.

Image from NREL

These low efficiencies leave OSCs to niche applications such as portable electronics, automotive, and the promised-land market of building-integrated photovoltaics (BIPV), which includes windows and facades, as well as concrete and other building materials. There is no real BIPV market today in the true sense of BIPV. (See "The Realities of Building-Integrated PV.") There are also military applications.

One of the appeals of third-generation thin-film solar cells is that they can be manufactured using solution-based, low-temperature, roll-to-roll manufacturing methods, using conventional printing techniques on flexible substrates. That is the sirens' song that has kept the VC money flowing.

The question remains: can organic solar cell technology be successfully commercialized in an unforgiving solar market dominated by low-cost crystalline silicon and First Solar's cadmium telluride?