In an ideal world, utilities would provide third-party developers information on a circuit-by-circuit level to show where solar or storage projects would have the greatest grid value.

But that is not the case in nearly every region of the U.S. Utilities often do not have their distribution systems mapped. And if they do, they are often not opening up that data to developers. That keeps development soft costs relatively high, even though the cost of solar equipment has declined precipitously.

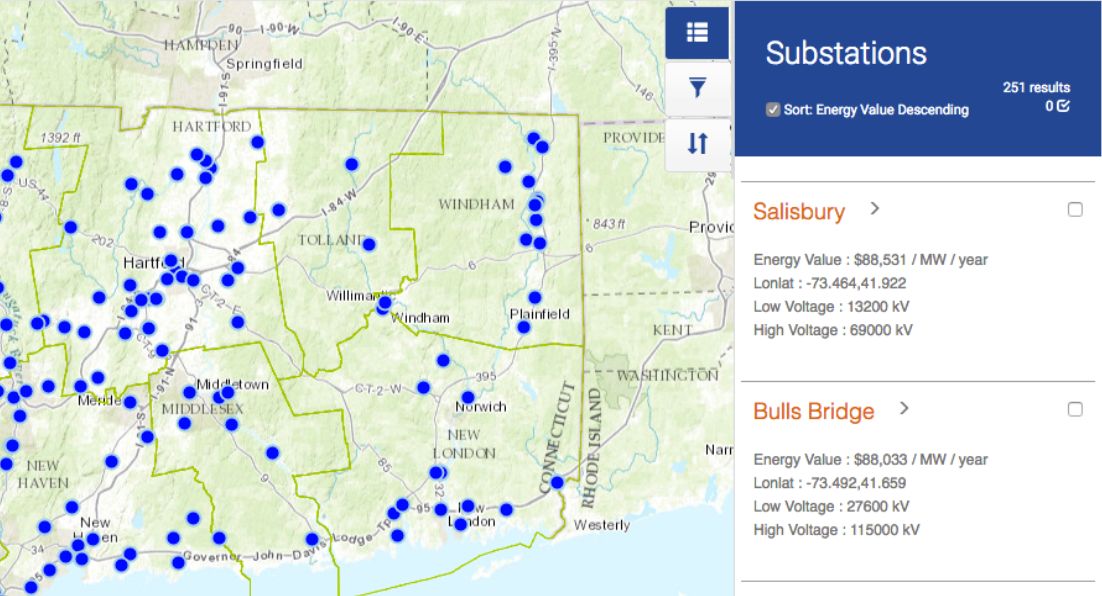

Kevala Analytics wants to solve that problem. The company just raised $1.7 million from the U.S. Department of Energy’s SunShot Initiative to help scale its Grid Assessor platform, which brings together public data on wholesale pricing and substation locations to understand the local electricity value at a particular site.

“Just like any other industry, market participants need to know where solar values are trending,” said Kevala CEO Aram Shumavon in a statement. “Instead of searching an entire territory or region, we can help developers find the best locations in a few clicks.”

“A lot of this information is publicly available, but it’s hard to aggregate and hard to get all in one format,” said Andrew Reed, EVP of project development at Borrego Solar. Borrego Solar is one developer that recently tested the software.

The software pairs the nodes used for wholesale pricing with substation locations, which is not always a one-to-one relationship. The software then adjusts the values for weather and compares it to historical wholesale prices to produce an energy value for solar production. Kevala also brings in as much feeder-level information as is available, whether from utility filings, outage reports or permit applications.

The software can help developers make faster, more informed decisions about whether to pursue a project, or help them develop an understanding of where interconnection costs are high. The pricing data is incorporated with property lines and other site characteristics, such as zoning policy or wetland location.

There is also value for developers crafting virtual power-purchase agreements that are often dependent on the nodal price of power where the system will be located.

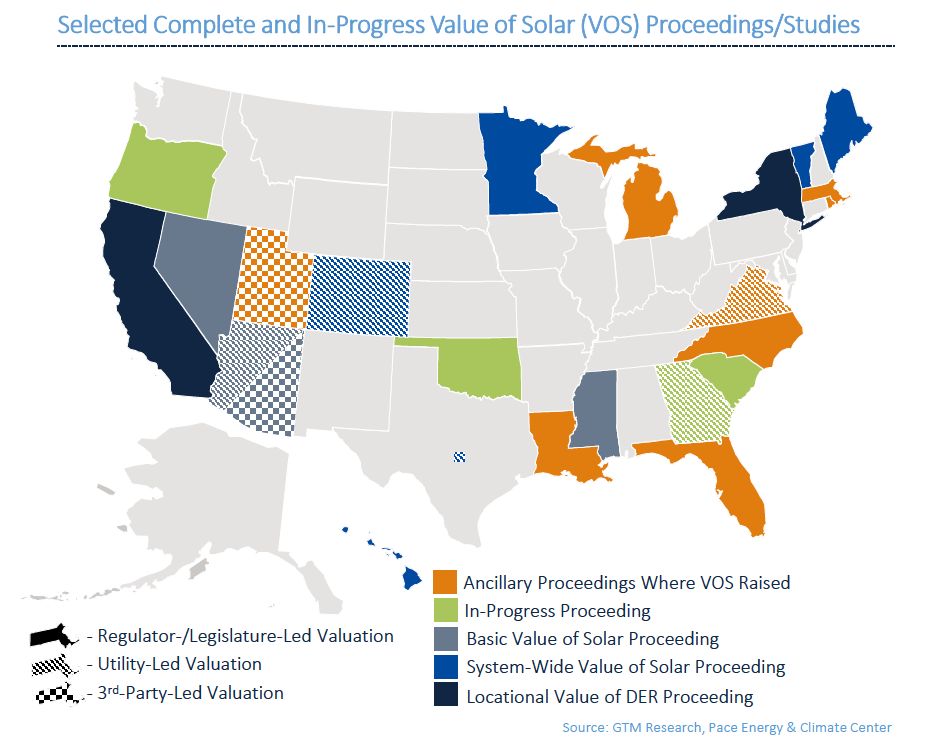

This type of information could also help craft policy for distributed energy resources. There are various states where value-of-solar proceedings are underway, and more are sure to come. Locational value data collected from an independent third party could be a valuable component of those regulatory debates.

Convincing utilities across the U.S. to provide hosting capacity analyses and locational pricing for distributed assets is mostly just a fantasy at this point. Power providers need to make expensive upgrades to their systems to collect the sort of granular data that third-party developers want. Then, of course, there are issues related to data privacy and competition.

Kevala isn't just targeting solar developers or utilities. The California Clean Energy Fund, for example, worked with Kevala to have it build a map of non-compliant Volkswagen diesel cars. The company is also working on a pilot project funded by BMW and the California Clean Energy Commission to help BMW better understand the best patterns for electric-vehicle charging.