China-based Jinko Solar withdrew its IPO plans due to "poor market conditions," according to Reuters. We reported on their IPO intentions here.

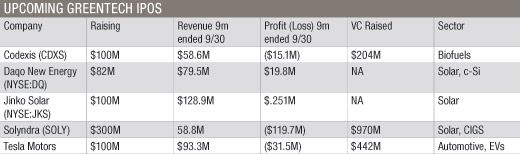

Jinko manufactures silicon solar wafers, cells and modules and had hoped to raise $100 million. Another China-based polysilicon manufacturer, Daqo New Energy, also pulled its $80-million IPO last month. Obviously, investors are a bit jittery about the solar industry in an environment where slim margins exist for commodity-level wafers and modules -- and where curtailed German subsidies might impact demand while the world waits for the U.S. and other markets to take off.

Here is Jinko and Daqo's revenue situation compared to other greentech IPO aspirants:

Are these two withdrawn IPOs a tocsin for the solar industry and for greentech IPOs in general?

Put simply, no. Daqo and Jinko are money-losing, marginal players in an oversupplied, undifferentiated field.

Solyndra is losing money and will continue to lose money, but the firm is certainly differentiated by technology. They are selling the story of the potential for new and innovative CIGS solar technology. Likewise, Tesla, also losing money, is selling a story that institutional investors might believe in -- unique luxury EVs.

Solyndra still has to contend with the falling price per watt of commoditized silicon. Tesla, on the other hand, as an automotive supplier, faces a market with less clear-cut value propositions. Price and value are only part of the car purchase decision.