Enel doesn't do grid edge halfway.

The Italian utility-turned-global-renewable-energy-developer rolled out smart meters to 100 percent of its Italian home and business customers in 2001 -- and achieved payback on the investment within four years.

Nearly every utility is turning to renewable energy, but Enel's green power division has installed 36 gigawatts of capacity across 24 countries. It will eventually take over the company's entire generation business, due to a corporate goal of 100 percent renewable energy by 2050.

Now the company is expanding its reach to Silicon Valley. On Monday, Enel unveiled an Innovation Hub housed at UC Berkeley to tap into energy entrepreneurship in Northern California. The goal, according to Enel leaders present at the launch, isn't to get into the business of VC finance. Instead, Enel wants to identify startups that could help fulfill some concrete need for the company, and offer them guidance and project contracts to help them grow and deliver on their potential.

All of this serves the company's overarching goal of transforming into a nimble, digital, clean energy company to weather the chaos shaking legacy utility business models in Europe, and, to a lesser extent, in the United States. The hub represents the latest in a growing roster of European utility investments in American grid edge talent.

Seeking ideas

The accelerator itself already existed. It's the CITRIS Foundry at Berkeley, which gives inventors advice and resources to build a technology over the course of a 12-month advisory period. In addition to office space, participants get access to maker labs with sophisticated equipment to prototype hardware. Some 68 percent of them are able to secure funding before graduating from the program.

On Monday, the Foundry's walls shined with new colors: the proud emblazon of Enel. The smell of catered Italian coffee wafted among the desks, accompanied by flurries of Italian conversation. The lasting change, though, was the addition of new opportunities afforded to those startups at work in the space.

Enel chose this spot for the partnership because it wants to solve big energy challenges, said Innovation and Sustainability Head Ernesto Ciorra, adding, "This is the Disneyland for innovators." The California hub is the logical extension of a search process during which the company has examined hundreds of startups for potential collaboration, and completed concrete, industrial projects with 80 of them, he noted.

"We want to look for startups, select the best ones and involve them [in] our industrial projects," Ciorra said. "We are here to work with the venture capital funds. We don't want to buy startups when they are in seed phase, but we want to support them with concrete industrial projects to work with."

Or, as Enel Green Power CEO Francesco Venturini put it, "The hubs are like ears listening to what's happening around the world." He would rather draw good ideas from bright minds in many countries, rather than get stuck in the familiar utility cycle of demonstration projects followed by yet more demonstration projects.

"Pilot projects end up never transforming themselves into new business models," Venturini said. "They stay as projects and never help us to change. [...] We're trying to move from a pure energy company to something that is different."

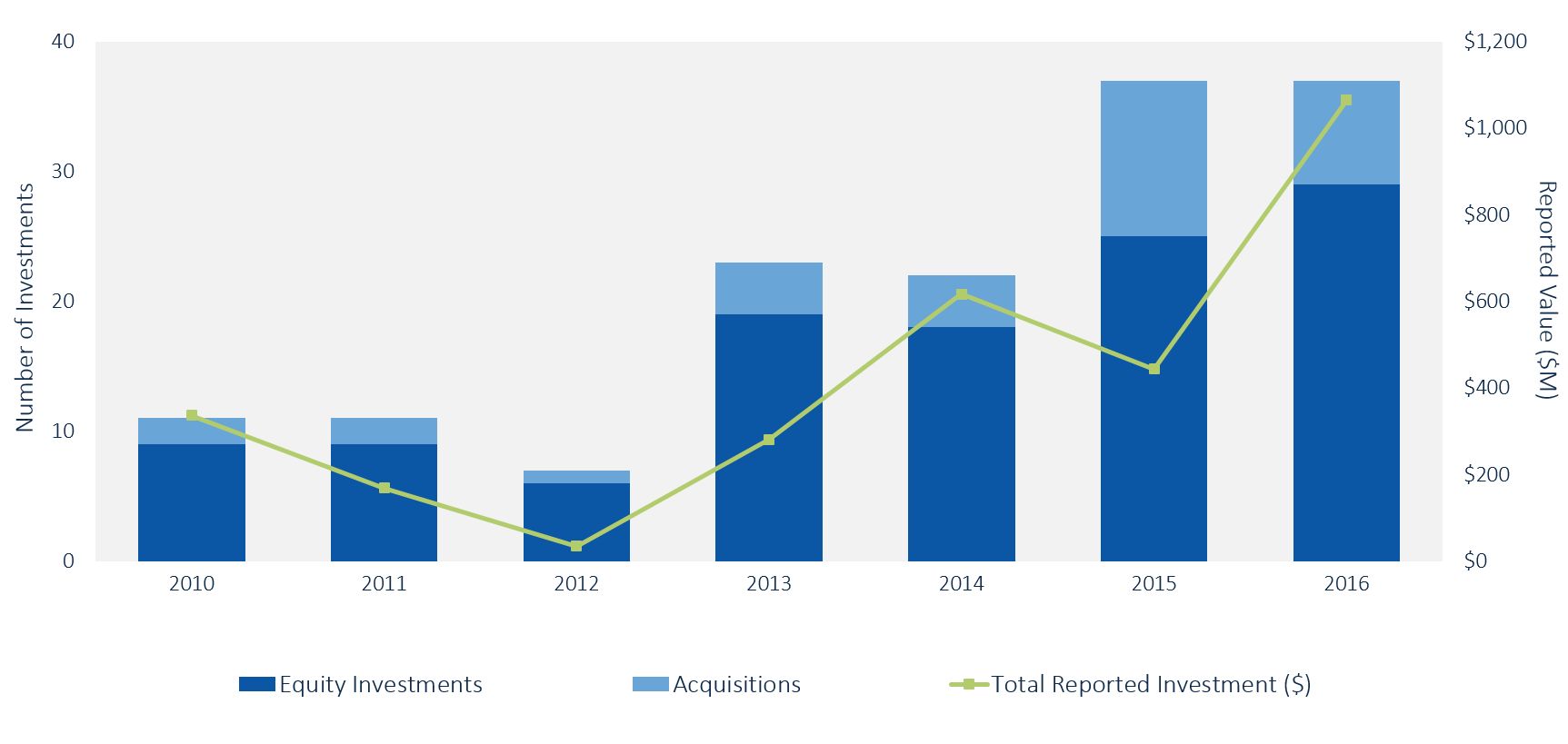

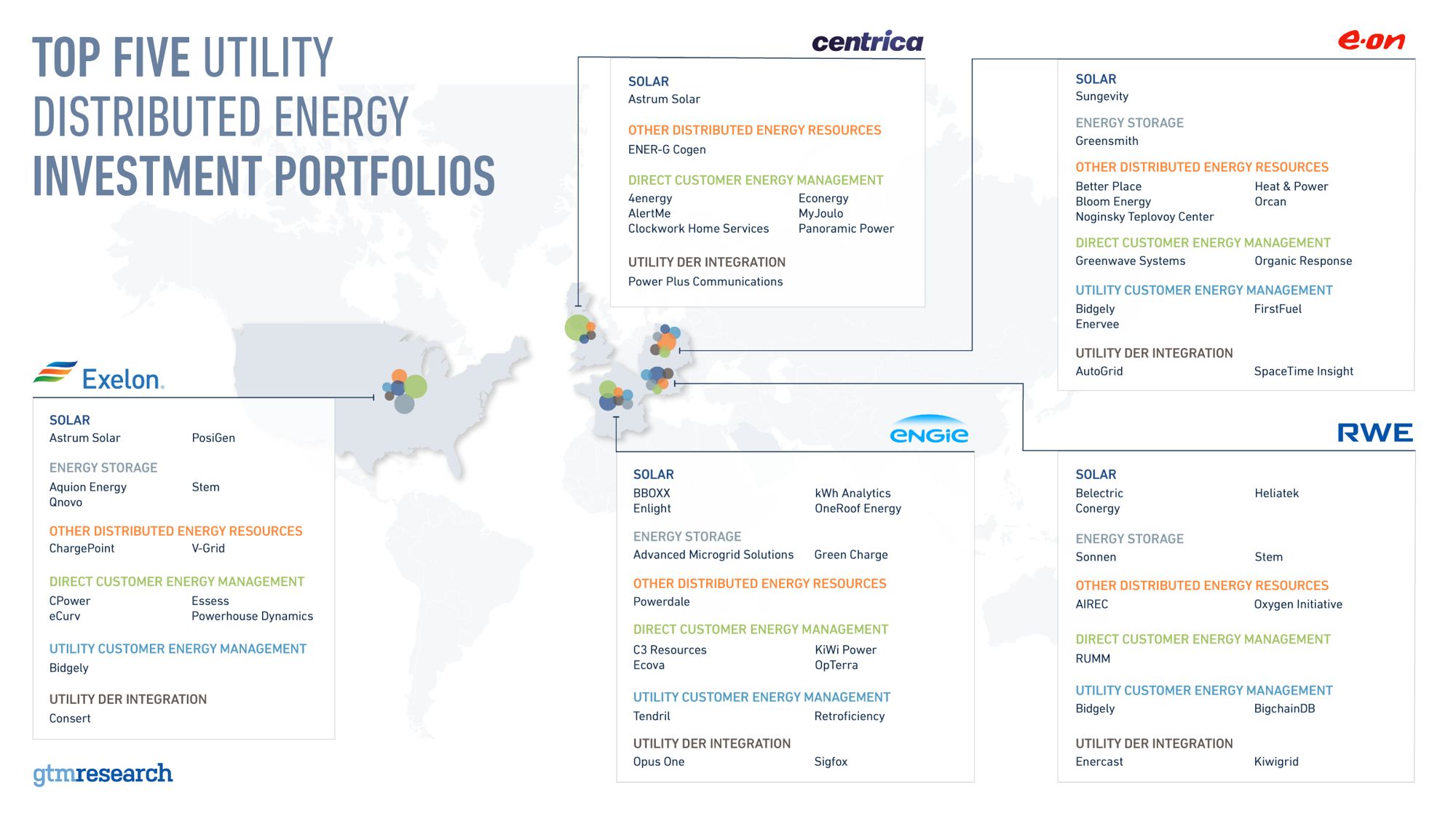

Utilities invested more than $1 billion in distributed energy companies last year, according to GTM Research, and the most active investors were European. French utility Engie launched a €115 million Engie New Ventures fund in 2014; German utility RWE created a $144 million venture fund to pick up promising startups. E.On, EDF and Centrica have been active investors as well.

(Source: GTM Research)

Enel's Silicon Valley strategy differs from its European peers by eschewing a more cash-heavy VC approach and focusing on projects. Enel decided that its core competency is not investing in early-stage startups to earn a return. If a startup offers a product that could do something helpful for Enel, though, the utility will pay for that, providing revenue for the startup at crucial early stages of development.

And if it finds a business that fits into its broader strategy, it's willing to go all the way, as seen in the acquisition of American energy storage and software company Demand Energy in January. Enel is working with that new subsidiary to add storage to its portfolio of renewable generation.

Crossing the Atlantic

The increasing involvement of European utilities in the U.S. energy system, both as investors and as independent power producers, is bound to affect the market for American utilities.

The transatlantic movement is driven by the faster adoption of renewables in Europe, which stressed the traditional utility business model earlier than it has in the U.S., as well as a tough competitive landscape in the European power markets. The U.S., where competition for power delivery is fragmented across state and regional boundaries, offers something of an escape valve for the battle-weary utilities of the Old World.

"In my view, at least, it's a less competitive market than you have in Europe, where everybody is fighting against everybody else," Venturini said in an interview after the launch. "That level of competition that you have in Europe is pushing you toward new and different models. Here in the U.S., [given] the fact that you are so based in your own territory, if you start innovating too fast there is the fear of cannibalizing yourself."

Meanwhile, utilities need better software to manage all the distributed assets coming onto the grid, and there's a perception that Silicon Valley is the place to find that talent. With traditional volumetric revenue declining, they're more willing to take chances on up-and-coming technology, and California is seen as the place to look.

Given all the new companies coming into the grid edge and renewables space, this is hardly a zero-sum game in which gains for European utilities mean that American utilities must lose out. Still, the flurry of investments poses a challenge to American power companies: It's risky to rush investments in emerging technologies, but if they keep waiting, there's a chance that the best talent will have already been claimed by their fast-moving European counterparts.

That doesn't mean the Europeans have a decisive lead, though.

"The European utilities are used to being first movers, especially when you're talking about new technology, but then American utilities have the capability of catching up pretty fast," Venturini said. "We do not live in the illusion that these guys are going to stay put for a long while. They're just monitoring and watching what's happening, and then when it's time, they will come out."