The evolution of smart buildings has been painfully slow over the last 25 years. But we are now on the threshold of realizing a fully automatic system that could control all the building services without the intervention of humans. This we call the building internet of things (BIOT).

The BIOT industry is currently being driven by players in IT and the communications industry. The building automation systems (BAS) business is becoming more important; however, it will need to take on a more prominent role if the future of building control is to be realized, according to a new research report from Memoori.

The global market for BAS services at installed prices was shared between nine sectors from 2010 to 2014. These include access control, building environmental control systems, energy enterprise software, BAS integration services, intruder alarms, lighting controls, video surveillance, fire detection, and other safety features such as monitoring and metering.

The average compound growth from 2010 to 2014 was approximately 8 percent. Video surveillance took a 25 percent share of the BAS market, and of this, some 40 percent of all new projects are IP network-connected. It has more connections to other BAS services than any other category.

Through BIOT, all aspects of a building's technical performance could be brought together through one common IP platform -- linking sensors and devices and optimizing control automatically through the use of analytical software.

BIOT systems will become less expensive to install and operate. They will allow the system to expand by simply adding new sensors and devices onto the network. But we are not quite there yet, and building owners will have to wait to get their hands on many of these new toys.

The reason why is that we need to connect together some nine categories of building automation systems equipment -- from building energy controls to video surveillance equipment -- which today all operate on different communication protocols. Moving to one protocol for all systems will take a long time, even though many have already moved to using IP networking products.

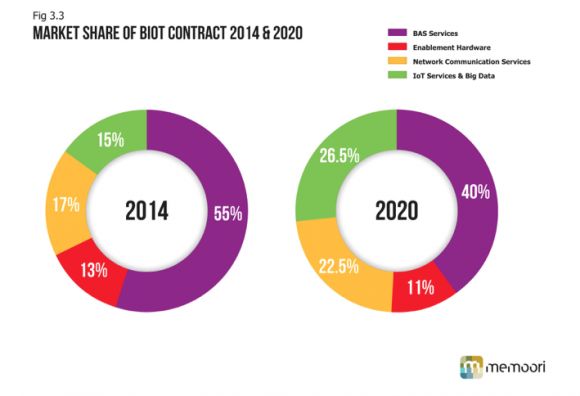

Memoori forecasts that the market for BIOT, including all the BAS services at installed prices, was worth approximately $46 billion in 2014 and is forecast to grow to $155 billion in 2020. Growth is likely to accelerate further in the next five years as big data and cloud services increases their share of the BIOT business.

The value of the BAS hardware associated with BIOT projects in 2014 accounted for approximately 55 percent, while enablement hardware look a 13 percent share, network communication services took 17 percent and IOT data services secured 15 percent.

These numbers include IP connectivity across single and multiple BAS services. But we have yet to identify any complex building that uses one single platform to connect all BAS services, particularly controlling distributed power and demand response.

We have identified LED lighting control systems in new medium-sized office buildings that have achieved full connectivity across lighting control, energy control and access control.

At the moment, most of the investment in BIOT’s development is being made by the IT contingent. If this continues, they will become the dominant force in this business.

However, while the IT players hold all the new technology to deliver automated buildings, they often aren't as well versed when it comes to the design, installation, operation and servicing of buildings compared to BAS companies.

Over the last five years, the major companies in each camp have been working together and formed strategic alliances to develop products and services. Acquisition activity has also increased, helping to link the two sectors. We have tracked 45 acquisitions ranging from $3.7 million to $3 billion, and 171 investment deals relating to BIOT over the last four years.

The BIOT market is still split. But there are signs that the IT and BAS sectors are coming together. And as that happens, fully automated buildings will get closer to reality.