The newest Ioxus ultracapacitor (ultracap or u-c) comes with an impressive number: 12 percent. Why it is impressive in a moment.

The current Ioxus ultracap is now in use in hybrid buses, fork lifts, heavy duty equipment starting, backup for uninterruptible power supply applications for data centers and wind turbine pitch control, according to Ioxus founder and Vice President of Sales Chad Hall.

What all these applications have in common is they require relatively large bursts of power from a quickly and frequently recharged source. Serving that function is what distinguishes an ultracapacitor from a battery.

Potential ultracapacitor applications are much broader, probably the most important being in their potential to partner with advanced batteries to give plug-in vehicles more range.

Ioxus had a banner year in 2011. “Product bookings increased seven times from 2010 to 2011,” Hall reported. In the coming year, he anticipates wind turbine applications to be 40 percent to 50 percent of sales, hybrid bus applications to be 30 percent and the remainder to be in materials handling and LED lighting.

Hall said the company foresees a 56 percent annual growth rate for the industry through the coming decade, moving global ultracap buying to $1.16 billion by 2015 and $7 billion by 2020.

Batteries have a higher energy density but, Hall noted, “ulracapacitors have a much higher power density. Power density is the ability to deliver large amounts of power in a short time.”

A flashlight, for example, could run for six hours on a battery, Hall said, and would also require six hours to recharge. “An ultracapacitor could run it about an hour and it would take 60 seconds to recharge.”

The other functional difference, he said, is cycle life. “You’re going to have roughly 400 to 1,000 cycles [of discharging and recharging] before you throw that battery away. With an ultracapacitor, you’re going to have millions of cycles.”

In a car, the first concern is miles per charge. “You would get a couple of miles out of the ultracapacitor, whereas you might get a hundred miles from a battery.” But a plug-in car’s battery pack must also provide power. Engine functions such as starting and acceleration require power, and power needs increase as a battery’s charge is drained.

“You have to be careful how hard you push a battery,” Hall said. Plug-in cars now have larger battery packs than the energy requirement would prescribe -- making the vehicles heavier and more inefficient -- because of the need for power. “The best application in electric vehicles is to use a battery and an ultracapacitor. That allows the battery to do what it’s chemically designed to do (provide energy) and allows the ultracapacitor to do what it’s designed to do, which is provide power.”

In applications where the two have been paired, Hall said, increased overall efficiency allows the battery to provide “25 percent to 33 percent more miles per charge.”

This application is not presently used in cars, Hall said, because car makers have only just begun to see at what is possible in “the overall system architecture.” At car design conferences, Hall said, “Engineers are talking about it now. They’re seeing where this makes sense.”

Unfortunately, real-world applications could be far off. “They’re designing year 2016 models now, so even if they started testing this last year, it would take four or five years of testing. You’re looking at 10 years.”

Today’s sophisticated 2.5-megawatt and 3.5-megawatt wind turbines are designed to be turned into the wind with precision by onboard computer systems. The 80-meter to 120-meter long blades must also be positioned to carve the fullest potential from that wind. Precise repositioning may be required very quickly by a sudden wind variation. Ultracapacitor-powered motors do that work.

“They take our 16-volt, 58-farad module. [There are] 90 of them per blade, 270 modules per windmill, 600 volts running at 30 or 40 amps. And they do that on a very high-cycle basis,” Hall said. Exerting power quickly to move the blades can drain the modules, but they can be recharged quickly with a small portion of the electricity the turbine generates.

When the much larger turbines now in design and prototype stages come to market, Hall said, Ioxus modules “will be in all of them.”

Ioxus has just brought to market its newest ultracapacitor: a 2.7-volt, 3,000-farad cell. Hall said it is improved electrically, mechanically and thermally.

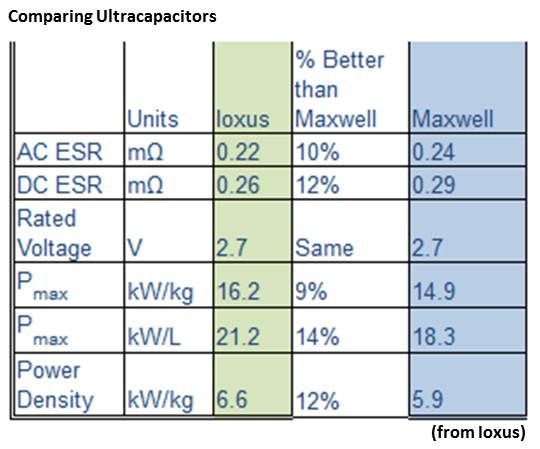

“Electrically, customers are always looking for the lowest equivalent series resistance (ESR), because the lower the ESR, the more efficient the cell,” Hall said. “Electrically, the iCAP is the lowest ESR cell on the market.”

Here comes that impressive number.

“European transportation companies agreed last year that a five percent increase in power density is big news,” Hall explained. In response, Ioxus went to work on its electrode-terminal interfaces and created a “12 percent improvement over the closest competition,” he said. “More than twice what they asked for.”

Hall said the “closest competition” primarily includes Maxwell, the ultracapacitor industry leader, and NessCap, an up-and-coming Korean firm.

Mechanically, a new three-option interface terminal allowed the iCAP, according to Hall, to become the first ultracap documented to pass the military’s random drop test by remaining functional through 45 minutes in a random drop tester. Thermally, the reduced ESR means less power-generated heat, a reduced cooling requirement and an overall system that is lighter and more affordable.

When asked to name the biggest obstacle to the widespread use of ultracaps, Hall replied: “Politics.”