Here's a (likely apocryphal) tale told in the thin-film solar manufacturing world:

An unnamed CIGS solar startup was doing process development and ran out of the de-ionized water used as a cleaning agent in their manufacturing process. That particular day, they substituted straight California tap water in their process and rather than ruin their experiment - the efficiency of the new PV material jumped a few percentage points.

The firm reacted by storing hundred gallon tanks of that day's tap water for later analysis to determine what mystery substance was improving their process.

The point is that there are countless variables to control in a solar cell, whether it be silicon, CIGS or cadmium telluride. And exploring those material, temperature, thickness and control variables in a systematic, rigorous manner can be beyond the capabilities of many solar firms. And certainly most start-ups.

Intermolecular changes that, maybe. I spoke with Craig Hunter, the Vice President and General Manager, Solar and Energy Technologies (formerly with Applied Materials' SunFab group) about the 120 person company. I also spoke with Tony Chiang, the CTO and the CEO, David Lazovsky.

For five years, VC-funded Intermolecular has partnered with semiconductor firms and more recently, solar firms in a collaborative development model to discover and hone new processes.

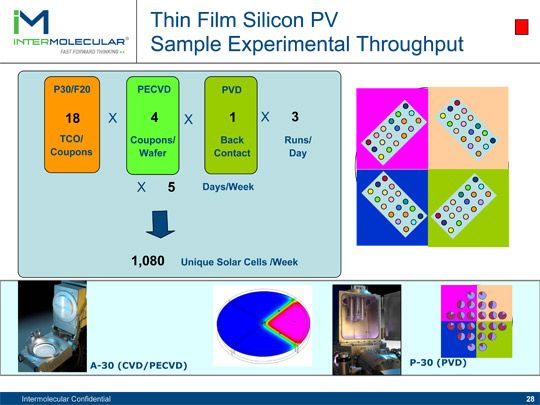

As reported earlier, Intermolecular claims it mastered is the ability to do many experiments on a single wafer -- up to 72 experiments per cycle. These are essentially miniaturized and site-isolated experiments. As an example: a wafer can be run with 18 different silicon wafer texturing processes, each with four different passivation techniques.

In a project that would take another company months and tax their analytical capabilities, Intermolecular can have a throughput of hundreds of uniquely characterized solar cells per week. Intermolecular has the flexibility to change gases, targets, chemistries and integration schemes. This is combined with automated probing and an "Informatics" software system that in many ways is similar to the techniques employed in biotech.

In turn, Intermolecular gets a royalty from products sold developed with their technology. But will solar or chip companies go for it? Semiconductor companies only reluctantly ever license technology. England's ARM is one of the few successful examples. Rambus and Tessera had to sue several large companies before establishing a royalty stream. Solar companies are similarly conservative.

Intermolecular is funded by CMEA, Redpoint and USVP. This trio of venture firms also funded cylindrical CIGS IPO-aspirant Solyndra. CMEA has a related portfolio firm - Wildcat Discovery Technologies which rather than look for new processes, instead searches for new materials for use in photovoltaics, batteries and in carbon capture.

According to Intermolecular, solar technology is like semiconductor technology in its ability to benefit from combinatorial R&D work flows The innovation at Intermolecular is "in applying a combinatorial methodology to device development."

Another innovation is in providing this semiconductor process development as a service. Note that Intermolecular doesn't focus on selling its equipment. The company sells its expertise for a fee and then, and here's the interesting revenue part -- it looks for a small royalty on the higher performance end-product. On the premise that a bump in efficiency, a reduction in cost or a more consistent and faster throughput is worth a lot to any solar firm. It's a unique approach.

The firm has already started working on projects aimed at improving alkaline texturing of monocrystalline silicon wafers and developing a more durable, lower cost antireflective coating for PV glass. The latest initiative getting underway is a development program focused on making high efficiency CIGS more manufacturable. The company is also considering programs targeting optimized transparent conductors and efficiency enhancement for earth-abundant PV materials like CZTS. Longer term ambitions include LEDs, thin film batteries, super-capacitors, and electrochromics.

The crew at Intermolecular is smart -- 50 percent of their 120 people have PhDs. And by all accounts -- their semiconductor business is rolling along. But there is a difference in the nature of semiconductor design and photovoltaic design and it's a difference that could limit Intermolecular's push into solar power. The IP in a semiconductor design is about clever layout and intelligent circuit and module design as well as process whereas the IP in a PV cell is often the process itself.

Solar firms might be reluctant to share the entirety of their secret sauce with the good people at Intermolecular.

That said, David Lazovsky, Intermolecular's CEO, cited Samsung's multi-billion dollar R&D budget as an indication of the opportunities that await Intermolecular, saying, "It's still so early in solar."