Here's a rundown on the most innovative wind technology on display at Windpower 2013.

There is a lot of action in resource assessment and forecasting, which is crucial because being able to promise and produce a contracted output helps remove the stigma of variability, according to GE Wind Product General Manager Keith Longtin.

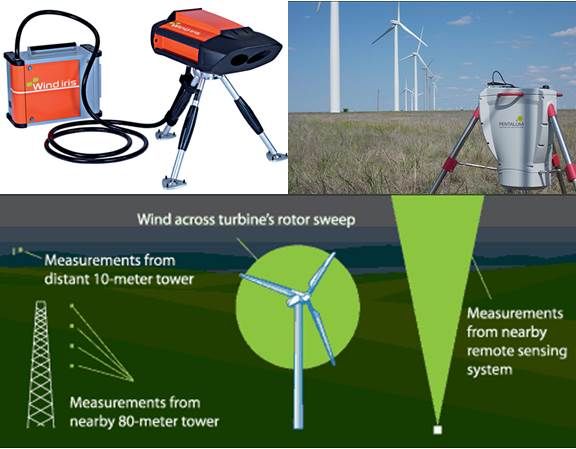

LiDAR devices, like Pentalum Technologies' Pentalum and NRG Systems’ Wind Iris, and sodar systems like Second Wind’s Triton, represent a new generation of remote sensing technologies, which, according to AWS Truepower Senior Business Development Manager Jesse Stowell, are making the financial community take notice.

Banks and the financial institutions crucial to project funding, which until recently rejected LiDAR and sodar in favor of traditional meteorological towers, now take seriously advice from consultants who tell them the data is scientifically valid and, in conjunction with met tower readings, can add a higher level of certainty to their investment. With the combination, said DNV KEMA Head of Energy Analysis Katy Briggs, measurements can be taken at hub height and across the rotor.

AWS Truepower’s openWind and 3TIER’s Numerical Weather Prediction (NWP) are advances on the ability to characterize wind resources with statistical precision, provide site plans based on cost-benefit analyses, and make predictions accurately enough for wind to derive revenue from ancillary energy markets.

“The difference today is the low cost of computing,” explained 3TIER Advanced Applications Consultant Jim McCaa. “With more computational power at a much lower cost, we can bring much more information to bear. We can do a full-blown time series analysis and look at wind in every hour instead of in twelve- or twenty-four-hour periods.”

ABB’s prototype HVDC breaker, now in pilot project development, was named one of MIT’s top ten disruptive technologies, according to ABB's Wind Business Development Manager Dennis McKinley. It sustains a transmission system’s reliability by automatically detecting any disruption and instantaneously rerouting as much power as is generated by a nuclear plant, faster than a blink of an eye.

Innovation is coming to market across the wind project delivery system, said Shermco President/CEO Ron Widup. New and emerging developments include:

- Monitoring of utility substations that detect anomalies in frequencies and voltages

- Sensors in the distribution system that instantaneously and wirelessly deliver data from wind installations to grid operators

- Power electronics that automatically optimize power as it is being conditioned in the nacelle

- Monitored turbine nacelle vibrational data that detects generator maintenance needs before they become repair needs (so instead of becoming an emergency, they become scheduled downtime)

- Increased automatic control of electrical arcing that makes turbines safer and eliminates costly hazards from maintenance work

Blade and tower makers are incorporating ultra-lightweight materials and utilizing 3-D computer designs to balance durability and flexibility.

Turbine manufacturers are bringing to market a new generation of machines that cuts costs and increases the harvest of slower winds.

While using analysis of the data from 400 onboard sensors and leveraging wireless technology to incorporate wind, energy market and grid forecasts, GE’s 2.5-megawatt, 120-meter-rotor Brilliant turbine also integrates storage at the turbine level. That will allow the turbine to do what is now being done only by wind farms with grid-scale storage.

Vestas and Siemens, GE’s closest rivals for market share, were asked to describe their new entries’ innovations but did not respond. Industry technology watchers said both firms are likely to have technologies similar to those being developed by GE.

Siemens (NYSE:SI) and GE (NYSE:GE) seem to be slightly ahead of the curve in the implementation of digital turbine operations, observed Competitive Power Ventures Director Martin Parizek.

Gamesa’s 2.5-megawatt, 114-meter-rotor, lower-wind machine claims a 29 percent energy harvest gain and a 10 percent cost of energy savings over its predecessor because of its WindNet remote control and monitoring system, which optimizes rotor positioning and predicts maintenance needs.

Goldwind USA, the only Chinese turbine manufacturer with a booth at this year's conference, takes a very different approach, according to Engineering VP Scott Rowland. A control system that allows predictive rather than reactive control is not rocket science, he said. The difficulty is getting useful forecasting information. Economies of scale mean that storage should be close to the substation rather than distributed at the turbine level. And Goldwind’s permanent magnet direct drive (PMDD) eliminates the need to condition the power, Rowland added.

The announcement by Goldwind USA CEO Tim Rosenzweig that his company is exploring a partnership with Boulder Wind Power, a U.S. startup creating advanced PMDD-based designs, is a clear indication that Goldwind's innovation emphasis is on building a better generator. “That’s pretty exciting,” Shermco’s Widup said of the announcement. “Not exciting for the gearbox people, but pretty exciting.”