In 2010, the International Energy Agency released a report predicting a resurgence for nuclear around the world. Months later, the Fukushima Daiichi disaster unfolded in Japan, rekindling fears about nuclear and sending shock waves throughout the industry.

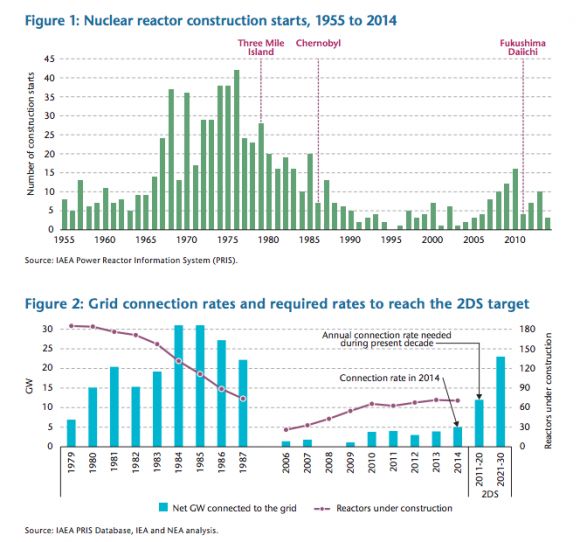

After the closure of reactors in Japan and Germany, global nuclear generation has dropped by 10 percent since 2010. Investment in new capacity also fallen. There were only three new plants under construction in 2014, with only 5 gigawatts of capacity added last year.

That's less than half of the yearly capacity additions needed to stabilize global temperatures at 2 degrees Celsius, argues the IEA in an update to its 2010 report.

According to analysts at IEA and the Nuclear Energy Agency, the nuclear industry will need to bring 12 gigawatts of capacity on-line every year for the next decade in order to meet the 2-degree target. By 2050, the industry will need to add an additional 530 gigawatts of capacity in order to boost nuclear generation to 17 percent of global production.

"Nuclear energy remains the largest source of low-carbon electricity in the OECD and the second-largest source in the world. Its importance as a current and future source of carbon-free energy must be recognized and should be treated on an equal footing with other low-carbon technologies," reads the IEA's technology roadmap, written in partnership with NEA.

While many agree with that sentiment -- including a growing number of scientists and environmentalists -- the reality for nuclear is bleak. Slowing power demand in many developed countries makes it difficult to justify building new plants. Post-Fukushima, new permitting requirements have also slowed construction. And across the world, new projects are facing long delays and cost overruns.

Doubling nuclear power plant construction rates in a decade's time won't be easy. Safety concerns and competition with distributed technologies for private and public investment will be impediments to growth.

The solutions to help spur new development are also likely to be controversial in some countries. Both IEA and NEA suggest tools such as capacity markets, carbon pricing or fixed-price requirements in deregulated markets to ensure nuclear can compete with natural gas, wind and solar.

"A clear commitment and long-term strategy for nuclear development at the national level is critical in raising financing for nuclear projects," write the agencies.

The organizations also called on regulators to improve their permitting processes and make it easier for advanced reactors to get approval. Finally, developers need to show they can build on time and on budget -- a rarity for nuclear.