IBM today announced that it will buy Tririga, a software company that specializes in commissioning and building management tools for large, commercial office buildings.

"If you have over a million square feet of real estate, you are a natural fit for us," said George Ahn, CEO of Tririga, in a profile in 2008. Ahn is an alum of IBM.

The company's software can be found in the facilities owned by one-third of the companies on the Fortune 100. Customers include General Electric and Nokia.

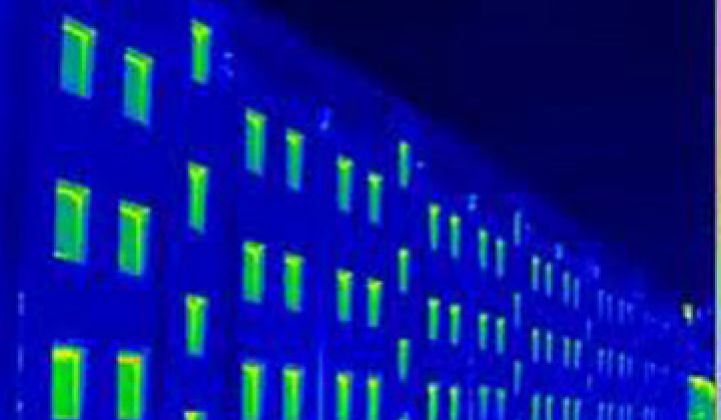

Buildings account for approximately 39 percent of all energy use in the U.S. and commercial buildings account for around half of that total. (IBM's press release mistakenly says that buildings account for 70 percent of all energy use in the U.S.; that's not quite right, but they do account for over 70 percent of all electricity use.)

A huge portion of that power, moreover, gets wasted: lights get left on after employees leave for home. Air conditioners flip on during cold days because the control system is set to flick them on at 4:00 p.m. no matter what. In Chicago, many skyscrapers are heated with electricity. Commissioning, or resetting these controls, happens infrequently and often involves hiring a bunch of consultants -- ugh.

"The way we heat and cool buildings in the U.S. is absolutely ridiculous," says Jim Lee, CEO of Tririga competitor Cimetrics.

As a result, companies large and small have been rushing into the space to establish niches. Many companies, such as Scientific Conservation, create software that rides on top of the existing building management systems from outfits like Honeywell and Johnson Controls that serves to enhance those systems. Some, such as Optimum Energy, focus on specific functions.

Others, like EnerNoc, are going for the whole building management/commissioning enchilada and creating full-fledged building management systems and then tying them into demand response networks. (Disclosure: this is one of my favorite segments in greentech, so the enthusiasm can be a bit much at times.)

Interestingly, the Tririga purchase fits a pattern that has been evolving in this space. Namely, it often is not the big, heavily funded startups backed through several rounds by VCs that are getting bought. Instead, acquirers are looking for value plays with existing clients. (Here's our first story on it.)

Last year, Siemens bought SureGrid, a company with a few big clients (such as the national chain of Michael's art and hobby stores) and little outside funding. Serious Materials got into building management last year by snapping up Valence Energy, which had just emerged out of Santa Clara University. Last year, Schneider Electric bought Vizelia, a company with only12 employees but 4 million euros in revenue. Honeywell, EnerNoc and others have made some acquisitions, too.

How come they can value shop? Partly, it's a function of supply. Mike Dauber at Battery Ventures told us a few months ago that there is a surprising number of commissioning/building management firms in the country. Many have been around for a few years, are self-funded, and already have existing clients.

So who is left? Cimetrics has a number of university clients. BuildingIQ has shown data in Australia demonstrating how it can significantly lower energy consumption, and it is run by a Goldman Sachs alum who probably can navigate a term sheet. A new company, Retroficiency, just emerged out of MIT that specializes in software for coming up with strategies for building retrofits.

And then there are the lighting networking companies like Lumetric, Lumenergi, Adura Technologies, Daintree Networks and Redwood Systems. Lights are generally not controlled by traditional building management systems. While lights account for 22 percent of all electricity in buildings, only one percent of California office buildings tout networked lights. Expect a shopping spree in light management soon.