Iberdrola USA finalized its acquisition of UIL Holdings this week to create a new company, Avangrid, which will be listed on the New York Stock Exchange as AGR.

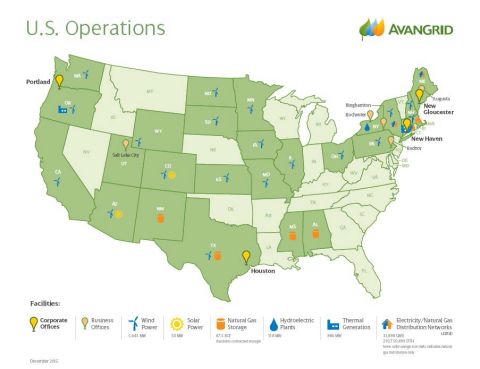

Iberdrola bought UIL for about $3 billion to offset losses closer to home in Europe, according to Reuters. Avangrid has about $30 billion in assets across 25 states. Regulated distribution utilities, like the ones UIL owns, offer a steady return in the face of variable energy policies and a sluggish economy in Spain.

There are some synergies for the two utility companies, particularly in the regions they serve in the U.S. Iberdrola USA is already active as an owner of regulated distribution utilities in the Northeast, including Central Maine Power, Maine Natural Gas, Rochester Gas and Electric and New York State Electric & Gas. UIL is the parent company to United Illuminating Company in Connecticut, Berkshire Gas, Southern Connecticut Gas, and Connecticut Natural Gas.

The new company, however, has plans beyond just streamlining operations across the eight utilities. “We will be a leader in the transformation of the U.S. energy industry,” said James Torgerson, CEO of Avangrid (formerly UIL’s CEO), in a statement. "A new American energy giant has been born."

In a conversation about demonstration projects under New York’s Reforming the Energy Vision (REV) earlier this year, Laney Brown, director of smart grid at Avangrid, said that utilities need to be more adept.

She noted that Central Maine Power was the first utility in New England that was settling data on a daily basis using its advanced metering infrastructure. Avangrid’s New York utilities currently have smart meter plans in front of regulators that will be further defined next June in a follow-up filing related to REV. The utility has been able to leverage some of its own lessons learned about customer communications as well as benefits of smart meters from Maine for its upcoming projects in New York. Central Maine Power has also been working with Tendril for customer engagement.

Brown has spoken about bringing innovation to the company, and not just to meet the objectives in New York around REV, which aims to transition utilities into platform providers for a distributed energy future. That could mean greater synergies across the utilities as there are lessons learned about leveraging smart meter data and integrating renewables.

In New York, for example, one of Avangrid’s key demonstration projects focuses on cutting the time and cost of interconnecting distributed resources. At the time the demo project was announced, Brown noted that within the past year, 40 percent of her company’s proposed distributed energy projects did not move forward because of slow or expensive grid-connection issues.

Any process improvements or technological advancements gained through this demonstration project could likely serve all the utilities under Avangrid’s umbrella, and not just the ones in New York. UIL, for its part, announced earlier this year it was ready generate 10 megawatts of clean energy under Connecticut’s renewable energy goals.

Besides the distribution utility, Avangrid also includes Iberdrola Renewables, which is the second-largest wind producer in the U.S., with projects in 18 states, and Iberdrola Energy Holdings, which includes natural-gas storage and energy services.

Avangrid was trading at $37.80 per share at midday on Thursday.