Spanish utility giant Iberdrola has unveiled a €75 billion ($89 billion) investment framework to 2025, with half the funds to be invested in renewable power capacity with its domestic market, the U.S. and the U.K. the main focal points of spending.

The new targets are up from those Iberdrola published in its 2019 annual report in February, which committed to increasing its annual investments to nearly €10 billion ($11.8 billion). It now expects average investment between 2023 and 2025 to be closer to €13 billion ($15.4 billion).

Back in February, the novel coronavirus was something happening in China, and the first cases in Europe had only just been identified. But by April, when lockdown restrictions were strongest, CEO Ignacio Galán recommitted to that figure and pledged to front-load the company's spending to help its supply-chain partners.

“As soon as possible, we will speed up our investments in order to contribute to economic activity and prevent...jobs from being lost,” Galán said during the firm’s annual general meeting in April.

On Thursday, Iberdrola held its capital markets day and pledged to boost its future growth plans even more. Of the €68 billion of organic investment, half will be allocated to renewables, catapulting the firm’s installed renewable capacity to 60 gigawatts by 2025 and 95 GW by 2030.

While the firm will be cutting carbon out of its portfolio, it has pledged to keep raising its dividend during the same period.

“The big transformation of the energy landscape that we’re going through has led us to analyze the prospects for the company looking beyond 2025. Up to 2030, the massive need for renewables confirms that our business model is the most appropriate way for us to deliver growth,” Galán told investors on Thursday.

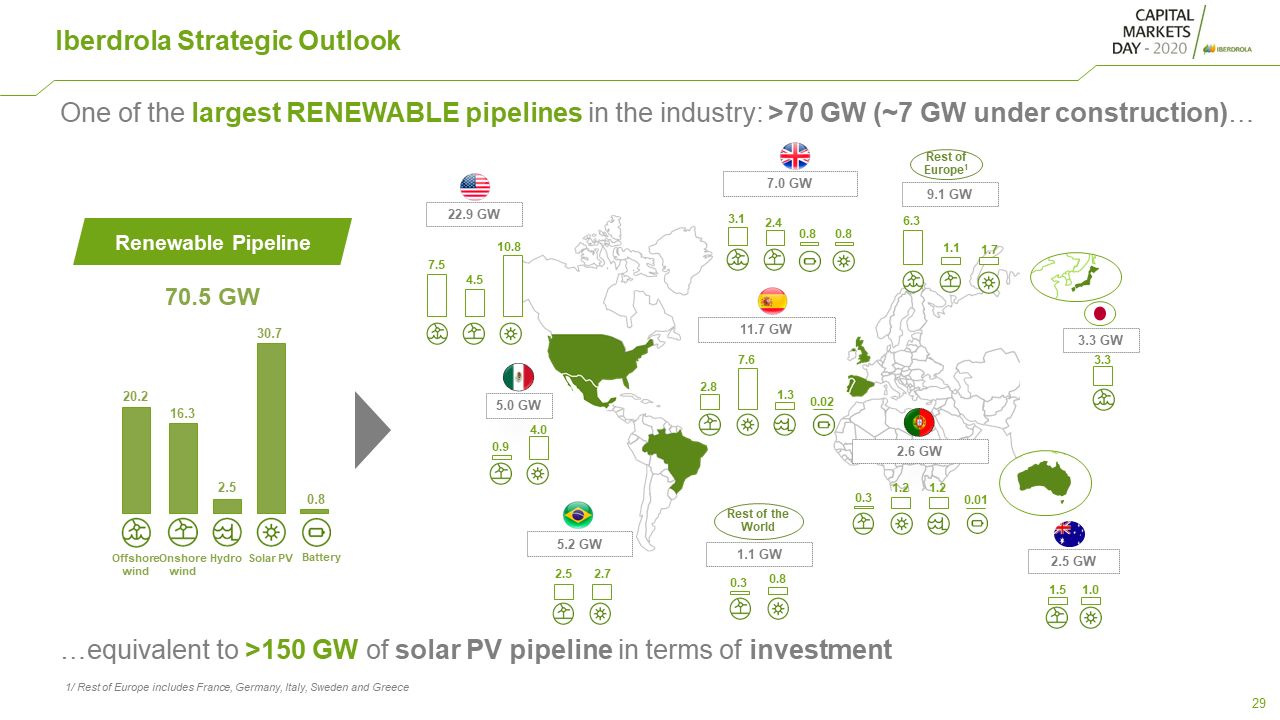

As of 2019, Iberdrola had 32 GW of installed renewable capacity. Of the planned organic investment, 34 percent will be allocated to the U.S. — €23 billion ($27.3 billion) — with Spain, U.K. and Brazil the next-largest markets to benefit. The firm’s 7 GW portfolio in the U.S. will double to 14 GW by 2025 under the new plans. Iberdrola owns 81.5 percent of the utility Avangrid and claims to have the second-largest offshore wind pipeline in the States.

In 2019, 30 GW of the company’s 32 GW renewables portfolio was hydro (13 GW) and onshore wind (17 GW). By 2025 solar will balloon to 15 GW alongside 14 GW of hydro and 26 GW of onshore wind as the company diversifies and improves its generation profile in the process.

Iberdrola's global renewables pipeline (Credit: Iberdrola)

Iberdrola stretches renewable ambitions beyond power sector rivals

According to Galán, 60 percent of the projects required to hit that 2025 capacity target has already been secured.

At Thursday's event, Galán also revealed that the company was raising its 2022 guidance for net profit. While the company expects lower demand and lower allowed returns for its network businesses to make a mark, this will be offset by lower interest rates, efficiency gains and the benefits reaped from its accelerated investments.

Iberdrola's new targets push it beyond its European rivals such as French rival EDF, which is targeting 50 GW of capacity by 2030. It also blows the spending of Shell and BP out of the water, although these and other European oil majors are making moves in offshore wind and the nascent green hydrogen economy.

BP is looking to scale up its low carbon investment, which includes carbon capture, hydrogen, EVs and renewables, to $5 billion per year by 2030, up from $500 million.