As battery prices continue to fall and the penetration of variable wind and solar generation rises, power plant developers are increasingly combining wind and solar projects with on-site batteries, creating “hybrid” power plants.

The variability of wind and solar power requires balancing to meet the demands of the system they operate in. While this is typically done at the system level — using dispatchable power plants, demand response and other techniques — developers are seeing some advantages to integrating batteries on-site, making the wind or solar plant look more like a conventional power plant.

Interest in hybrid plants is high, and hybridization can offer benefits relative to standalone plants, according to new research from Lawrence Berkeley National Lab and the Electric Power Research Institute.

However, there are also limitations to hybridization, and market rules and policy incentives can make or break the finances of a project. The research, appearing in The Electricity Journal, looks at the operational benefits and drawbacks, relative costs and benefits, and industry trends toward hybrid power plants.

Surging hybrid project development

There are already 4.6 gigawatts of wind, gas, oil and photovoltaic power plants co-located with batteries in the U.S., with another 14.7 gigawatts in the immediate development pipeline and 69 gigawatts in the longer-term interconnection queues of regional power markets, according to interconnection queue data from the U.S. Energy Information Administration, regional transmission organizations and independent system operators.

In the interconnection queues, a quarter of all proposed solar projects are combined with batteries, with 4 percent of wind projects also proposed as hybrids. In California, almost two-thirds of solar projects are proposed as hybrids.

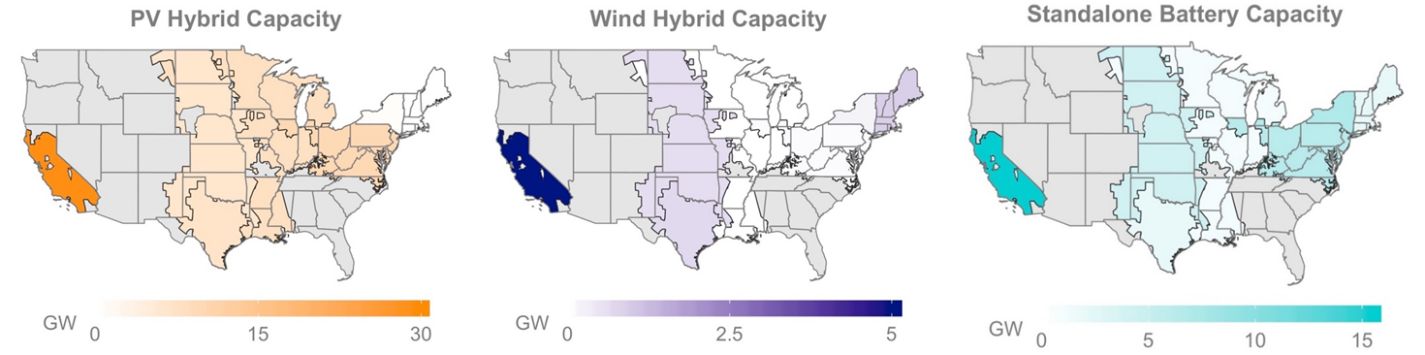

Hybrid capacity and standalone battery capacity in each ISO queue.

Thanks to its high penetration of solar (it accounted for 20 percent of the energy mix in 2019), California is seeing low net load in the day, with a large ramp in the evening hours, as the sun goes down — a phenomenon known as the “duck curve.” The state is also seeing the highest amount of standalone battery systems proposed and is the region with the largest number of proposed wind hybrid projects.

To hybridize or not to hybridize?

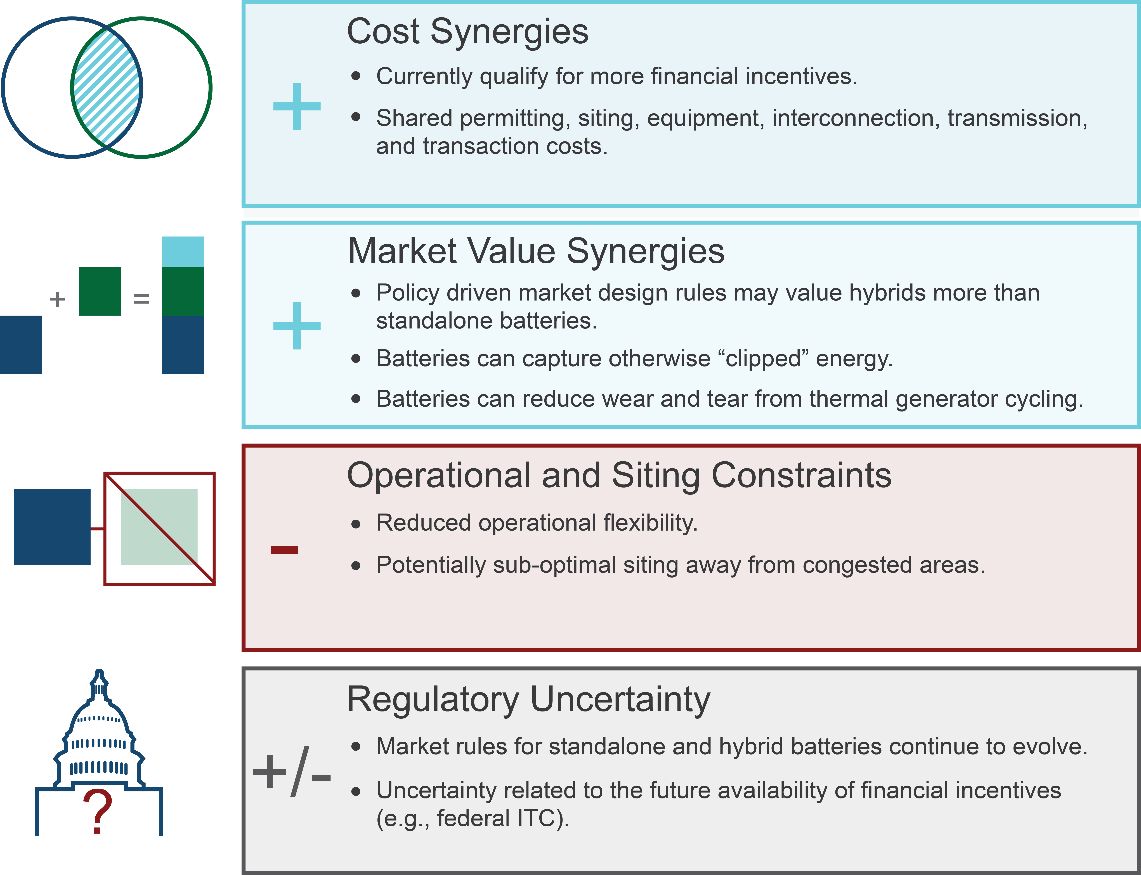

Putting the generators and batteries in one location can save on shared equipment and interconnection and permitting costs, capture otherwise clipped energy, and take advantage of federal tax credits that encourage coupling solar and batteries. System operators and purchasers may prefer hybrid plants relative to standalone generators given their greater dispatch flexibility.

But co-locating batteries with generating units may not always be the optimal solution.

Batteries may be blocked from full participation in the market if constrained to charge from their co-located generators. Plus, co-locating could reduce siting flexibility of a battery project. Large wind and solar plants are located where the renewable resource is strong, land is available and grid connections are possible. However, this location might not be where a battery provides the most grid benefits. Policy and market designs can also be a critical factor.

Pros and cons of hybridization

Capacity markets make a big difference

The growth of hybrids is also being driven by falling prices. Power-purchase agreement prices for hybrid power plants have plummeted in recent years, with declining costs for wind, solar and batteries. Based on contract price information for 23 of the 109 online and pipeline solar-battery hybrid projects, our study found that prices have fallen from the 2017 range of $40 to $70 per megawatt-hour to $20 to $30 per megawatt-hour in 2018 and 2019.

However, whether developers get paid for providing capacity or just energy is a big factor in whether hybrid plants pencil out economically. The cost of adding four-hour battery storage at a utility-scale solar project ranges from $4 to $14 per megawatt-hour. But the added value can be as high as $13 to $31 per megawatt-hour in the combined energy and capacity market in California, or as low as $1 to $9 per megawatt-hour in the energy-only power market in Texas.

Value premium for PV and wind hybrids compared to standalone projects.

Whether hybrid plants are economically attractive is location-dependent and will be influenced by future wholesale pricing trends. And while federal tax incentives for solar power can also be applied to batteries that are directly charged by the solar panels, that means the batteries can’t always be charged from the grid, limiting their ability to take advantage of periods of low-priced power.

The Berkeley Lab research finds that, compared to standalone wind/solar and battery plants, hybridization that restricts grid charging and decreases the hybrid plant’s combined interconnection limits results in a 2 percent to 11 percent loss in wholesale market value. The benefits of hybridization from receiving the federal Investment Tax Credit and reducing interconnection costs may need to exceed these levels to offset the value loss from hybridization.

Time will tell whether this trend is a short-lived product of current policy drivers or a more lasting phenomenon. Co-locating batteries with wind and solar can offer cost synergies and a value premium in current wholesale markets. But independently sited batteries without limitations on grid charging or renewable generator interconnection limits can currently capture more value.

More research is needed to clarify the long-term cost-reduction potential, market value and risks/benefits of hybrid projects within the electricity system.

****

Will Gorman is a graduate student researcher at Berkeley Lab.

The article, “Motivations and options for deploying hybrid generator-plus-battery projects within the bulk power system,” is available in the Vol. 33, Issue 5 issue of Electricity Journal, or online here. The authors are Will Gorman, Andrew Mills, Mark Bolinger and Ryan Wiser of Berkeley Lab; Nikita G. Singhal and Erik Ela of the Electric Power Research Institute; and Eric O’Shaughnessy of Clean Kilowatts.