Solar module suppliers will finally receive some bottom-line comfort as global prices stabilize or even rise, following two years of tumbling prices and a year of promising recovery.

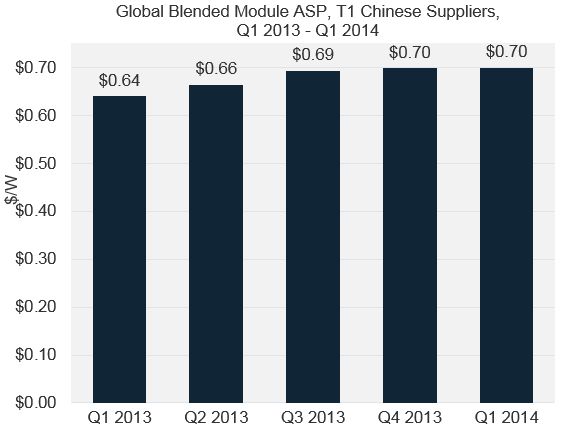

The global blended average selling price for top Chinese suppliers increased by 9 percent, from 64 cents per watt in Q1 2013 to 70 cents per watt in Q1 2014. This was primarily due to significant improvement in supply-demand balance, with robust demand growth in China, Japan and the U.S. coming into contact with a fitter, leaner supply chain.

Source: GTM Research PV Pulse

However, as we have pointed out before, with module pricing now varying by as much as 25 cents per watt across regional markets, there is limited value in looking to a single, global module price to infer market trends. The chart below from GTM Research’s latest report on PV pricing shows that regional price levels for Chinese-produced modules varied from 80 cents per watt in Japan to 55 cents in Chile in Q1 2014, a mean spread of 31 percent.

Source: Global PV Price Outlook: Q2 2014

Though the upper and lower bound are not expected to change by a significant measure in 2014, there are new price drivers set to shuffle average price levels and ranges for a few major and emerging regional markets.

United States: Chinese module prices will rise above 75 cents per watt

Prices for Chinese-produced modules in the U.S. exhibited the most fluctuation during the first quarter of 2014, with pricing for orders in the 1-megawatt to 5-megawatt range up 3 percent from 70 cents per watt in Q4 2013 to 72 cents in Q1 2014. Pricing for larger order volumes has remained below $0.70 cents per watt, although it has inched upwards in recent months as well. The main driver for Chinese module prices in the first half of the year will be the cost of Taiwanese cells, the price of which increased 2 percent quarter-over-quarter to 44 cents per watt in Q1 due to strong demand. Cell prices are expected to reach 45 cents per watt in the second quarter of 2014. Regardless of the shipment strategies that will come into play following the anti-dumping and countervailing duties decision, prices are expected to be in excess of 75 cents per watt. GTM’s latest channel checks confirm this, with quotes from select Chinese vendors for delivery in the second half of 2014 (1 megawatt to 5 megawatts) ranging from 78 cents to 82 cents per watt. This would bring Chinese prices closer in line with Japanese, American and European competitors in the U.S., which are currently quoting prices in the low-to-mid 80 cents per watt level.

Europe: China import price floor lowered, selling prices to follow

Though prices for Chinese producers have stayed flat to the price floor of €0.56/W since it was set in Q3 2013, conversion to U.S. dollars reflects a change from $0.74 cents per watt in Q3 2013 to $0.77 cents per watt in Q1 2014. As of April 2014, the price floor for Chinese producers dropped to €0.53/W; prices are expected to fall in line with the new floor.

China: Average selling prices will increase in the second half of 2014

Selling prices in China have been flat at $0.62 cents per watt since mid-2013. Weak prices in Q1 were due to seasonally weak demand and poor weather conditions. Though prices are still comparatively weak relative to the average global selling prices of $0.70 cents per watt, the region's average selling price (ASP) has increased 7 percent since Q1 2013, and pricing is expected to further increase in the second half of 2014 to $0.64 cents per watt as demand picks up.

Japan: Stronger focus on the utility-scale market will drive lower ASPs

Prices for Chinese-produced modules in the Japanese rooftop market stayed flat at $0.80 cents per watt, while prices in the utility-scale market decreased 1% to $0.69 cents per watt due to stronger price competition. A renewed focus on the utility market has caused the average regional price to decline 3 percent quarter-to-quarter to $0.74 cents per watt in Q1, a trend that will continue throughout 2014. Domestic producers in the residential space are still selling at significantly higher rates (more than $1.00 per watt and up to $1.50 per watt), though suppliers are focused on selling solar kits (module, inverter, battery), making it difficult to differentiate module prices.

Mexico: Talks of cutting the 15 percent import tax on solar modules

Prices for Chinese-produced modules in Mexico’s rooftop market ranged from 65 cents per watt to 75 cents per watt in the first quarter of 2014. This doesn’t include the 15 percent import tax which companies are splitting with customers, promising discounts if the tax is removed and suppliers are retroactively reimbursed. Currently, the government is considering moving modules to the “generator” classification, which would eliminate the tax in whole. Though this would decrease the cost for Chinese-produced modules, there is a clear preference for U.S.-produced modules (SolarWorld, Suniva), which are currently priced between 85 cents per watt to $1.00 per watt.

Brazil: Cut of the 12% import tax on solar modules under review

Modules were being quoted around 70 cents per watt in Brazil during Q1, which is in line with the global average. That figure is pre-import tax, so final prices range from 90 cents per watt to $1.00 per watt, though we’ve also had reports of post-tax prices in the $1.30 per watt to $1.50 per watt range. The Brazilian parliament is currently assessing whether to exclude solar modules from the import tax.

***

Jade Jones is a solar analyst at GTM Research, where she covers the upstream manufacturing space. She is also the author of the recently published report Global PV Pricing Outlook: Q2 2014.