While some talk about the necessity of developing new utility business models, solar finance and installation leaders are actually making it happen by forging partnerships with retail electricity providers.

Clean Power Finance’s new partnership with North American Power demonstrates one of two ways in which a retail electricity provider (REP) can profit from selling solar in deregulated electricity markets, according to Sierra Peterson, CPF's director of business development. North American Power ranks among the top fifteen REPs in the U.S., serving more than 320,000 electricity and natural gas customers.

If a REP has capital and a tax-equity appetite, it can become a project finance investor and gain the advantage of the investment tax credit and accelerated depreciation while generating a long-term, secure revenue stream.

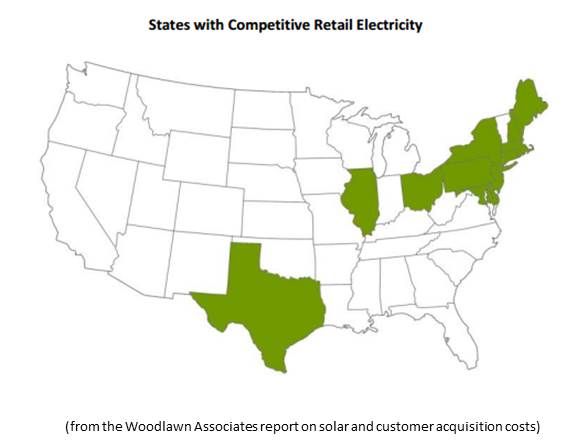

But many of the REPs now serving the region with more than 11 million electricity customers in thirteen states and Washington, D.C. are not in a strong cash position, Peterson said. Margins are “razor-thin, [amounting to] tenths of a cent per kilowatt-hour,” and the average customer contract of 36 months brings in only about $300 per customer in average lifetime value for the REP, Peterson added.

“We’re in a period now of M&A activity,” she added. “Retailers are thinking about how they can make it through.”

Competition and consolidation have forced REPs to hone and refine their customer-acquisition skills. The number of residential customers under contract grew 16 percent per year from 2008 to 2012, and REPs captured more than half the residential electricity consumers in many deregulated markets.

But the popularity of deregulation is waning, Peterson said. New territories are not opening up. Growth now is likely to be a “zero-sum” proposition that essentially entails “poaching” other REPs' customers. “Many are looking at new products, like branded solar and home energy management systems, to try to differentiate themselves.”

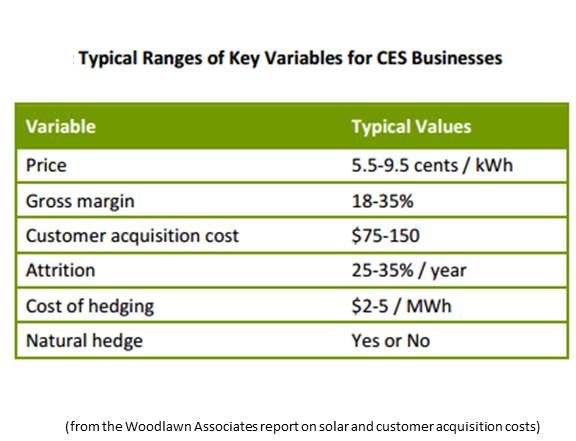

“A company’s ability to find customers efficiently is one of the major determinants of success,” according to the report Electrical Potential: Reducing Customer Acquisition Cost and Increasing Lifetime Value in Solar and Competitive Energy from consultancy Woodlawn Associates. "Customer acquisition cost, which typically ranges from $75 to $150, is a key operating metric.”

By contrast, the average customer acquisition cost for SolarCity, according to the company's earnings reports, is $2,500, Peterson said.

Now REPs are applying their skills at securing customers to the prospect of closing solar service contracts. The fee CPF pays for a completed solar contract is a multiple of the $300 lifetime average value a REP would otherwise get from the customer, according to Peterson.

A much larger opportunity awaits those few REPs which, like Integrys Energy Services, can put up the cash for a solar finance fund.

"There are two models,” Peterson said. “You find a customer who's interested in going solar. You close the solar sale through CPF. We pay you. You retain the brand and the customer relationship. Case closed. The other option is you own the system.”

By putting up the big upfront capital to own the system, the REP can extend the lifetime value of the customer relationship to twenty years and generate a payoff of many times more than that $300, Peterson said.

Woodlawn Associates estimated that the “net present value of a new solar customer to be $4,000 to $8,000, depending on the value of key variables.”

In either business model, CPF handles all transactions and payments and manages the downstream installation process. Its national network of qualified installers builds and maintains the system on behalf of the REP brand.

“If you're an energy retailer, the thought of having a twenty-year relationship with a consumer and being able to up-sell on home alarm and energy management systems is a very attractive proposition,” Peterson said. “They profit while building their brands.”

Other national installers are developing REP partnerships, as well. SolarCity is working through Viridian in the residential space and with Direct Energy in the commercial and industrial solar sector, though Sunrun has not yet followed suit. NRG Energy is a very large REP building its own residential solar activity through its NRG Solar subsidiary and via a partnership with Reliant in Texas. OneRoof just announced a lead generation partnership with Choose Energy, which is sort of like the Kayak of REPs.

CPF’s differentiator is that “the originator’s brand will always be upfront” and the REP maintains its ability to return to the customer with more product offerings. In contrast, "Once you sell through SolarCity, it [becomes] SolarCity’s customer,” Peterson said.

The next big frontier for CPF is finding the right business model for regulated and municipal utilities, according to Corporate Development VP Micah Myers. “But the construct will be similar. Solar is just as complementary for utilities to sell in regulated markets. And new channels, including media and telecommunications companies, are kicking the tires on solar.” CPF already manages a large third-party fund for Google, Myers said. "Maybe there could soon be a Google Solar brand."