1366 Technologies and Innovalight both started life with an ambition to make solar cells.

And since the crash of 2008, both have shifted their business plans for the better. This could be a model for the rest of you.

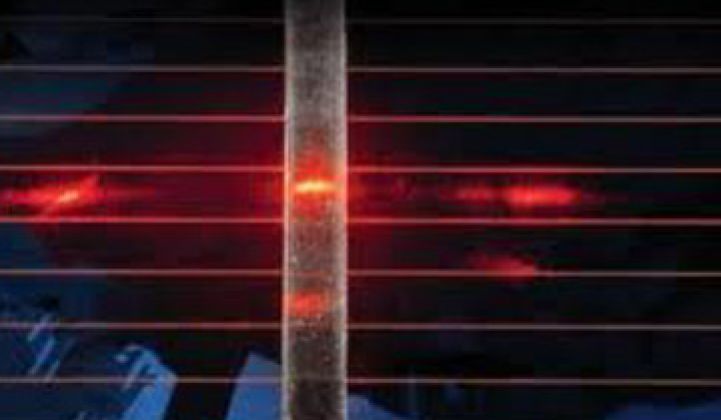

1366, which announced it raised $20 million in a second round today, says it has come up with a way to produce crystalline silicon wafers that could cut the cost of solar modules by 40 percent or more. Under its "direct wafer" technology, molten silicon is directly converted into wafers, which can then be processed into solar cells. Traditional wafer manufacturing is a time-consuming, four-step process involving sawing and ingot formation in which half of the silicon is wasted, according to 1366 CEO Frank van Mierlo. The company's improved process reduces the cost of making a wafer by 80 percent, he said, and wafers account for more than half the cost of producing a module.

"We literally have the best process on the planet," he said. "If you can dramatically reduce the cost of the wafer, you can dramatically reduce the cost of solar.

"In this space, we have an advantage that will allow us to be a manufacturer," he added.

The process was invented by MIT professor Ely Sachs in 2009. "He deserves all of the credit," said van Mierlo. ARPA-E funded development of the technology with a $4 million grant. The technology is actually independent of the solar cell that was at the core of 1366's original business plan. (Incidentally, '1366' does not refer to the year the Black Plague started; it's the measure of how much solar energy (1366 watts) strikes a square meter of the Earth on average.)

The company will use the money to build a factory. The current round will pay for around half of the factory, and 1366 hopes to break ground a year from now. The company, however, will be able to get wafers out beforehand.

South Korea's Hanwha Chemical, which acquired China's Solarfun, is an early customer. Hanwha, which plans to invest $5 billion into solar manufacturing, was also an investor in the latest round.

Now we change a few nouns and verbs and deliver a similar story. Innovalight has signed a deal to sell its silicon inks to Solarfun.

This is the third deal for Innovalight: it signed deals with Yingli Green Energy and JA Solar earlier this year.

When added to crystalline silicon solar cells, Innovalight's ink can boost their efficiency. Right now, adding Innovalight's secret sauce increases efficiency by about a percentage point, i.e., an 18-percent-efficient solar cell becomes a 19-percent-efficient cell. Put another way, adding in the ink turns a 30-megawatt-per-year line into a 35-megawatt line without the need for lots of expensive new equipment. Next year, the ink will add two percentage points to overall efficiency, and in 2012, the target is three percentage points.

Both 1366 and Innovalight could produce their own solar cells and modules. Unfortunately, solar modules and cells -- despite being elegant examples of technology -- get priced as commodities and Chinese manufacturers have an edge in lower labor costs and sometimes-favorable government policies.

Rather than fight the trend, both companies have decided to go up the supply chain and come out with products heavy on intellectual property that can deliver a marked advantage and, just as important, can't be easily copied by competitors. Meanwhile, Asian conglomerates will fight for market share in the finished goods market. (See Will Your Next Employer Come from China?).

Can producing components like this revive manufacturing and provide the same amount of economic benefits associated with actually making branded products? IP companies generally don't employ as many individuals, but these two companies are combining IP functions with manufacturing. Another advantage to this model. Neither 1366 and Innovalight are licensing patents or processes, which can be stolen. They are selling IP-intensive goods: unlocking the secrets of finished materials takes time, luck and really good reverse engineering.

Companies such as Nanostellar (catalytic powders for diesel engines), e-Solar, and Mission Motors have shifted toward similar intellectual property/component models, as well. The trend started in 2008.

In a way, it's almost a reverse of the situation that prevailed in the '90s, when U.S. companies made the "brand-name" products and Asian companies made components.