Now that we’re into the (slightly) slower summer months, it seems like a good time to take a step back and evaluate how utility rate structures are evolving in a changing energy landscape, and how those rate structures might be improved.

Also, it just so happens that several papers and reports were recently published on this topic, so that’s what we’re going to delve into.

The previous State Bulletin looked at how to adopt more effective state energy-efficiency policies -- which can be a source stress on the traditional utility business model. Building on that theme, this week’s column looks at ratemaking as it relates to distributed energy resources, and solar in particular, which is another source of tension in the electricity space.

First, a look at the latest solar policy action

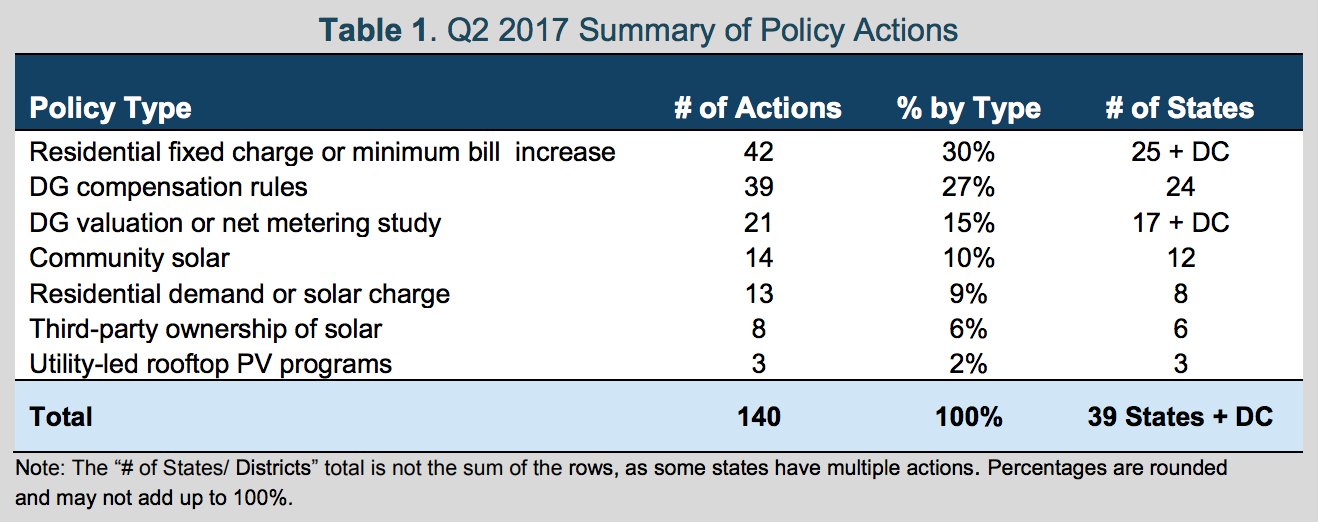

The North Carolina Clean Energy Technology Center's 50 States of Solar report for the second quarter of 2017 finds that 39 states and the District of Columbia took some type of solar policy action during Q2 2017. In those states, a total of 140 state and utility-level distributed solar policy and rate changes were proposed, pending or enacted in Q2 2017.

The report notes the top five policy developments of Q2 2017 were:

- The New Hampshire Public Utilities Commission adopting a net metering successor tariff

- The Nevada legislature nearly restoring net metering in the state

- Montana initiating a review of the costs and benefits of net metering

- The North Carolina legislature passing a bill that would enable solar leasing and a review of net metering credit rates (which the governor signed into law late last month)

- Maine’s governor vetoing compromise net metering legislation passed by the legislature (and the legislature failing to overturn it)

“There seems to be a movement from net metering toward alternative compensation structures that are based on the value distributed energy resources provide to the grid,” said Achyut Shrestha, senior policy analyst at NCCETC. “How these proceedings play out will have an important impact on state solar markets.”

How to set time-of-use rates

There’s a growing consensus that utilities need to adopt dynamic pricing that varies based on the time of day. Why? Because it helps utilities manage load peaks and ramps, which reduces costs for all ratepayers. What's more, if properly implemented, dynamic electricity pricing is fairer and will generally encourage customers to use electricity more efficiently -- enabling them to have more control and save money.

But while there’s widespread support for utilities moving to time-sensitive rates -- there’s still a lot of debate around how to design and implement them.

In 2019, utilities in California will roll out time-of-use (TOU) rates at an unprecedented scale by making them the default for all residential electricity customers. Residential solar customers are already making the switch. As of July 1, 2017 all new solar customers are required to take TOU rates, as the state’s utilities implement NEM 2.0.

The transition hasn’t exactly gone smoothly. There’s been a lot of concern around how the rates are structured, and specifically on when utilities set their peak periods. There’s also ongoing confusion around the details of the rates and frustration over how fast they’re being implemented in some places.

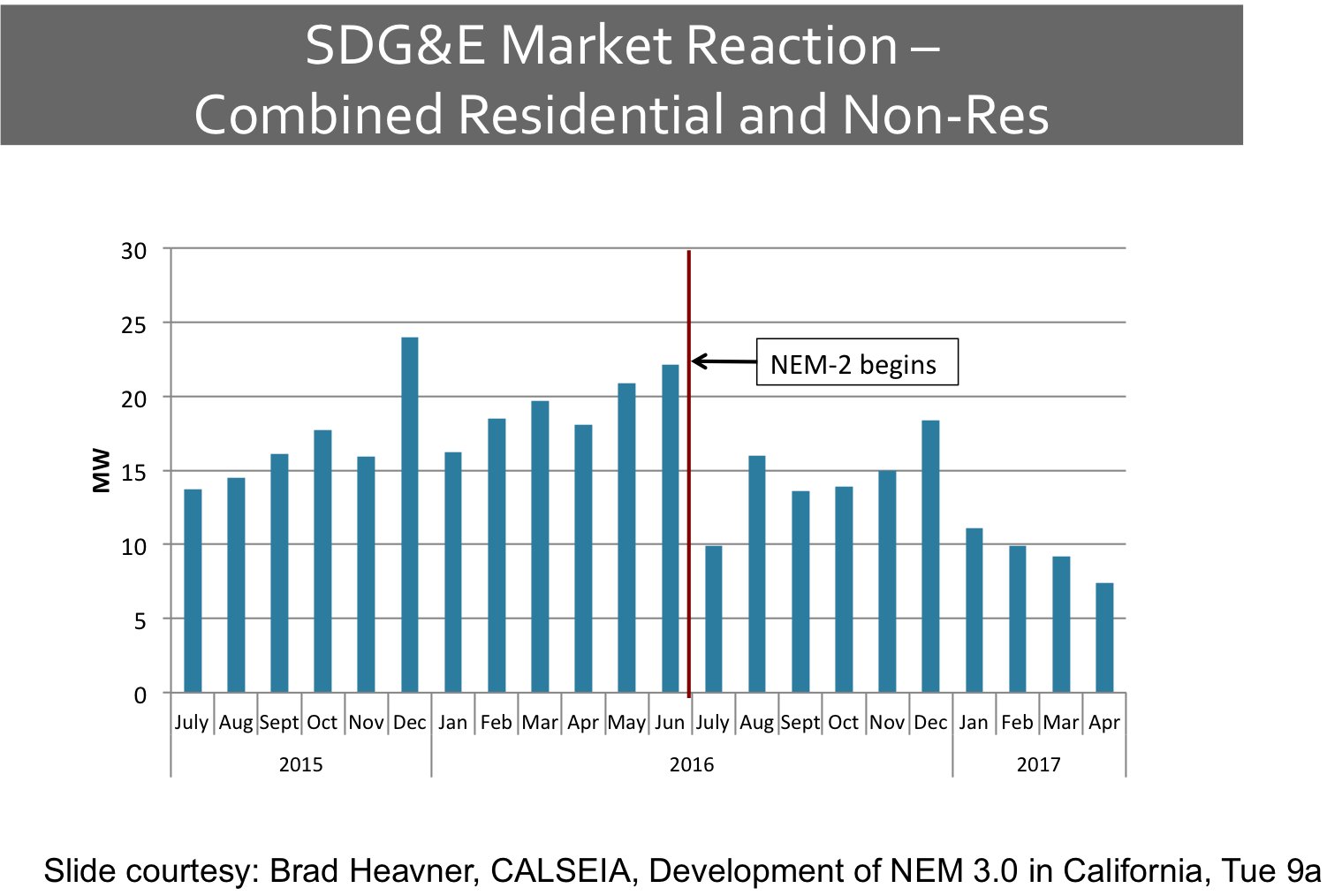

The rollout of TOU has had an effect. In SDG&E territory, NEM 2.0 caused the number of installations to noticeably decline.

To help inform the TOU debate, John Colgan, former commissioner at the Illinois Commerce Commission, recently co-authored a paper offering guidance for regulators looking to establish time-sensitive rates. The paper cites both the potential benefits of TOU (i.e., improved system utilization, reduced peak demand, and lower energy bills) as well as the potential drawbacks (i.e., electricity price spikes and higher bills for low-income customers).

Colgan writes that “public utility commissions should weigh TOU rates meticulously -- and other alternatives to achieving similar goals -- with special attention paid to ensuring that any implementation does not disproportionately harm low-income consumers, elders, and others who are particularly vulnerable to adverse health effects of unsafe indoor temperatures.” He also offered several recommendations, including:

- Require explicit upfront identification of the utility system and policy objectives to be achieved with a TOU rate, such as economic efficiency, deployment of DER technologies, peak load reduction, emissions reduction, and/or more equitable cost/benefit allocation.

- In evaluating impacts on customer bills, carefully consider the drivers of new generation as well as new transmission and distribution capacity in the relevant jurisdiction, and study the degree to which a change in overall residential load profile may occur and impact those drivers and cost allocation to the customer class.

- To help make TOU rates both effective and understandable, keep the rate design to a relatively few time periods (e.g., two to three) that are well synced with underlying system costs.

You can read the full list of recommendations here.

Time to make three-part rates standard?

TOU rates are a widely supported option for utilities looking to implement dynamic pricing, but some electricity experts say TOU rates are not the best solution.

Earlier this year, Brattle Group released a report on time-varying rates in Ontario. Besides Italy, the Canadian province is the only region in the world to have rolled out smart meters to all of its residential customers and to have deployed TOU rates for generation charges to all customers who stay with the default regulated supply option. Analyzing price data over a three-year period, the report concludes that default TOU rates yielded tangible reductions in peak demand in Ontario. But if the peak to off-peak price differentials were higher, “there is every reason to expect that the reductions in peak demand would have been higher,” wrote Brattle Group Principal Ahmad Faruqui.

In California’s case, Faruqui believes that differential must to be higher or the state will fail to adequately address the issue of over-generation and sharp load ramps in the afternoon. What’s really needed, he argues, is a three-part rate including a monthly fixed charge, volumetric charge and demand charge.

“As soon as demand starts spiking and the price starts rising, customers with enabling technology can respond to that price signal to help manage the demand spike,” Faruqui recently told Utility Dive.

“TOU rates solve yesterday’s problem," he said. "The future is dynamic pricing enabled by smart technology that brings variable renewables and DER onto the grid at the right time and the right price.”

In a July 2016 report, Faruqui wrote that advanced metering infrastructure has made it possible to offer more complex, time-based rates that better align pricing and costs and “incentivize customers to change consumption patterns, which can help utilities achieve lower generation and distribution costs as well as renewable energy integration.”

“It is time to make three-part rates the standard offering for all residential customers,” the report concludes. “Doing so will encourage better use of grid capacity, minimize cross-subsidies between customers, and foster adoption of advanced technologies. It’s a win-win-win opportunity”

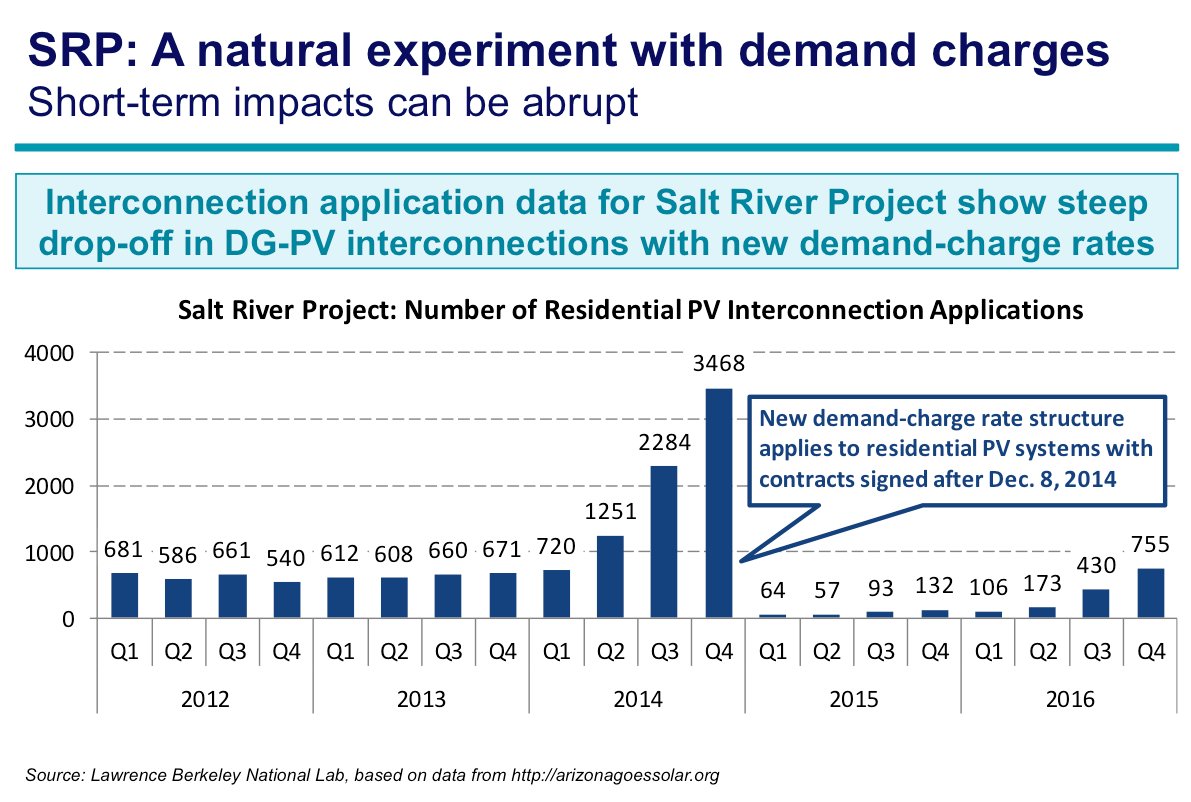

The difficulty, as with TOU, is structure. For instance, Salt River Project implemented demand charges, and the number of solar installations in its territory dropped dramatically. So if three-part rates are to be a “win-win,” it's critical that customers understand what demand charges are and have the ability to change their behavior in response.

Battle of the proxy policy groups?

While the conversation over ratemaking for DERs is evolving and becoming more nuanced, it’s still not entirely free from conflict.

A recent story in The New York Times drew new attention to the role the Edison Electric Institute (EEI) has played in advocating for policies that are unfavorable to distributed solar -- and it caused a bit of a stir. Some in the industry, like Sunrun CEO Lynn Jurich, said the article was spot-on, while others said the story was oversimplified and unproductive. “The ideas that more rooftop solar = good at all times and places and rate reforms always = 'war against solar' need serious interrogation,” tweeted MIT’s Jesse Jenkins.

A paper released in May by the Energy Policy Institute, a pro-solar watchdog group, detailed EEI’s efforts to advance policies considered hostile to rooftop solar. The objectives laid out in EEI documents include “reforming electric rates and advocacy for increased fixed and demand charges, while other priorities deal with EPA regulations, tax issues, litigation efforts, and outreach activities to ‘minority and community organizations,’” the paper states. Energy Policy Institute also claims that utility customers are funding these anti-solar efforts, because utilities pay dues to EEI in large part with funds collected from customers’ energy bills.

EEI spokesperson Brian Reil replied to Midwest Energy News about the Energy Policy Institute report, stating: “Public utility commissions across the country conduct open and transparent regulatory rate reviews to determine what costs regulated energy companies can appropriately recover. During these proceedings, EEI’s member companies provide necessary record evidence to support each recoverable expense, including a portion of trade association dues.”

Riel also pointed to a report by the Campaign for Accountability that says the Energy Policy Institute has close ties to the solar industry and effectively operates as a PR firm for the sector. The Campaign for Accountability is also labeled a nonprofit watchdog organization. The group states that its mission is to use “research, litigation and aggressive communications to expose misconduct and malfeasance in public life and hold those who act at the expense of the public good accountable for their actions.”

Meanwhile, another group named the Partnership for Affordable Clean Energy (PACE) came out with a report last month that refutes claims about the value of residential solar, “namely that it provides significant value by avoiding capacity, enhancing reliability, hedging against price volatility, and more,” a press release states. “Residential solar adds value, but not as much as some advocates claim.”

"Where states choose to maintain net metering payments at a retail rate, costs are shifting to non-solar customers at an alarming rate," said David Gattie, associate professor of environmental engineering at the University of Georgia and author of the PACE report.

If you were to ask the Energy Policy Institute, the problem with this finding is that PACE is intentionally seeking to undermine DERs. PACE is a “dark money” group that “advocates for the positions of fossil fuel and utility interests,” according to Energy Policy.

Clashes between interest groups are unlikely to end anytime soon, especially at a time of dramatic change and uncertainty in the electricity sector. What seems most important is that policymakers ignore the noise and focus on the data that’s relevant to their state and the utilities they regulate.