Out in Utah, a coal-fired power plant supplying electricity to Los Angeles is being outfitted with natural-gas-fired turbines that will eventually be able to run on hydrogen, created via electrolysis with wind and solar power and stored in massive underground caverns for use when that clean energy isn’t available for the grid.

This billion-dollar-plus project could eventually expand to more renewable-powered electrolyzers, storage and generators to supply dispatchable power for the greater Western U.S. grid. It could also grow to include hydrogen pipelines to augment and replace the natural gas used for heating and industry or supply hydrogen fuel-cell vehicle fleets across the region.

That’s the vision of the Western Green Hydrogen Initiative (WGHI), a group representing 11 Western states, two Canadian provinces and key green hydrogen industry players including Mitsubishi and utilities Dominion Energy and the Los Angeles Department of Water and Power. WGHI launched Tuesday to align state and federal efforts to create “a regional green hydrogen strategy,” including “a large-scale, long-duration renewable energy storage regional reserve.”

At the heart of this effort are two projects in central Utah. The first is the Intermountain Power Project, a coal-fired power plant operated by the state-owned Intermountain Power Agency, which supplies municipal utilities in Utah and California, including the Los Angeles Department of Water and Power. By 2025, Intermountain will be converted to turbines to supply 840 megawatts of power using natural gas blended with 30 percent hydrogen, a proportion that will rise to 100 percent hydrogen over the coming decades.

The second project is the Advanced Clean Energy Storage project, which will invest roughly $1 billion to develop a nearby underground salt dome to store compressed hydrogen. ACES will provide up to 150,000 megawatt-hours of energy storage capacity, a scale that dwarfs the lithium-ion battery capacity being installed in California and across the Intermountain West.

WGHI’s members hope this green hydrogen hub can “avoid uneconomic grid build-out, prevent renewable curtailment, repurpose existing infrastructure, reduce greenhouse gases and air pollution, reduce agricultural and municipal waste, and diversify fuels for multiple sectors from steel production to aviation.”

But industry groups say this kind of expansion will take a concerted effort, support for which has just begun to emerge from the U.S. federal government. The WGHI plans a regional approach "that's taking a page from the playbook" of green hydrogen plans being put forward in Europe and Asia, said Laura Nelson, executive director of the Green Hydrogen Coalition advocacy group.

Long-duration storage for an increasingly renewable-powered grid is a first step, but a two-day virtual conference this week will take a look at other targets as well, she said.

"We know there are lots of other sectors that could be decarbonized using green hydrogen, and we know intuitively that there are other opportunities in the West," Nelson said in a Monday interview. "How do you aggregate that demand to create sufficient momentum in the market to drive investment?"

Intermountain and ACES: The hub of a Western green hydrogen network

Mitsubishi Power won the contract to supply Intermountain with its new gas-to-hydrogen capable turbines earlier this year, and it and Magnum Development, which holds rights to develop the underground salt dome, have partnered on the ACES project, which could include compressed-air energy storage, flow batteries and solid-oxide fuel cells.

Mitsubishi also makes lithium-ion batteries for the rapidly growing global market, said Paul Browning, CEO of Mitsubishi Power America. But today’s batteries can’t cost-effectively store more than four to eight hours of energy at a time, whereas hydrogen can be stored indefinitely.

“Hydrogen projects are going in where there are existing underground hydrogen storage capabilities and a utility that’s announced a net-zero carbon target,” Browning said. That’s the case with ACES, as well as with Gulf Coast utility Entergy, which is working with Mitsubishi to convert power plants and oil and gas salt cavern storage sites to meet its recently announced zero-carbon targets.

“We feel that we need both of those to be true for hydrogen to make sense right now,” he said. Green hydrogen is still at least four times as expensive to produce as “brown hydrogen” made from fossil fuel feedstocks, and the infrastructure to generate and use it needs development to bring down those costs.

One key factor in that cost reduction will be “scale, not just of our projects, but of the electrolysis industry,” which will need to grow its annual production capacity by several orders of magnitude and improve in efficiency over the coming decade.

The other key cost factors lie in the clean power used to make hydrogen, he said. ACES and Intermountain are part of a transmission network connected to California and Nevada’s growing solar resources and to growing wind and solar power from Wyoming and other Rocky Mountain states. But using only power that would otherwise be curtailed would leave electrolyzers sitting idle most of the time, unable to recover their capital costs.

“We’re going to be opportunistic in using as many curtailable renewables as we can get our hands on, while also building our own renewables to increase our capacity factor,” he said.

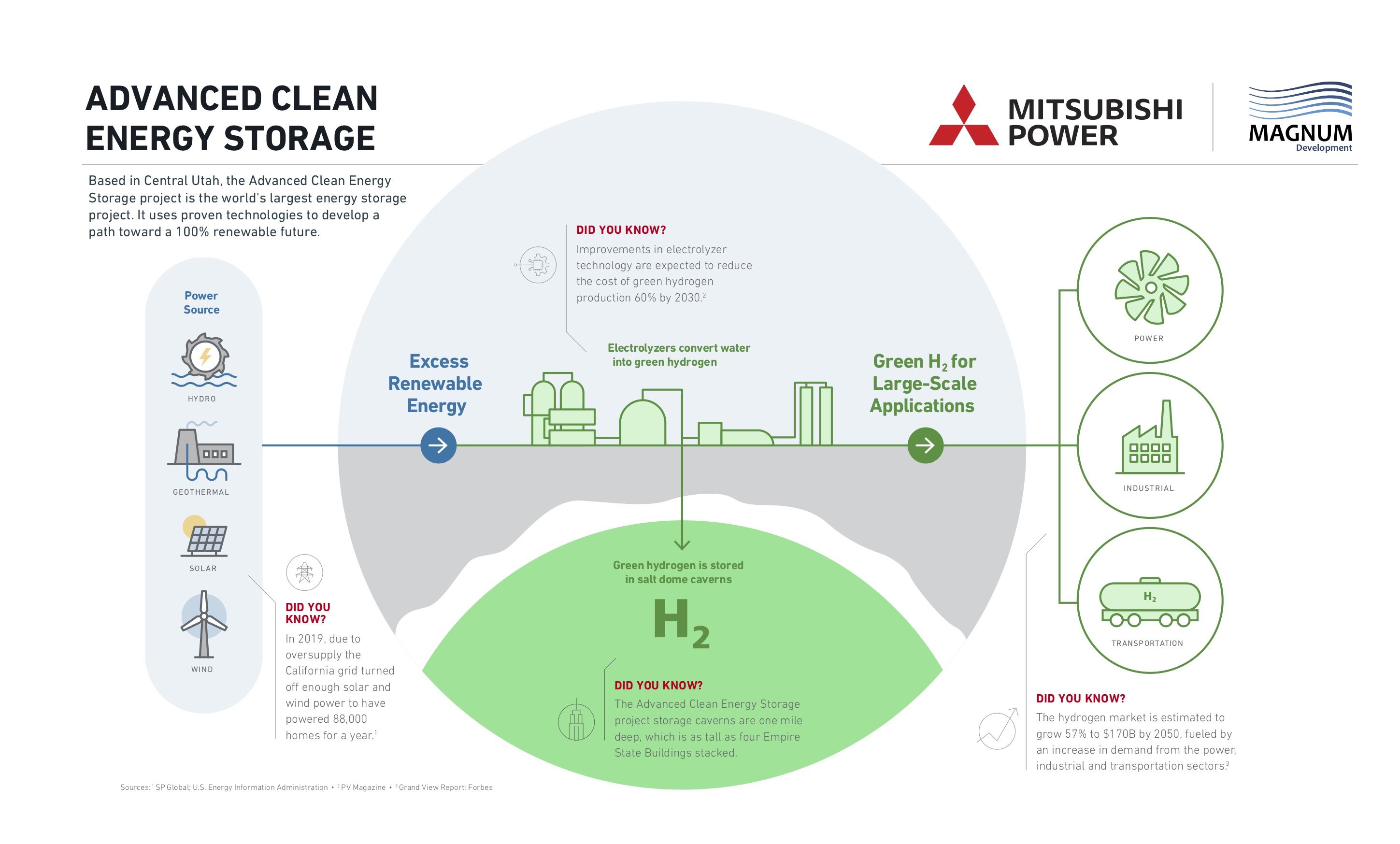

An infographic laying out the ACES project (credit: Mitsubishi)

Next steps in green hydrogen development

With Intermountain and ACES as a hub, Mitsubishi is looking for opportunities to “connect hydrogen into similar gas turbine projects that will be able to use local renewables” in an expanding network of similar sites, Browning said.

One example is a project being proposed for Berkeley Pit, a massive former open-pit copper mine near Butte, Montana filled with billions of gallons of contaminated water. Earlier this year, Mitsubishi Power opened discussions with state and local government officials on a plan to convert that water to hydrogen using the rising amount of wind power being built in that state and nearby Wyoming.

While the project is still in its exploratory stages, it could “provide affordable, reliable energy while supporting state and regional targets to reduce carbon emissions," Michael Ducker, vice president of renewable fuels for Mitsubishi Power, told government officials in a September conference call. That could include replacing power from Montana’s Colstrip coal plant, which is under economic pressure to close and faces a highly uncertain future.

The project could also include a 400-mile hydrogen pipeline to connect the Berkeley Pit site to the Utah salt dome project. Hydrogen’s lower energy density compared to natural gas requires more storage and transport capacity of a specialized design largely confined to oil and gas production zones today. However, “the safety issues are well understood,” Browning said.

Approving and financing such a large-scale project would have to build on successfully securing long-term hydrogen generation and supply agreements at the Intermountain and ACES projects, he noted. “Once we have that, then the next step will be to win an electrical supply contract from the utilities in the Northwest,” he said.

Green hydrogen as an energy storage technology, not a replacement fuel

Whether green hydrogen can cost-effectively replace natural gas for its myriad current uses will depend largely on the carbon-reduction drivers involved. But it will also require a redefinition of what it’s doing for the broader electrical system, said Jussi Heikkinen, director of growth and development for the Americas division of Finland-based Wärtsilä Energy Business.

Wärtsilä’s engines power about one-third of the world’s cargo ships and a good deal of electricity generation, he said. It’s been making strides in converting its engines to run on 100 percent hydrogen and is developing hydrogen generation projects in the U.S. and Europe.

In a study focused on California, Wärtsilä showed that zero-carbon hydrogen, or methane generated with carbon-capture technologies, to fuel power plants is a much less expensive alternative to building the battery capacity needed to cover the final 5 percent to 10 percent of grid power needed to reach its 100 percent carbon-free energy goals.

“When there are huge load peaks, cloud cover or unusual weather, these plants kick in, and allow you to build a much smaller battery storage fleet,” he said. But such rarely used plants will need different economic models for paying back their costs.

Mitsubishi’s Browning agreed that “green hydrogen is an energy storage technology. That’s really important because if you look at it as a fuel, you want to compare it to the price of natural gas and coal and other fuels — and that comparison does not look very good for hydrogen.”

“The proper comparison is what it would cost compared to lithium-ion or other storage technologies,” he said. In that role, green hydrogen could eventually be “the final source of storage” for the Western transmission network, he said. “When all of your batteries are filled up and you still have more renewables you’d otherwise have to curtail, we’re going to have an unlimited capacity to absorb that renewable power.”