Offshore wind projects “are complicated to build,” Lawrence Berkeley National Lab wind authority Ryan Wiser explained. “They present technical challenges, cost challenges, permitting challenges, a whole variety of challenges,” adding, “We have a ways to go to get those projects to the finish line.”

“The only thing onshore wind and offshore wind have in common is wind,” said Mark Leyland, who led early construction on the U.K.’s 30-turbine, 150-megawatt Ormonde Offshore Wind Farm.

Leyland, who has worked for decades in ocean construction, is now with Baryonyx Corporation and developing wind installations off the South Texas Gulf coast, a region he calls “the windy crescent.” Baryonyx could, Leyland estimates, eventually build three gigawatts of capacity there.

“We have what is classified as an excellent wind resource,” Leyland said. “It’s 8.5 meters to 9 meters per second. And the wind blows when the grid’s need for power is greatest.” The lease area is at a manageable water depth and “within a reasonable distance of the grid.”

But the Baryonyx application with the Army Corps of Engineers for a general permit describes nothing specific because “this is a very, very long process,” Leyland said. “We will not have turbines in the water before 2016 at the earliest.”

Baryonyx will draw on the Texas offshore oil industry’s experience. “Having built an offshore wind installation and been in the offshore construction business,” Leyland said, “I have confidence the engineering capability U.S. offshore wind needs is in Texas, as is the fabrication capability and the installation capability. And the vessels. And the ports and the harbors and the load-outs.”

Offshore wind, Leyland said, “is a nascent industry in the U.S. It’s a good idea to rely on existing capabilities and work with people who know the vast scale and harsh ocean environment in order to build these things as cost-effectively as possible.”

Baryonyx expects to face the years-long, full spectrum of environmental studies before it earns the right to build. “The fact that we are in state waters does not give us a shortcut,” Leyland said. On the other hand, Baryonyx reached “a leasing agreement with the General Land Office that didn’t require we go through a process with the federal authorities.”

Cape Wind’s at-last finalized Department of the Interior-supervised federal regulatory process has been challenging.

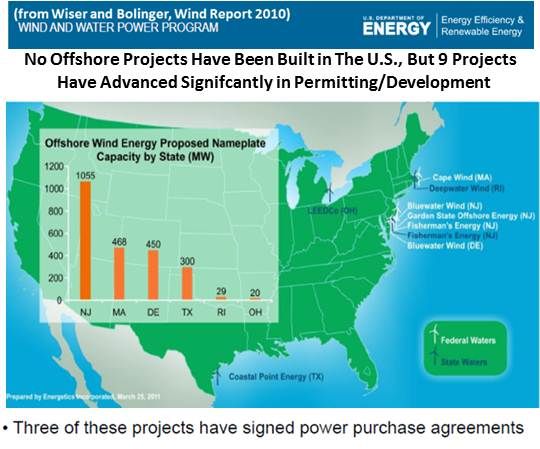

Undertaken in 2001, Cape Wind intends to build 130 3.6-megawatt turbines (with a nameplate capacity of 468 megawatts) in Nantucket Sound, five to ten miles off Cape Cod. Through a decade of struggles, the project's backers have reportedly spent over $45 million in development costs.

“It’s an expensive industry. You’re not talking millions; you’re talking billions,” said Jim Tolan, offshore wind engineering specialist and president of U.S. operations for Scotland-based SgurrEnergy. “It takes a lot of upfront money and it takes a lot of time.” SgurrEnergy was brought on as Cape Wind’s technical advisor in 2009, with Tolan leading.

Developing an offshore project “is a daunting, multi-faceted thing,” Tolan explained, ticking off four phases (project selection and permitting, financing, construction, and operations) and highlighting the financing phase.

Offshore wind’s protracted timeline creates money issues. Cape Wind recently saw its Department of Energy federal loan guarantee rescinded, not because it was deemed unworthy, but because the project will not begin construction in a time frame that is compatible with the program's current life span.

And, Tolan pointed out, “Most of the incentives for wind in the 2009 Recovery Act expire in 2012.” Most offshore wind projects conceived in 2009 will be barely halfway through planning by the end of 2012. In terms of federal policy supports, Tolan said, “There’s nothing currently out there beyond 2012.”

There are projects working through the financing process, Tolan said. “One or two projects might get to financial close next year.” After financing closes, “A bigger project might take two to three years to build.” Significant big project construction in federal waters, Tolan said, is “probably three to five years” off.

When that happens, “they’re going to be iconic.” Cape Wind, Tolan said, will be as identifiable as the Golden Gate Bridge.

Acceptance, Tolan noted, will allow offshore wind to deliver renewable power to East Coast load centers with little new transmission infrastructure. Costs will come down because financing projects will be perceived as less risky, moving interest rates lower. Ports from Hampton Roads to New Bedford will be revitalized. A construction vessel industry will follow.

“For their first fifteen to eighteen years, these projects are expensive,” Tolan said. But after that, he explained, “the cost of energy is going to be pretty good, unlike a coal plant that has to keep buying coal. It’s like an investment in a house after you pay off the mortgage.”

Who will be first in the water? “I’m not in a race,” Mark Leyland said. “I genuinely wish every offshore wind project in the U.S. success. That’s the way the industry will prove itself. There’s a place for a bit of healthy competition, but competition can become destructive. We need to be careful because the overall objective is to get renewable energy in the water and reduce reliance on imported fossil fuels. We have to make it work.”