Utilities have doubled down on distribution spending as a primary growth opportunity.

Capital expenditures on the distribution and transmission system have skyrocketed since 2008. However, this investment in the grid threatens to crowd out the value of key distributed technologies that are building blocks for a clean, cheap, resilient energy future.

Load growth, wholesale prices and utility business models

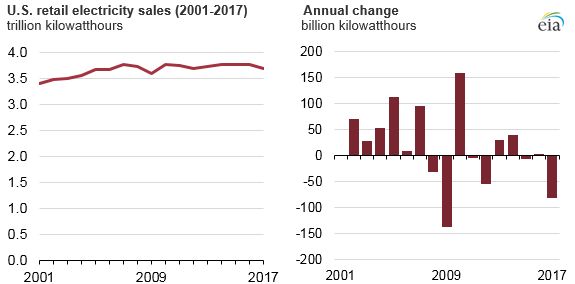

Falling wholesale generation costs and low load growth are major trends dramatically reshaping utility business models. As wholesale prices fall and customer load declines, utilities’ primary revenue source decreases and they struggle to grow, fundamentally transforming how utilities recover costs and seek new growth opportunities.

Forecasted load growth is a key input supporting utility investment plans. Based on forecast increased energy usage, utilities will build capital-intensive power plants and grid infrastructure, using the increased revenue to cover costs, often without raising prices.

These infrastructure investments are what shareholders care about. While wholesale energy costs are typically recovered dollar for dollar through customer rates, infrastructure costs are recovered at a premium, receiving a regulated return on equity that ranges from 8-12 percent. Utilities then recover those costs through increased sales revenue. Energy use increases, utilities grow, and they continue to satisfy their shareholders.

However, declining load causes gross revenue declines, making it harder for utilities to recover capital investment costs without increasing prices or increasing customer fixed charges. While shareholders expect growth, it’s becoming more difficult for utility managers to justify more investment to regulators in the face of declining energy use.

Satisfying shareholders in the face of stagnating load

To adapt, utilities are finding ways to grow through three traditional investment areas: generation, transmission and distribution.

New capital-intensive thermal power plants (mostly gas and some ill-advised nuclear plants) and renewable energy projects are getting built, but finding room for new kilowatt-hours in an environment of declining energy demand can be difficult, and often comes at the expense of existing generators. Today, markets are awash in generating capacity and low prices, so there’s little incentive to build these plants. Even despite the difficult economics, more than 100 gigawatts of new natural-gas generation are being proposed around the country.

Public policy and economics can nevertheless justify building new generation, even in today’s oversupplied, low-price marketplace. In many regions, the marginal cost of operating a coal plant exceeds the all-in cost of new wind and solar generation, and hundreds of gigawatts of wind and solar sit in interconnection queues. Regulated utilities won’t own much of this capacity, however, partly due to some financial barriers around federal tax incentives. But much of it is driven by the historical bias against clean energy being developed by independent power producers (non-utility generators).

Vertically integrated utilities like Xcel Energy are starting to get into the solar and wind generation game. Xcel recently articulated substituting “steel for fuel” as an investment strategy that retires old coal units (fuel) and replacing those kilowatt-hours with cheaper renewables (steel) that earn returns for shareholders for decades. Still, the prospect of building new generation can be difficult in low-growth and low wholesale price environments lacking a clean energy policy.

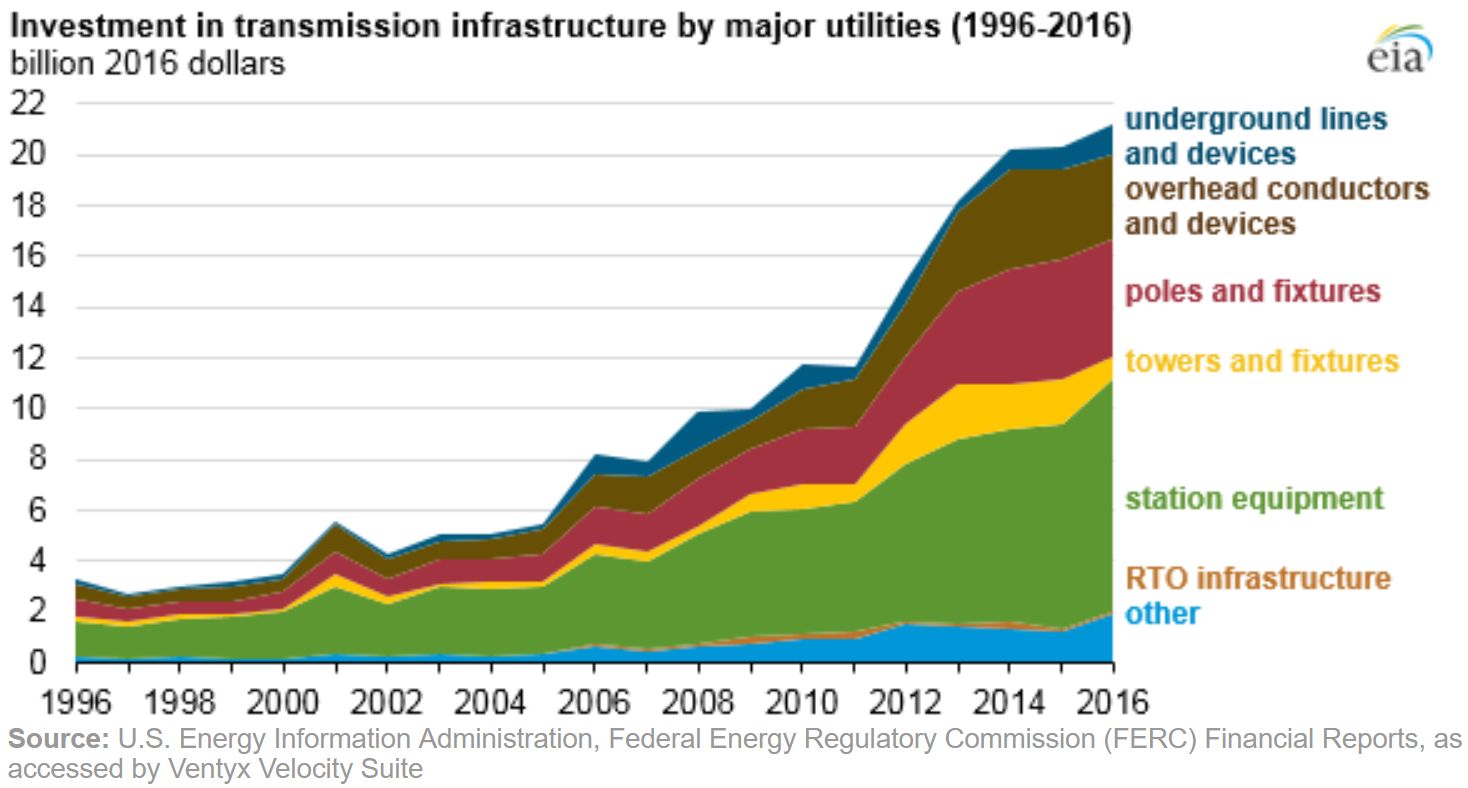

Utilities can also invest in the transmission system. Transmission is notoriously difficult to build, is hard to justify with regulators, tends to spark local and vocal opposition, and often requires long, arduous planning and permitting processes. Despite that, annual transmission spending for investor-owned utilities (IOUs) has almost doubled since 2010, when the trend of flattening load began in earnest. Increasing connectivity between regions tends to lower wholesale energy costs, as places where generation options are limited by transmission congestion gain access to low-cost energy.

Utilities can further invest in the distribution grid, which links the bulk system to end-use customers at lower voltages. In the past, distribution investments were lower than transmission and generation.

But given the barriers to build new transmission or new generation, we are now seeing an explosion of growth in distribution infrastructure.

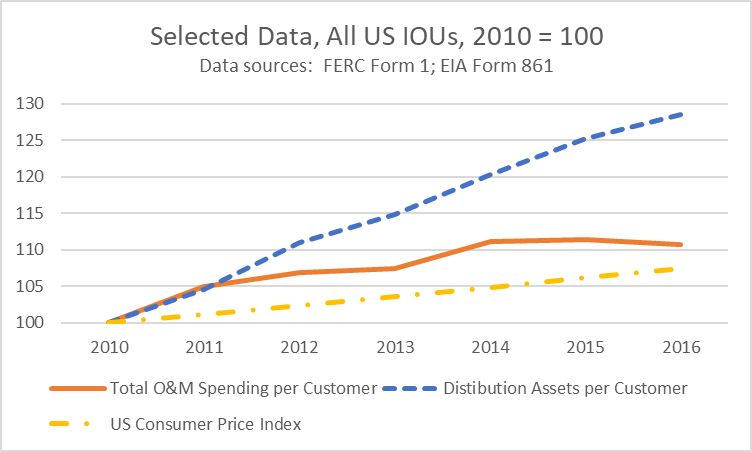

IOU distribution assets per customer grew an average of $217.50 per year between 2010 and 2016, a compound annual growth rate of about 4.5 percent, well above the rate of inflation over the same period. Overall distribution system costs grew from around $30 billion in 1997, to $50 billion in 2017, with almost all of the growth coming from capital investment — meaning utilities are increasingly building large, expensive infrastructure on the distribution system.

Source: GridLab, Modernizing the Grid in the Public Interest: A Guide for Virginia Stakeholders

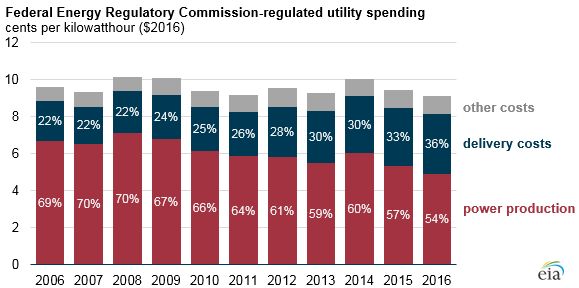

As a result of this investment strategy shift, the cost of delivering energy through transmission and distribution systems has grown relative to the cost of generating electricity. Major investor-owned utility data shows what percentage of each delivered unit of energy (kilowatt-hour) is due to generation costs and delivery costs. Delivery costs have expanded from 22 percent of overall costs in 2006, to 36 percent in 2016, while generation costs have fallen from 69 percent to 54 percent.

Source: EIA

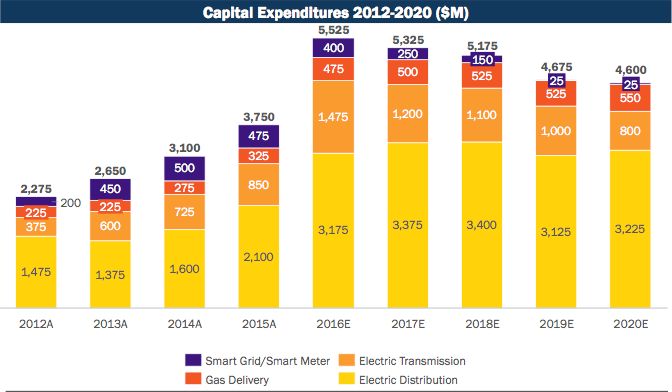

Exelon is a large investor-owned utility that exemplifies this trend, indicating in a recent investor presentation its plans to double distribution system spending, from $1.5 billion annually now, to $3 billion annually through 2020. Part but not all of this increase is due to Exelon’s acquisition of Pepco, the utility that serves Washington, D.C. and surrounding areas.

Why it matters that utilities are spending less on generation and more on distribution

“Dumb” distribution spending that only focuses on reliability or resilience can crowd out spending on infrastructure to support a grid transition to a cleaner, more affordable and more reliable grid. If the dollars go to “grid hardening” like undergrounding lines, then distribution infrastructure that supports value from distributed energy resources (DERs), EV charging, advanced metering infrastructure, and foundational distribution software will fall to the wayside.

Even more importantly, distribution dollars should go to economic, clean non-wires solutions (NWS) that use nontraditional solutions for generation, transmission and distribution needs. These nontraditional solutions include distributed generation, energy storage, energy efficiency, demand response or grid software and controls.

NWS open up markets for DERs, reduce risk, and move the distribution system from a closed system to a more open platform. There are high institutional barriers to NWS, as they open up to competition what was an exclusive domain of distribution utilities. But as GridLab details in a recent paper, DERs can play an integral role in reducing customer costs and increasing the flexibility of the grid to help handle more renewable energy.

California utility PG&E's Oakland Clean Energy Initiative Project provides an example where infrastructure spending would otherwise crowd out a local clean energy solution. Here, the retirement of a 40-year-old gas-fired peaking plant posed risks to local transmission reliability. To replace the plant, the California grid operator CAISO and PG&E evaluated whether a portfolio of DERs could replace traditional investment options, such as building new gas turbines or transmission lines.

The resulting proposal, approved by CAISO, allows PG&E to procure 20 to 45 megawatts of clean energy and DERs, including 19.2 megawatts of demand response, 10 megawatts of battery storage, a mix of local generation and energy efficiency upgrades, and some traditional grid upgrades to transformers and substations for a total cost of $102 million — $400 million cheaper than the traditional wires upgrade.

DERs can provide a wide range of services that can help displace more expensive, often dirtier infrastructure solutions. These include avoiding transmission and distribution costs, avoiding the need for generation (usually coal or natural gas) to meet peak load, and improving grid flexibility. Given this potential, policymakers considering utility investment plans in the distribution system need tools to evaluate a wider range of solutions.

Tools for policymakers

Policymakers around the country considering utility proposals to increase distribution spending and “modernize” the grid should take a few key steps to develop tools that help ensure consumers get the most out of money spent on infrastructure, or alternatively, cheaper DERs that provide the same services.

First, a robust and transparent integrated distribution planning (IDP) process is critical. As detailed in a recent GridLab paper, IDP is a holistic planning process that opens up what has been a traditionally utility-driven planning approach. IDP also ensures that NWS are considered for major distribution upgrades, and includes hosting capacity analysis to help plan for and interconnect DERs — even more important as transportation and buildings electrify and add flexible load to the grid.

Second, policymakers can map out their strategic goals for the distribution grid, and then map proposed smart grid investments into those goals. GridLab’s recent paper on grid modernization in Virginia helps stakeholders evaluate Dominion’s proposed grid modernization investments in the context of strategic goals. To maximize return on investment for customers and the environment, planning processes must be designed to first identify the most critical capabilities of a modern grid. Regulators can then use these capabilities to define performance outcomes for utilities and structure investments around the most cost-effective ways to maximize available benefits for customers, from conservation to DERs to smart grid technologies and poles and wires.

We must ensure that the distribution grid investments we make today are thoughtful and carefully planned, or we could end up with “dumb” distribution spending that crowds out the opportunity for a clean, smart distribution system.

***

Ric O’Connell is the executive director of GridLab, which provides comprehensive and credible technical expertise on the design, operation and attributes of a flexible and dynamic grid.