Sub-Saharan African utilities are caught in a complex interplay between centralized grid-extension costs and the decentralized off-grid generation boom. Liberalizing their electricity markets may be a partial solution.

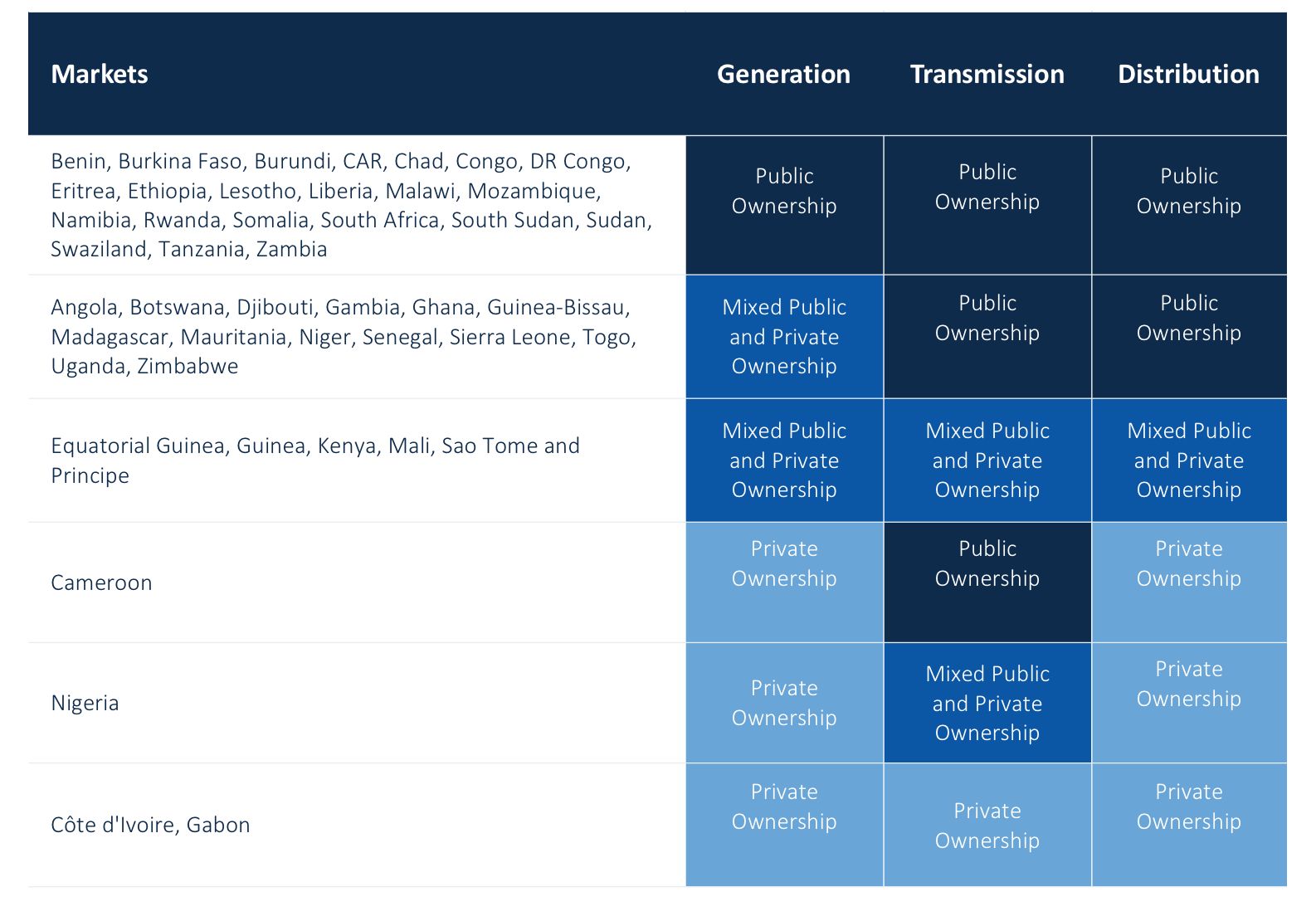

While high demand growth and the need for investment drove dramatic electricity sector reform in low- and middle-income countries in the 1990s and early 2000s, Power for All and GTM Research find that 71 percent of sub-Saharan African countries currently rely on vertically integrated utility structures, although the proportion is steadily declining.

Source: Power for All, GTM Research (Key: Light Blue: Privatized, Medium Blue: Mix of Public and Private Ownership, Dark Blue: Public Ownership)

Electricity market liberalization means more than unbundling

Pioneering reform programs have generally included corporatization; vertical and horizontal restructuring of generation, transmission, distribution and retail functionalities; and unbundling of tariffs; as well as the introduction of independent performance-based regulatory mechanisms.

With the aim of segmenting the cost of generation, transmission and distribution, empirical evidence shows that such liberalization reforms lead to increased operational efficiency, reduced pricing distortions and increased electricity access for poor consumers.

In sub-Saharan Africa, reforms are slowly being implemented. Unbundled utilities on the continent tend toward segmented -- and to some extent, privatized -- generation, transmission and distribution. In most cases, however, public control is maintained over the grid. Electricity continues to be sold at rates below cost recovery and infrastructure is not well maintained.

While this has led to an investment surge into private generation assets, leaving transmission and distribution infrastructure behind hurts the financial solvency and expansion plans of these utilities.

In fact, from 1995-2015, independent power producer (IPP) capacity in sub-Saharan Africa doubled every five years, primarily in countries with attractive credit ratings and stable investment climates, while investment in transmission and distribution infrastructure lagged significantly in the same period, falling well short of the $435 billion estimated necessary for universal access by 2040.

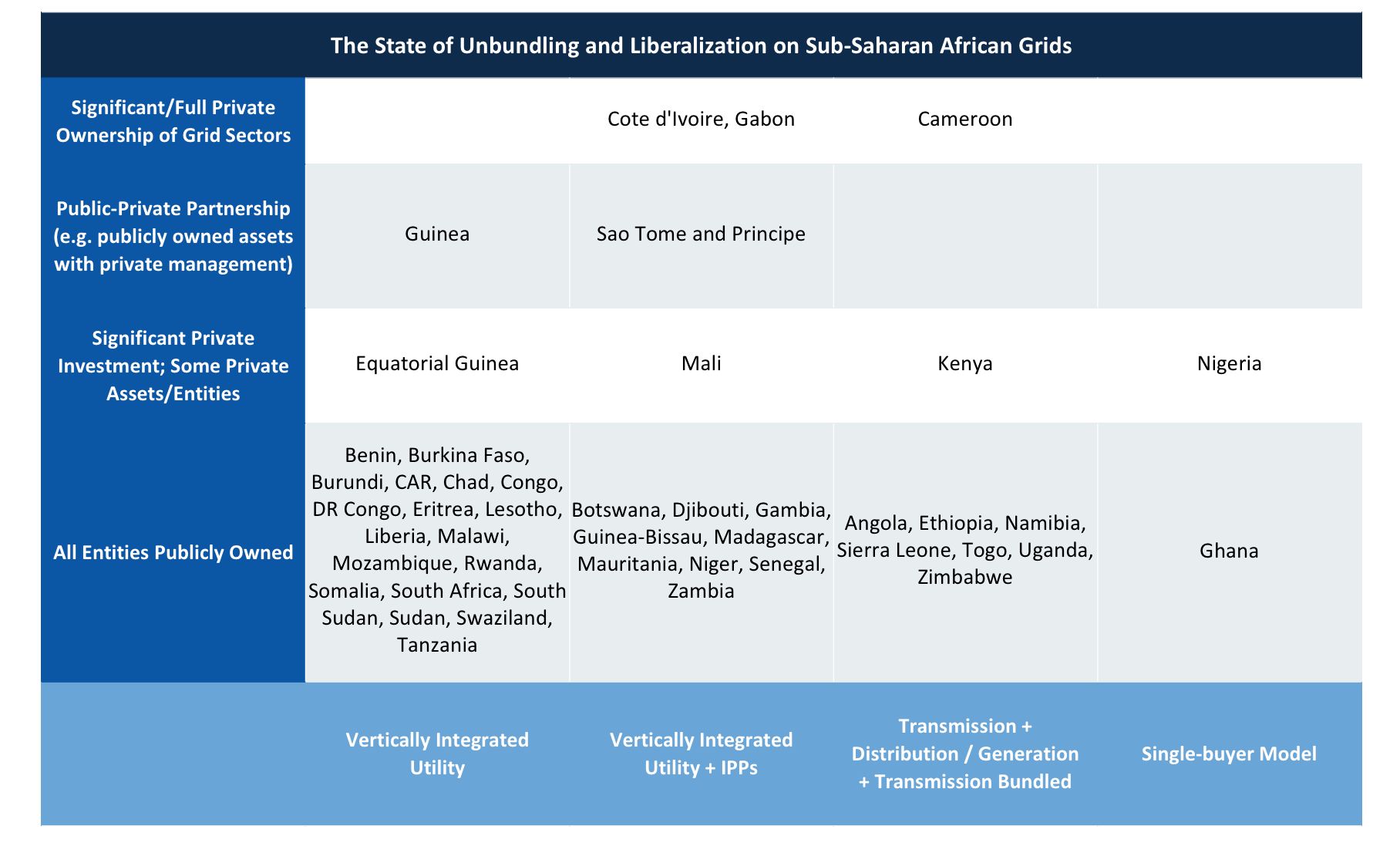

IPPs operating in Africa have pointed to a looming crisis in generation, as almost all countries are expecting generation surpluses in the not-too-distant future. Increasingly, the trend is to see national governments operate as a majority stakeholder alongside a number of provincial agents and private IPPs, as the requisite policy for full private ownership often does not accompany liberalization.

But reforms are slow going

Developing such effective regulation has proven one of the most challenging aspects of the restructuring process in sub-Saharan Africa.

As such, despite the push toward liberalization, chronically undercapitalized African utilities have historically been unable to recover operational and capital costs.

Last year, the World Bank found that of 39 sub-Saharan countries surveyed, only the Seychelles’ and Uganda’s national utilities were fully recovering both operational and capital costs, and only 19 of the 39 collected enough cash to cover operational expenditures only, hampering their ability to meet demand reliably and keep up with population growth and rising incomes. Financial difficulties in recently reformed electricity markets in Mali and Senegal even caused the power sector to revert to state ownership.

Source: Power for All, GTM Research

So how can liberalization boost reliability and electrification rates?

Unbundling reforms have major implications on the financial health and capacity expansion outlook of struggling public utilities.

As more utilities begin to seriously prioritize universal energy access within their service territories, ensuring their own financial health as a public service provider and as an offtaker for IPPs must be the first course of action. Additionally, regional cooperation in the form of cross-border energy trading could be a powerful incentive for private investment in high-voltage transmission projects.

A 2015 McKinsey study suggests that regional integration could save over $40 billion in capital expenditures and $10 billion annually for African consumers by 2040, though less than 8 percent of power generated in Africa is currently traded across borders. On the national level, tendering transmission and distribution capacity and leapfrogging the West on advanced metering infrastructure and collection will significantly improve operational efficiency and reduce technical and non-technical losses.

Liberalization can have major implications for new technologies and distributed renewable energy (DRE) solutions. Unbundling opens up markets for behind-the-meter generation across the various tiers of energy solutions that DRE provides, from solar home systems to grid-integrated mini-grids. Separating the cost of service and the cost of infrastructure also allows the opportunity for exercising tariffs that truly reflect the cost of electricity generation, particularly critical as part of an enabling environment for mini- and microgrid developers.

Also important for mini-grids, regulation and the establishment of integration standards often means more efficient access to transmission networks. Furthermore, electricity policy reform and a competitive grid also bring increased transparency around grid extension plans, a huge risk for mini-grid developers, and the opportunity to develop a conducive regulatory environment for decentralized renewable energy applications and coordinate with off-grid developers and installers.

For instance, the 2013 unbundling of the Ethiopia Electric Power Corporation into the Ethiopian Electric Services and Ethiopian Electric Power (EEP) in response to the country’s energy shortage in the 2000s allowed private investment into generation, transmission and distribution assets, as well as allowing for the import and export of IPP-generated power.

In order to meet a huge gap in capital investment, the Ethiopian central government also created the Ethiopian Energy Agency to foster both wholesale and retail price competition between IPPs and EEP, improving the operational efficiency of EEP, but raising tariffs for end-use consumers. As a result, a slew of financing vehicles for DRE solutions were mobilized, making Ethiopia one of the top three markets for solar home systems and pico solar adoption in sub-Saharan Africa.

While U.S. and European utilities hold their own regulatory debates about cost-of-service ratemaking and why volumetric tariffs no longer capture the emerging value proposition offered by the grid, steps toward competition and increased efficiency on the grid taken in sub-Saharan Africa suggest that African utilities are moving in the right direction.

Indeed, a recent PwC survey of African utility executives finds that 70 percent agree that the opening up of markets, in the form of unbundling and liberalization, would have a high or very high impact on electrification and supply reliability.

However, survey participants also agree that modernization of regulation to keep up with and encourage the potential of off-grid and mini-grid solutions is critical. This includes fast and low-cost licensing and permitting for mini-grids, technical regulation and quality standards, tariff and VAT exemptions for DRE components, and transparent protocols for distribution companies on mini-grid operator rights if the grid arrives.

If universal energy access is to be achieved by 2030 across the continent, sub-Saharan Africa’s moves toward liberalization will need to be faster, with greater attention to regulatory reform that encourages the inclusion of off-grid solutions while simultaneously creating effective regional power markets to improve cross-border trade.

African electricity sector leaders recognize the critical role that off-grid solutions have to play, and are beginning to engage with last-mile and under-the-grid consumers in creative ways to fill those gaps served most reliably and at least cost by centralized infrastructure.

--

This is the first installment in a joint series between GTM Research and Power for All exploring the dynamics of energy access issues in emerging markets. Power for All is a global coalition of 200 private and public organizations campaigning to deliver universal energy access before 2030 through the power of decentralized, renewable electricity.

As a pillar of Wood Mackenzie’s redefined focus on studying global trends in the transformation of power, GTM Research is studying the energy transformation occurring Beyond the Grid Edge in the off-grid rural energy access space.