Europe’s emerging demand response market is heating up -- and where homegrown contenders have held sway, U.S. competitors are now staking their claims. But they’re not going there alone.

U.S. demand response leader EnerNOC made that clear last week when it bought German DR provider Entelios and Irish aggregator Activation Energy. These moves give it immediate entrée into key European markets, as well as helping to bolster its existing beachhead in Europe’s most developed demand response market: the United Kingdom.

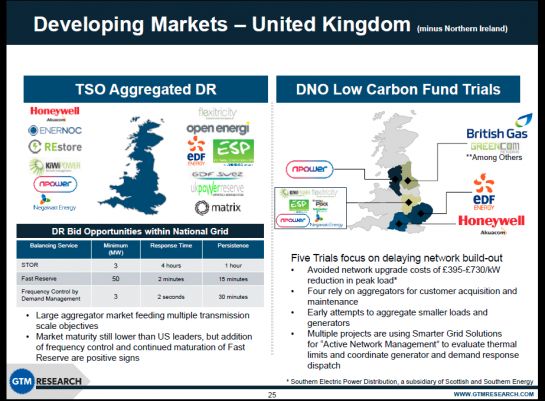

Another way to break into European markets is via technology partnerships. That’s how Honeywell is going about its big push into the U.K. demand response market known as the Short Term Operating Reserve, or STOR. Its partner in this case is Stor Generation, a startup launched in 2012 to bring real-time demand response to a market that’s almost entirely supplied by backup generation today.

Late last month, the two companies announced a partnership to use the OpenADR technology supplied by Honeywell subsidiary Akuacom to merge many different building loads for bidding into the STOR program, which is operated by National Grid. Both Honeywell and Stor Generation have done smaller-scale demand response projects under the U.K.’s low carbon network fund, but this is their first foray into the nationwide STOR market.

That means that Honeywell and Stor Generation are entering a market already served by companies including EnerNOC, KiWi Power, REstore, Flexitricity, and a number of business units of giant utilities like RWE, EDF and GDF Suez, all serving up megawatts of demand reduction and generation capacity. And in so doing, they’ve ruffled some feathers in the U.K. demand response world because of their characterization of their partnership as a “first-ever” offering.

“This will be the debut of ADR [automated demand response] technology in National Grid’s U.K. and European territories,” Honeywell’s press release stated. “And Stor Generation is the first energy aggregator in the region to use ADR to reduce grid stress rather than calling on customers to switch over to backup diesel generators.”

That claim is simply not true, according to Yoav Zingher, co-founder of U.K.-based KiWi Power. His startup has been operating automated demand response with National Grid for more than three years, and it’s not alone. Flexitricity launched its ADR service in 2012, and Belgian startup REstore offers automated demand management in the U.K. as well as in its home market.

“As far as automated demand response, we’ve been doing it for awhile,” he told me in a phone interview last week. In fact, among the U.K.’s various DR competitors, “most...are automated” to one extent or another, Zingher said.

In response, Honeywell noted that its claim of first-comer status is tied specifically to its use of OpenADR, an open-standards-based technology that’s emerging as a global standard for automating demand response. “The technology at the heart of our partnership is built on that communication standard -- and delivers the benefits of an open system -- not a proprietary protocol,” a Honeywell spokeswoman wrote in an email last week.

KiWi Power’s Zingher noted that this may be technically true -- but only because some of KiWi Power’s deployments have been built to operate with customers who wanted to use alternative methods to link their sites with KiWi’s control and aggregation center. In the meantime, companies like his are taking advantage of OpenADR as it becomes more advanced, he said.

“We’ve got a big portfolio of sites, and our first sites have been OpenADR-compatible for three years now,” he said. “Our system uses OpenADR protocols. I also know that some of our systems are proprietary -- some of the things we do, you can’t do with off-the-shelf protocols.” Alastair Martin, founder and chief strategy officer at Flexitricity, described a similar situation for that company's earliest automated DR projects in a 2012 interview with Greentech Media.

Honeywell has about twenty OpenADR projects underway in the U.S., Australia, China and India, giving credit to its claim of strong real-world experience in fast aggregated demand response. But nearly every other major demand response provider is moving rapidly to incorporate OpenADR-based capabilities, meaning that Honeywell's lead isn't necessarily going to last.

KiWi's Zingher agreed that all of the providers of automated demand response in the STOR program are trying to increase the share of non-generator resources from its currently small share. Because the STOR program requires at least 3 megawatts of aggregated load to bid into the program, that requires a lot of disparate customers that can be controlled as a block of generation, load reduction, or a combination of the two.

Azad Camyab, Stor Generation’s CEO and co-founder, told me in an October interview that his company has aggregated multiple megawatts of backup generation to bid into the STOR program. While the program allows some of its resources to have as long as four hours’ warning before coming on-line, it offers preferential treatment in picking bids that can bring their resources on-line within 20 minutes.

Being able to respond quickly and reliably are also important for demand-side resources seeking to bid into into faster-responding programs like fast reserve, or frequency control via demand management, which offer more lucrative payments.

Camyab noted that, as Stor Generation adds the capability to automate the control of aggregated megawatts of commercial building lights, air conditioners, refrigerators and other discrete loads, the company will be exploring the potential to create an “energy avoidance pool,” to be put to use by energy traders in the country’s wholesale energy markets. “We are building this pool with a trading organization -- I can’t say who yet -- to really monetize this pool of excess avoidance, and sell it in a virtual power plant context,” he said.

In the meantime, programs like STOR, and the pilot programs that are reducing distribution grid congestion via demand response in cities across the U.K., could soon start to see more regulations seeking to reduce their reliance on fossil-fuel-fired generators, according to Jeremy Eaton, vice president and general manager of Honeywell’s Smart Grid Solutions group.

“We think in the not-too-distant future, you’re going to see balancing markets that will have some requirements, or a portion of it will be earmarked for carbon-neutral, carbon-favorable technology,” he said in a January interview. Changes to the rules that govern the U.K.’s mixed bag of demand response products could start appearing this summer, giving competitors in this market good reason to highlight differences in their their speed of response, ease of aggregation, and value to participating customers.

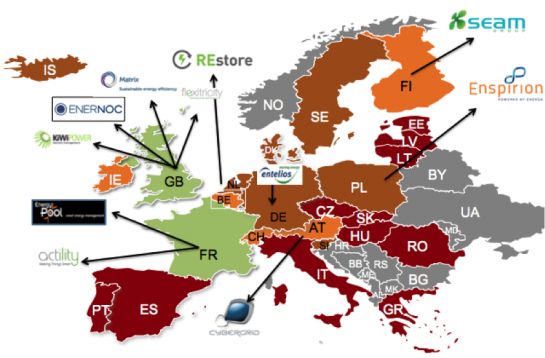

Meanwhile, the U.K. has by far the most competitive demand response market in Europe, as the map below from the Smart Energy Demand Coalition industry group illustrates. That makes the continent a likely testing ground for a number of contenders, whether from Europe or the United States, as they seek to prove their mettle and prepare for the opening up of other opportunities.