Highview Power is taking its unusual cryogenic or liquid air storage from demonstration to commercial scale.

The company is developing its first large-scale system in the northern part of the U.K., it revealed Monday. The first project will have a capacity of 50 megawatts/250 megawatt-hours and could be up and running by 2022.

It's not a done deal: Highview is still looking for offtakers to secure contracted revenue that could balance merchant activity in Britain's wholesale markets. But Highview has a location locked down at a retiring thermal plant site and is working on procurement for the construction phase.

If built as described, this project would mark a milestone for the exotic technologies challenging mass-market lithium-ion batteries for longer-duration grid storage. Battery plants have begun supplying several hours of power in certain markets, but they are not economic for storing days' or weeks' worth of renewable power. A motley crew of technologies is vying to fill that gap, including flow batteries of various chemistries, giant block-stacking cranes and some mysterious but well-funded designs.

This sector of the storage industry has had trouble migrating from the lab and the demonstration phase into large-scale commercial deals. Highview's announcement puts it on track to claim the largest storage plant among the lithium-ion alternatives, if another company doesn't get there first.

"Early bets are already being placed by the investment community on alternatives to the dominant battery chemistry, but this project would give Highview bragging rights as one of the first to move beyond the smaller pilot phase," said Daniel Finn-Foley, energy storage director at research firm Wood Mackenzie Power & Renewables.

So far, Highview has built a 350-kilowatt pilot project followed by a 5-megawatt/15-megawatt-hour demonstration plant that has been operating since 2018. That means the company is preparing to scale up power capacity tenfold compared to its largest operational system.

That's not a problem, CEO Javier Cavada told GTM, because the plant will use off-the-shelf components from the natural gas and power plant industries that are already built for this kind of scale.

"The bigger, the better for this technology," Cavada said. "We are bringing it to the real size where this technology makes sense. To demonstrate it, it was scaled down."

The competition from gas peakers

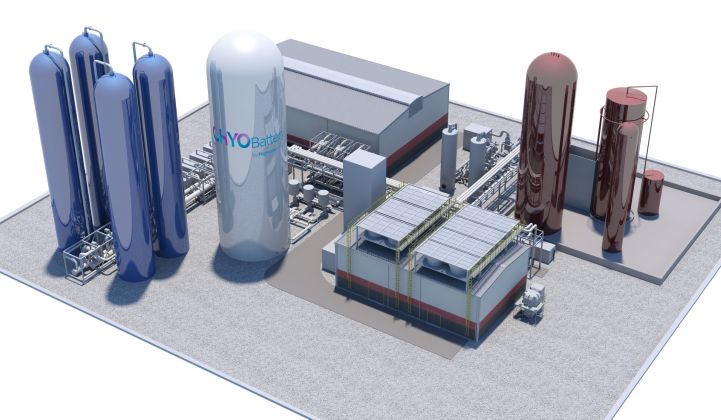

The design uses compressors to super-cool air and squeeze it into tanks. Releasing the compressed air spins a turbine to regenerate power. The whole thing looks like a small liquefied natural-gas terminal, Cavada said.

The Highview plant would address two trends stressing the U.K.'s grid: thermal plant retirements, which reduce inertia on the wires, and new wind plants, which inject more intermittent power. After literally filling the gap left by a retiring plant, Highview will store power during influxes of wind generation and make it available when peak demand drives prices up. The spinning mass of its turbine will also contribute to the inertia that keeps the grid humming along.

The business model is still being finalized but could involve multiple market roles, including energy arbitrage (buy low, sell high), frequency regulation, reserve power and grid constraint management services. The technology could also work in tandem with renewables developments to provide a dispatchable renewable product.

Even this major construction is just a starting point for Highview. Lithium-ion plants are already under construction that will store more power; to break new ground, Highview will need to add even longer durations. But, Cavada noted, it's much cheaper to add hours of duration by sticking more tanks on an existing cryogenic storage facility than it would be to buy additional batteries.

He sees the competition as flexible natural-gas plants, not lithium-ion batteries.

"We are already below gas when you are coming to those levels of 50 megawatts, 5 hours [of duration]," he said. "We are way below lithium-ion for this size of plants."

The non-lithium contenders

Among the non-lithium competition, a few stand out.

There are a handful of pumped hydro storage projects in late-stage development, like Absaroka Energy's site in Montana. This technology is vetted by decades of field operations, but constrained by geography and permitting difficulties, so it likely won't pose much of a threat to Highview's business outlook.

Energy Vault raised $110 million from SoftBank to scale its gravity-based, block-stacking energy storage concept. Its first commercial project is expected online this year, but the basic design clocks in at 4 megawatts/35 megawatt-hours of storage, much smaller than Highview's planned facility.

A closer parallel to Highview's approach might be Hydrostor, a Canadian firm using equipment from established industries to store energy underground as compressed air. Instead of requiring specialized underground caverns, Hydrostor can dig its own shafts or use existing mine shafts. Like Highview, its leaders say it will hit an economic stride at much larger scale, because that's what the industrial equipment it buys is geared for.

Hydrostor is building a 5-megawatt system that will participate in Australia's wholesale markets; it raised $37 million this fall to continue scaling operations.