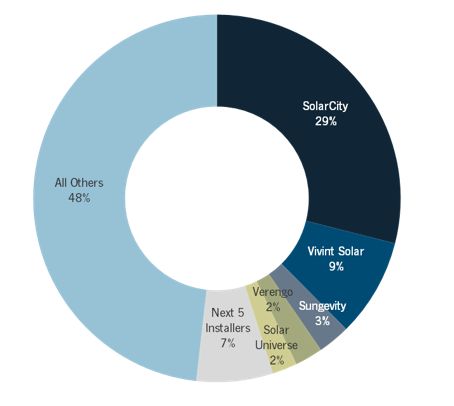

SolarCity is pursuing an aggressive growth strategy -- and it’s been paying off. According to the GTM Research’s U.S. PV Leaderboard, SolarCity installed 29 percent of all residential solar in the first quarter of this year, three times the volume of its nearest competitor, Vivint Solar. The company has been buoyed by a string of recent successes, including three securitizations, vertically flavored acquisitions in racking (Zep) and modules (Silveo), and growing its business to the tune of 30,000 customers in a single quarter. SolarCity's stock price has been rising since mid-June, and the firm boasts the second-largest market capitalization for a U.S. solar company, behind First Solar.

FIGURE: Leading U.S. Residential Installers, Q1 2014

Source: GTM Research U.S. PV Leaderboard

But I’d be very surprised if SolarCity settled with dominance in the U.S. market, and Mexico is the obvious next step. Here are a few of the top reasons why, culled from GTM’s Latin America PV Playbook.

An aggressive growth strategy means constantly looking to new horizons, and tapping into emerging markets is a tried-and-true method for growing business off an established base. Many of SolarCity’s competitors have already taken this route and are active overseas, most notably Sungevity, which made the jump from Australia, but also SunEdison, Pure Energies, and Gehrlicher. In fact, SolarCity recently hired Gehrlicher’s VP from its Mexico office, Jesse Jones, as a director of project development, and the company is listed on Mexico's stock exchange.

Of the emerging residential and commercial solar markets that SolarCity is likely to be considering, Mexico is the obvious choice. First, its geographic proximity to the U.S. makes expansion easier, both from a management perspective and a supply chain standpoint. Moving into India, China, or even elsewhere in Latin America such as Brazil or Central America, doesn’t boast that same advantage.

Second, the Mexican distributed generation market is extremely attractive on its own merits. The fundamentals are strong: insolation levels range from 5 to 8.5 kilowatt hours per square meter per day, and there are 37 million customers in Mexico, 99 percent of which are residential and commercial, totaling about 30 percent of total sales. From a regulatory standpoint, the market is ripe: net metering has been in place since 2007 and the recent Energy Reform legislation has both expedited interconnections and sanctioned direct sales. Projects of less than 500 kilowatts don’t require regulatory oversight from CRE, just a technical signoff from the utility CFE, and projects can generate power to be consumed in multiple locations, creating opportunities for innovative business models such as one recently developed by Q-Cells in the commercial market.

Third, SolarCity has an opportunity to bring real volume to the Mexican market and capture a kind of first-mover advantage. According to the upcoming Q4 Latin America PV Playbook, the current competitive landscape in Mexico comprises approximately ten to fifteen companies performing ~80 percent of distributed generation installations, with the final ~20 percent spread out among several hundred smaller companies.* None of these companies have a national presence, although several are growing at an impressive rate and have operations in multiple regions, including eSun, Desmex, Conermex, and Powerstein.

Commercial rates average 22 cents per kilowatt-hour, ranging from 18 to 23 cents per kilowatt-hour based on consumption with fixed charges of between 4 and 18 dollars per kilowatt. Solar could be a highly competitive alternative for these consumers. The only oft-cited drawback in Mexico is the low average tariff paid to residential customers, which comes out to about 8 cents per kilowatt-hour. But this shouldn’t matter to SolarCity. For one thing, that is an average tariff. A smart customer differentiation strategy will show that, in fact, over a half-million customers are paying a special high-consumption rate of about 28 cents per kilowatt-hour, amounting to an $840 million market per year. Because tariffs increase with consumption, there are also many users who are paying the intermediate rate of approximately 12 cents per kilowatt-hour averaged out against many ultra-low-consumption consumers. The bottom line is that solar is very competitive for many residential and commercial customers.

Another reason not to worry too much about the tariffs is that SolarCity’s sweet spot -- financing -- is what can really break open the market in Mexico, even for the lower tariff customers. Financing still has not really taken off in the Mexican market, despite impressive product offerings from existing companies such as Envolta and Galt. Most commercial debt that banks offer for solar isn’t on very attractive terms, averaging 10 percent interest with a seven-year tenor. Many consumers don’t have the upfront capital for solar, but they do have good credit, either through Infonavit (a mandatory savings program) or electricity bill payments with CFE. A coordinated effort to bring capital into the Mexican market would grow the addressable market significantly beyond the high-tariff customers by tapping into the many thousands of middle-income families who would like to bring their consumption down or offset it entirely. Simply put, the Mexican residential market's greatest weakness is SolarCity’s greatest strength.

Viva la SolarCiudad.

***

*Non-agricultural distributed generation

Adam James is a solar analyst with GTM Research covering global downstream markets, and the author of the Latin America PV Playbook. You can find him on Twitter at @adam_s_james.