In the five years that the Smart Grid Consumer Collaborative has been monitoring the utility consumer’s relationship to grid technology, the landscape has changed a lot. But some things have pretty much stayed the same.

According to the 2016 State of the Consumer report released on Monday, the things that have changed -- an increasing openness to using technology to manage energy bills and incorporate renewables into the grid -- could be used to strengthen the utility-customer relationship.

About half of all U.S. utility consumers aren’t familiar with terms like "smart grid" or "smart meters", and another quarter have heard them but don’t know what they mean. That's largely unchanged since SGCC’s first survey five years ago, SGCC executive director Patty Durand noted in a Monday presentation at the DistribuTech conference in Orlando.

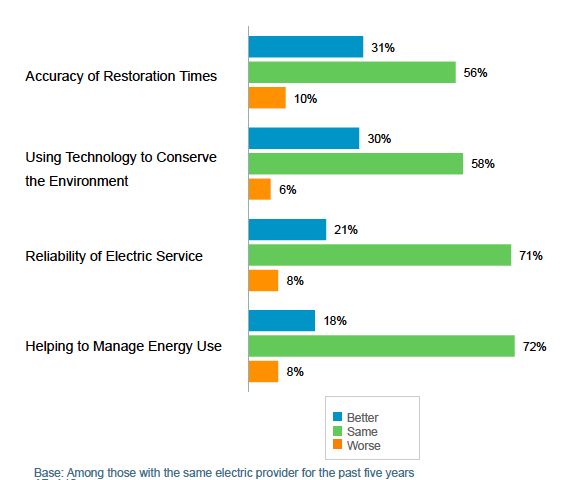

But when asked whether their utility’s fundamental services have improved, more say "yes" than "no," as the chart below indicates. That’s a sign that smart grid technologies are benefiting customers, Durand said -- even if they aren’t aware of it.

While many consumer attitudes about the smart grid have remained the same, a few important changes have taken place, she noted. Specifically, SGCC’s research has shown a “statistically significant” increase -- from 80 percent to 90 percent -- in the number of customers who see the smart grid as important for reducing greenhouse gas emissions and increasing the share of renewable energy on the grid.

The other big change has come in consumers’ interest in adopting new technology, Durand said. The percentage of consumers who say they agree with the statement “I am always eager to be the first one to buy new products or technologies” has climbed from 19 percent in 2011 to 31 percent in 2015.

“We don’t have causal reasons for this,” said Durand. But it’s likely that the smartphone revolution of the past five years has helped, as has the popularization of smart thermostats from companies like Google-owned Nest Labs.

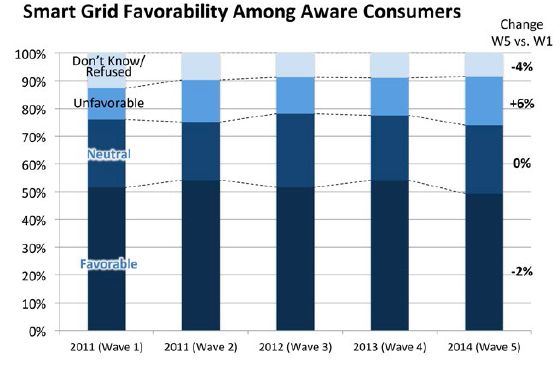

That’s the good news for utilities -- but there’s still plenty of bad news. First, Durand noted a significant increase over the past five years in customers who are both aware of what the smart grid is and view it unfavorably. While most of these “aware customers” still view these technologies favorably, that number has fallen slightly over the same period of time.

SGCC didn’t poll for reasons behind this shift, but it has pulled quotes from customers noting that they fear that smart meters and other grid improvements benefit utilities instead of them, or that these technologies may open them up to having their data stolen or their power shut off without their permission. (The long-running fight against smart meters by a tiny but vocal group of consumers may also be affecting this trend.)

Finally, there remains a gap between customers’ desire to use smart grid data to manage their energy use and the real-world technology deployments and utility programs that make that possible. As the report notes, “the utility industry has not yet figured out a way to make granular usage data compelling enough to drive ongoing consumer engagement.”

We’ve been covering the implications of this ongoing utility-customer data divide for some time. Monday’s report notes that it’s still a significant challenge. Many customers are very leery of their ability to change their energy consumption patterns to benefit from time-of-use or critical peak pricing programs, for example.

Data alone can’t necessarily fix this problem, as long-running Department of Energy studies of utility-customer pilot programs have shown. But pricing programs that favor rewards over punishments for reducing energy use, smart thermostats that can automate that process, and an “opt-out” structure that automatically enrolls customers who don’t actively take themselves out of it, tend to yield better results, the report notes.