Dora Nakafuji, director of Hawaiian Electric Co.’s renewable energy division, likes to talk in acronyms and animal shapes when describing her island utility’s grid-edge challenges.

The animals -- Bessie the elephant, and in extreme cases, Nessie the Loch Ness Monster -- signify the disruptive influence of solar PV on HECO’s power grid. And the problem is likely to grow as the state pushes toward its target of 100 percent renewables by 2045.

The acronyms denote Hawaii's multi-year, multimillion-dollar effort to understand, integrate and control intermittent, distributed renewable energy at island scale. Funded by a slew of Department of Energy grants, and featuring a who’s-who of companies in the distributed energy resource (DER) field, these projects may well be the most holistic approach to grid-edge DER integration in the country.

Distributed Resource Energy Analysis and Management System (DREAMS), a weather forecasting, distribution automation and control system integration overhaul, brought increased visibility into solar and wind’s effect on the supply side of the grid equation. That's critical for an island that wants to make this on-again, off-again resource its main power supply, said Nakafuji.

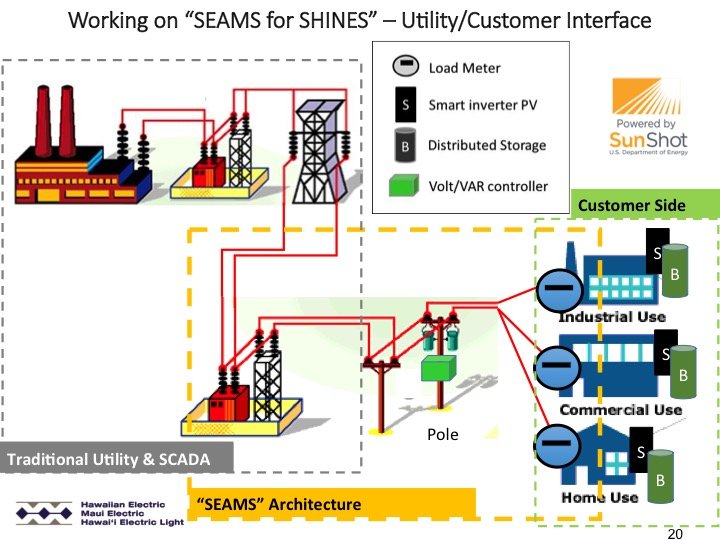

The initiative known as Integrating System to Edge-of-Network Architecture and Management (SEAMS) is bringing demand-side resources into view, she said. This outreach includes home energy management, behind-the-meter batteries and distributed energy.

Finally, there’s Sustainable and Holistic Integration of Energy Storage and Solar (SHINES), HECO’s new grant-funded initiative under DOE’s SunShot program, aimed at proving that energy storage can smooth out the capacity and stability problems that solar PV can create, and optimize its integration with the grid to unlock additional values.

HECO’s work goes beyond anything on the mainland in terms of its depth and breadth. “We’re one of the only utilities with these kinds of capabilities today,” Nakafuji said.

The jury is still out on which parts of the project will end up being the most cost-effective ways to deal with the utility’s problems, she noted. “You can’t set user requirements, you can’t project costs, until you have a degree of learning."

But the effort makes sense, given Hawaii's unique challenges. Those include the price of imported energy and the resulting economic competitiveness of solar-plus-storage for grid-tied, or even off-grid, applications.

The state’s renewables mandate also puts pressure on HECO to manage an increasing amount of inverter-based solar and wind power, which may end up unmooring its truly islanded grids from the stability of inertia provided by old-fashioned fossil-fuel generators.

Other utilities may soon be facing the same issues, said Ray Hudson, the DNV GL solar segment leader who’s involved in measuring and validating HECO’s SHINES grant work.

“Hawaii is an ideal laboratory that will continue to provide valuable information for utilities in the U.S. and around the world,” he said. “I am aware of a good number of utilities around the world that have been closely following what is going on in Hawaii.”

The supply side: Merging high-tech weather forecasting, grid sensors and control systems

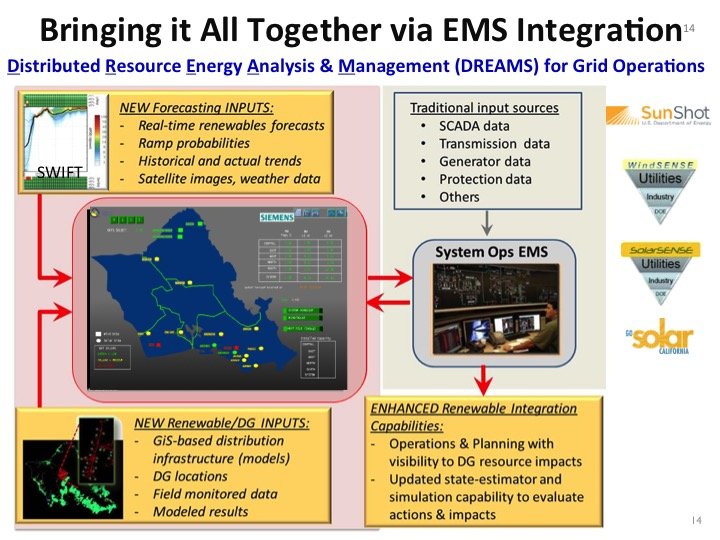

Let’s start with the first of HECO’s big acronym-bearing projects, DREAMS. The SunShot-funded project, launched in 2014, was meant to create a “next generation, integrated energy management infrastructure (EMS),” one that can incorporate the effects that weather has on the generation profiles of utility-scale and behind-the-meter distributed generation.

Today’s EMS systems have a lot of insight and information about generators, power flows and demand patterns. But they weren’t necessarily built to incorporate the on-again, off-again profile of intermittent renewables.

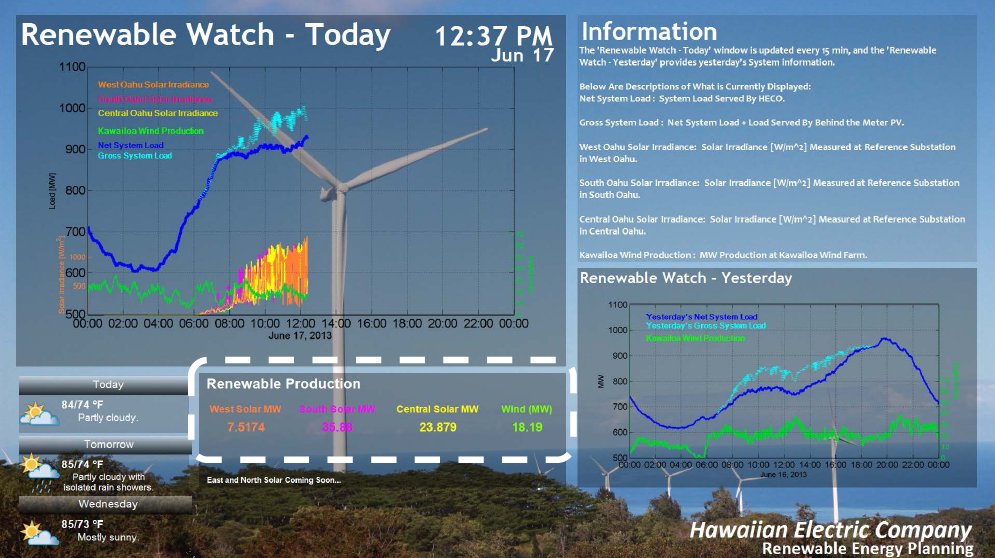

HECO’s DREAMS project incorporates wind and solar predictions, enabled by a complex array of sky-facing cameras, lidar and sodar (light and sonic detection and ranging) devices, and multiple other weather forecasting resources. That system is called SWIFT, for Solar and Wind Integrated Forecast Tool. AWS Truepower has developed it with HECO, starting with DOE stimulus grants in 2009, Nakafuji said.

That system now provides tracking and forecasting of solar generation across the island’s west, south and central regions, along with real-time tracking of the island’s biggest wind farms, in 15-minute increments.

Siemens provides the EMS for Oahu’s grid, and was already involved in a big DOE-funded sub-transmission and substation automation project called the East Oahu Transmission Project. Under DREAMS, it took on the next step of bringing in the advanced visualization and probabilistic forecasts of renewable energy generation forecasts to inform operational decisions, explained Kenneth Geisler, vice president of strategy for Siemens’ transmission and distribution grid unit.

“Dora’s aim was to determine if she could collect that information, massage it, and make it visible to the operations people, as well as give them a heads-up on forecasting,” he said. “I would characterize it as visibility and forecasting of distributed resources -- what does today look like, what will tomorrow look like.”

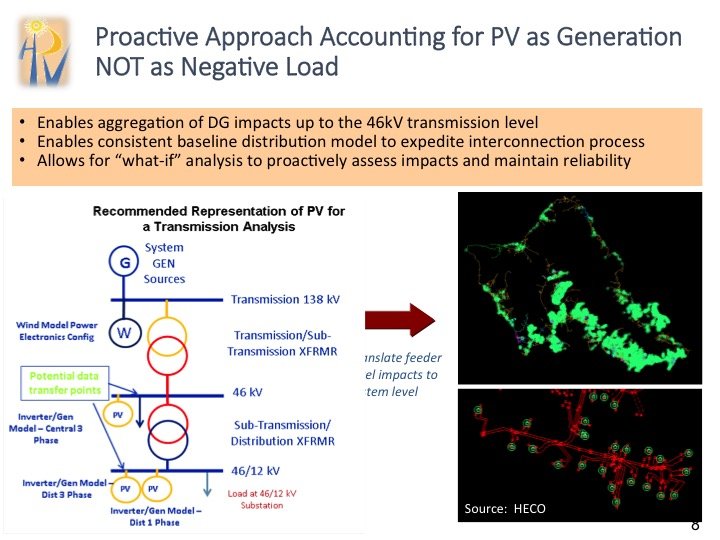

As part of its search for supply-side clarity, HECO had to start differentiating the impact of rooftop solar as a source of generation, not just as a reduction in load, Nakafuji noted. From 2012 to 2014, HECO worked with the Electric Power Research Institute on a “solar nodal modeling” project, to aggregate distributed PV into system models.

The final result remains “the brains of the operations system,” she said. As Hawaii’s share of diverse and distributed generation resources continues to grow, grid operators “don’t need to know every little detail, but they need some communications, they need some data, whether it’s status or availability,” she said.

Below is a diagram that represents all the new data resources being pulled into Siemens’ and Alstom’s EMS platforms under the new program.

The demand side: bringing the energy-enabled customer into the mix

Where DREAMS deals with the supply-side challenges of renewable energy, “what’s next is to understand what our customer needs are in terms of load, how they want to use their energy,” Nakafuji said. “That’s really the intelligence we don’t have today -- that’s what all this talk about smart grid means to us.”

HECO’s term for this effort is SEAMS (System to Edge-of-Network Architecture and Management). “That’s really getting from our lowest point of automation, our distribution substations, all the way to the meter,” she said. It also gets them behind the meter, into home and building distributed-energy and demand-response systems.

This broader effort incorporates a whole host of utility- and customer-owned resources. “We have different partners giving us the lay of the land, at the points where they’re deployed,” she said.

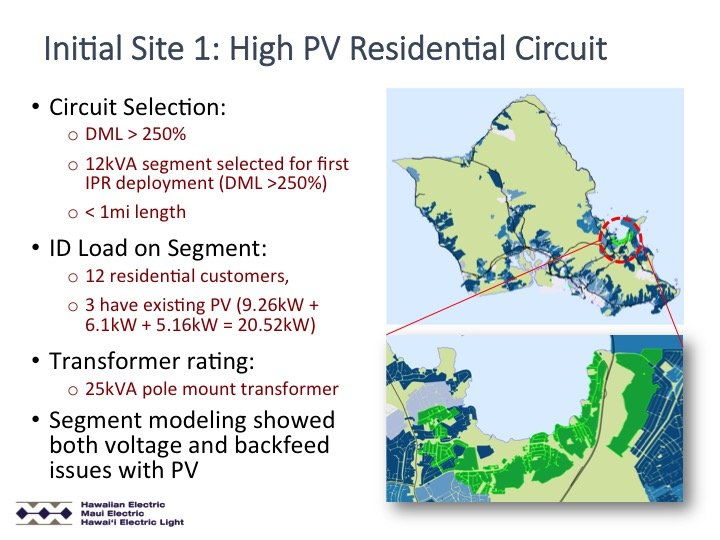

On the utility side, HECO earned an award at last month’s DistribuTech for best renewable integration by a U.S.-based utility for the project with Gridco using the startup’s novel next-generation power electronics-based in-line power regulators (IPRs).

“The use case is solar -- high-voltage conditions resulting from high PV penetration, particularly of residential solar, and remediating those, even with backfeed conditions,” Naimish Patel, Gridco’s CEO, told me in a February interview. Gridco has been working with HECO since early 2015, deploying its devices to stabilize solar-influenced distribution circuits on Oahu and Molokai.

So far, Gridco’s IPRs have shown they’re capable of leveling out voltages on distribution circuits with lots of rooftop PV, which can cause over-voltages and lead to solar power backfeeding up to substations. That could allow HECO to avoid spending money to beef up those circuits to accommodate more solar, or, conversely, putting a halt to new solar installations on heavily penetrated circuits.

“What we’re helping them do, ultimately, is meet their RPS targets, while maintaining quality and reliability -- but importantly, at the lowest possible costs,” he said. “The first part of that is understanding the problems, and what we can do, and modeling the operations and economics,” which provides its own share of valuable data to HECO’s grid operators, he noted.

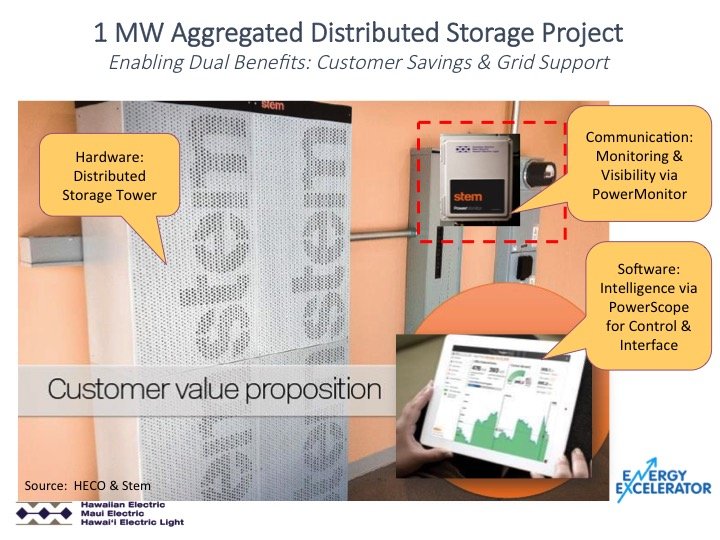

Other SEAMS resources are coming from the customer side of the meter. One big example is HECO’s 1-megawatt pilot project with Stem, Nakafuji said. Since late 2014, the San Francisco-based startup has been seeking out commercial, industrial and institutional customers on Oahu willing to deploy its behind-the-meter batteries to reduce their demand charges, as well as provide some level of direct control to HECO.

As of late January, Stem had signed up 29 customers for the pilot program, said Tad Glauthier, the company’s vice president of Hawaii operations. Those customers have access to Stem’s up-front financing, as well as HECO incentives, to reduce their costs. As for HECO, “we’re offering them a service called grid response. It’s reminiscent of demand response, but with higher levels of reliability and availability,” he said.

HECO asked Stem to make sure the utility can call on each customer to discharge their batteries -- and thus reduce their load -- for up to an hour at a time to help it manage system-wide peaks. Over the next two quarters, Stem will be activating that system, which will be available to the utility’s system operators via a separate screen at first, and eventually through integration with their EMS platforms.

Behind-the-meter batteries don’t make sense for all of HECO’s customers, Nakafuji noted. But as part of an add-on pilot project, they’re getting access to Stem’s PowerMonitor, an on-site energy metering system, and its PowerScope software for tracking and analyzing that energy data, she said.

HECO’s SEAMS work is timely given the state’s push to allow DERs to participate in a full array of grid services and demand-response opportunities. Nakafuji mentioned several other ongoing demand-side pilots involving controllable water heaters from Sequentric and window-mounted air conditioning units from Hawaii startup Ibis Networks.

Pulling it all together to find the right mix of solar-plus-storage

All of this work comes together in HECO’s SHINES (Sustainable and Holistic Integration of Energy Storage and Solar PV) project. According to the DOE’s project profile, the goal is to “demonstrate successful distributed photovoltaics, energy storage, and dynamic load control deployments,” featuring “new energy management system logics to ‘see and interface’ with distribution-system level, customer-hosted electricity resources.”

The top-line goal of the SHINES program is to enable solar-integrated storage at a cost of about 14 cents per kilowatt-hour. That figure includes the cost of integrating it all into utility operations -- a far different metric than simply adding up the cost of solar and storage equipment.

“We need to develop reliable and cost-effective PV and storage technologies offering customers more plug-and-play options to integrate with the grid,” Nakafuji said.

For HECO, that boils down to having enough information about ongoing operations of distributed and customer-sited energy resources to know how they’re affecting the individual circuits they’re connected to, as well as how to enlist them in helping to solve those problems. “If what’s happening on our circuit exceeds our capability to handle it, we can deal with that on our own -- or we can look to capabilities on the customer side,” she said.

HECO has already been working for some time on determining which of its distribution circuits are under threat of being overloaded by customer-supplied solar energy. The need for this came to a head in 2014, when the utility placed restrictions on new net-metered solar interconnections, and in early 2015, when state regulators ordered it to lift the restrictions wherever possible.

Some of that work has been done through pulling data from Enphase’s microinverters, which make up a significant portion of Oahu’s rooftop solar market. HECO is also tapping the data from microsynchrophasors, miniature versions of synchrophasor devices used to collect microsecond-level data on grid frequency and voltage from transmission grids.

SolarCity has also contributed, working with DOE’s National Renewable Energy Laboratory to show how smart features could unlock additional capacity on circuits with a high concentration of rooftop PV. Other inverter makers are also involved, including SHINES partner Apparent, Nakafuji said. The Novato, Calif.-based company was one of the first manufacturers to comply with HECO’s new smart inverter rules put in place late last year (PDF), which put Hawaii ahead of any other state in requiring solar inverters that can adjust their operations to ride through grid disruptions, inject reactive power, or curtail power going back onto the grid.

As for energy storage, Hawaii already has a lot of it, much of it installed to help mitigate the effects of intermittency from large-scale wind farms. Other DOE-funded projects are testing how batteries can help mitigate the grid impacts of high-voltage DC charging stations for electric vehicles, or in the case of the Stem pilot, how they can help reduce customers’ utility bills while also serving grid needs.

But there’s plenty of battery-backed solar investment going on in Hawaii without HECO’s participation. GTM Research found that Hawaii beat out California last year to lead the country in residential behind-the-meter energy storage deployments.

Last year’s decision by the Hawaii Public Utilities Commission to replace the state’s net metering program with a lower rate that discourages feeding power back to the grid could spur more solar providers to add energy storage. SolarCity announced its so-called “self-supply” package for Hawaii last month, including Tesla’s Powerwall batteries, smart electric water heaters and thermostats, and a gateway to control it all.

SolarCity is pricing its new package at a lease price of 26 cents per kilowatt-hour. That’s nearly twice the DOE’s SHINES price goal, but less than Hawaii’s average price of 32 cents per kilowatt-hour for grid-supplied electricity. These figures highlight how energy storage is starting to make economic sense for many HECO customers -- and they indicate the pressure the utility and regulators are under to come up with solutions to integrate this into grid operations.