Last week, Royal Dutch Shell announced that it had created an Memorandum of Understanding (MOU) with Cosan to produce a 50-50 Brazilian ethanol joint venture valued at a staggering $12 billion. This investment represents the single largest commitment to biofuels that any oil company has made to date. To summarize, the joint venture will own 4,500 retail stations and production capacity of 1,323 MGY --- catapulting the company into the top four in terms of global ethanol production (ranking behind U.S.-based POET, Archer Daniels Midland, and Valero). Shell is contributing $1.63 billion in capital and its retail and marketing units (valued at $3B). Cosan's assets are valued at $4.93B, while part of its $2.5B in net debt will be carried on the balance sheet of the joint venture.

Have the major oil companies finally woken up to the potential of biofuels as a major source of liquid fuels?

Actually, they have had a seat at the party for awhile.

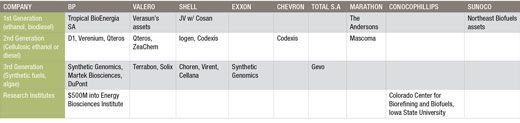

Every major oil company has made some sort of investment in biofuels. British Petroleum (which used to call itself "Beyond Petroleum") has arguably been the most aggressive investor --- and perhaps the most hedged. The company invested $90M to create a 50-50 joint venture with cellulosic ethanol producer Verenium. BP has a JV with DuPont to commercialize biobutanol, and is exploring other avenues in the sector, as well, such as producing algae with Martek Biosciences, jatropha with D1, cellulosic ethanol with QTeros, and ethanol with sugarcane with Brazilian-based Tropical BioEnergia SA.

Until the Cosan announcement, Shell had invested solely in second- and third-generation biofuels, bypassing first-generation biofuels like food-based ethanol and biodiesel. Shell had already announced investments in producing synthetic fuel with Virent and Choren, cellulosic ethanol with Iogen and soon-to-be publicly traded Codexis, and algae with Cellana.

Other oil majors have been quieter. Exxon-Mobile, whose CEO Rex Tillerson famously said in 2006 that, "there's an enormous amount of uncertainty around this whole question [of global warming]," has made one biofuel investment --- a $300-$600M algae collaboration with Synthetic Genomics. Chevron invested in Codexis, while French major Total S.A. invested in biobutanol leader Gevo.

Is Big Oil's presence in biofuels a cynical attempt to control alternative fuel technologies so that humanity will remain dependent upon oil until every last drop has been extracted from the ground? Or do biofuels make compelling economic sense?

Conspiracy theories aside, the Shell-Cosan might be seen as an endorsement that first-generation biofuels --- despite their well-chronicled shortfalls --- will likely remain the only commercial biofuel for the foreseeable future. Under the Energy Independence and Security Act of 2007, U.S. refiners are required to blend increasing amounts of ethanol into the nation's gasoline supply. 15 billion gallons of corn ethanol are required to be blended by 2015 (from 10.5 billion in 2009), while advanced biofuels like cellulosic ethanol are not required to be blended in significant volumes for several more years. Last week's downward revision by the EPA for the renewable fuel mandates for cellulosic ethanol (from 100M gallons to 6.5M) was not exactly a ringing endorsement for the near-term prospects for advanced biofuels.

Over the last year, U.S. oil refiners Valero and Sunoco purchased the bankrupt assets of first-generation producers for dimes on the dollar of replacement cost. By mid-2010, Valero will have 1.1 billion gallons of ethanol production capacity (from zero in 2008), making it the third-largest producer in the United States.

If we consider that the oil majors are not in the oil business, but rather, the infrastructure business --- and as long as they control the liquids that come out of the pumps, they won't care if it is made from petroleum or cow dung --- then we shouldn't be surprised that they are increasing their investments into biofuels.

Oil Majors’ Investments in Biofuels

Click on image to view larger.