Spain and Portugal are currently the most powerful examples of how to transform a nation's energy mix -- a necessary transformation if we are to mitigate the impacts of climate change and peak oil. These nations are rapidly shifting to a renewable energy economy.

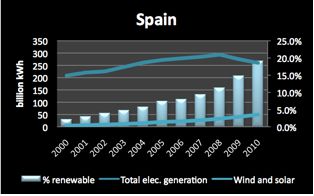

Spain has grown from just two percent wind and solar power to almost 20 percent in a decade (see Figure 1). Spain’s electricity consumption grew by 50 percent from 2000 to 2008, only to drop rapidly from recession and price-induced conservation since 2008.

Spain now enjoys approximately 35 percent total renewables (including large hydroelectric), with the rest of its power coming from natural gas, coal and nuclear. Moreover, Spain is an apt comparison to California because both share key population and climate characteristics.

Figure 1. Spain’s electricity sector transformation, 2000 to 2010 (Source: EIA)

Spain’s solar sector plummeted after 2008, however, due to major changes in the country's feed-in tariff law that were prompted by broader economic problems. A number of solar companies recently sued the Spanish government for retroactively changing contract prices under the feed-in tariff.

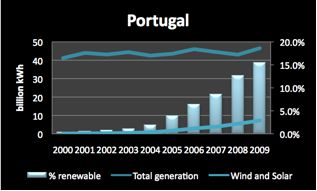

Portugal has demonstrated an even more remarkable transformation in the last five or so years. In 2004, Portugal had just two percent wind and solar, but by the end of 2009 (the latest year for which data are available), this had risen to over fifteen percent. Its electricity consumption remained fairly level during the last decade.

Figure 2. Portugal’s electricity sector transformation, 2000 to 2009 (Source: EIA)

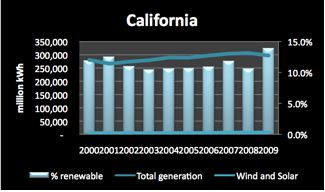

Compare these nations to California, which is generally perceived as the leading state for renewable energy in the U.S. Figure 3 shows that wind and solar penetration has generally been stagnant in California for the last decade. It’s only in 2009 and 2010 that a pickup has occurred, but wind and solar have remained below three percent despite some recent growth. The rest of California’s renewables come from geothermal, biomass and small hydro (large hydro doesn’t count as renewable under California law).

Figure 3. California’s electricity sector, 2000 to 2010 (Source: California Energy Commission)

This figure does not include net-metered solar, because the chart includes only wholesale data. Even if net-metered solar were included (under the California Solar Initiative), it would add only a small amount to the total amount of wind and solar. Although California’s net-metered solar market is by far the largest in the country, it is still a small fraction of the wholesale renewable energy market. Note that these figures are for California as a whole, not just for the big three investor-owned utilities, which are tracked in CPUC reports.

It’s also important to note that 2010 was a good year for California’s renewables market, resulting in the addition of twice the megawatts of 2009. Early numbers (not yet finalized by the Energy Commission) suggest that the total renewables went up a couple of percentage points again in 2010, so the Renewable Portfolio Standard is starting to have a significant effect -- eight years after it became law. California is on track to achieve the 20 percent mandate by 2012 or so, in compliance with current law. It is less clear whether the more ambitious 33 percent mandate by 2020 can be achieved.

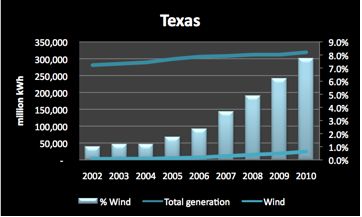

Texas is the leader in the U.S. in wind power, growing from almost no wind power in 2000 to about 10,000 megawatts of wind -- almost 8 percent of Texas’ total electricity consumption. At times, wind has provided one quarter of all the electricity used in Texas. ERCOT stated in a recent press release: “ERCOT recorded a new wind output record of 7,227 megawatts (MW) at 7:16 am on Dec. 11, 2010, representing 25.8 percent of the load at the time. The new peak beat the 2009 record by almost 1,000 MW.”

Texas has almost no solar power generation.

Figure 3. Texas’ electricity sector, 2002 to 2010 (Source: Electric Reliability Council of Texas)

Each jurisdiction is different, with its own mix of land use and pricing policies for renewables. Interestingly, California’s boom period for renewables occurred in the 1980s and early 1990s, reaching the high teens before diminishing as a percentage from the early 1990s until 2007. This was a result of the first robust feed-in tariff in the world: the Public Utilities Regulatory Policies Act (PURPA), which mandated that states offer contracts to renewable energy producers and cogeneration facilities. California implemented this law aggressively and saw about 10,000 megawatts of wind, solar and geothermal come online in just a few years -- until the boom ended due to a reduction in fossil fuel costs, which acted as the proxy for contract pricing, as well as an end to tax credit programs.

Similarly, the boom in Spain and Portugal has been prompted by feed-in tariff laws. Spain’s solar sector, as mentioned, is suffering from dramatic changes to the law, but the wind power sector -- far larger than the solar sector -- continues to grow dramatically. So the debate over feed-in tariffs will continue, but it is simply not the case, as some critics insist, that countries like Spain show the folly (boom and bust) of feed-in tariffs for all renewables. The discussion in this article demonstrates this point.

I need to also mention Germany and China, which have seen similar, very robust growth in renewables. While their capacity additions are very impressive -- Germany has by far the largest solar capacity and China now has the world’s largest wind power capacity -- their percentage of renewables is not as impressive as Spain or Portugal. Germany’s wind and solar percentage rose from two percent in 2000 to about 7.5 percent at the end of 2009; China is still below one percent wind and solar even though their wind power sector doubled each year in five of the last six years (which will lead to very high penetration if this growth pace continues).

Another very encouraging trend is the decline in wind and solar power costs over the last few years, which I wrote about recently. Wind and solar are, when compared accurately to the appropriate baseload, load-following or peak power resources, cost-effective today.

So what is California to do, in light of these analyses?

My client, the Clean Coalition (formerly the FIT Coalition) is leading the campaign in California to reach the Governor's target of 12,000 megawatts of distributed renewables. We are working to create CLEAN (Clean Local Energy Accessible Now) programs that use the best elements of successful feed-in tariff programs around the world, save money for California ratepayers, and create good local jobs. A recent report from the Center for American Progress provides strong support for CLEAN programs as effective tools for promoting renewables.

Our goal with the CLEAN California bill is to achieve the same transformation Spain, Portugal and Texas have experienced in the last decade -- and that California achieved in the 1980s.

***

Tam Hunt is president of Community Renewable Solutions, LLC, a renewable energy consulting and project development company. He is also a Lecturer in climate change law and policy at UC Santa Barbara’s Bren School of Environmental Science & Management. His blog, Thought, Spirit, Politik, is at www.tamhunt.blogspot.com.