The U.S. solar market continues its strong growth, installing 1,354 megawatts* of solar photovoltaics in Q3 2014, up 41 percent over the same period last year.

The numbers come from the latest edition of GTM Research and the Solar Energy Industries Association's (SEIA) U.S. Solar Market Insight report, released today. According to the report, Q3 was the nation's second-largest quarter ever in terms of PV installations, bringing the country's cumulative solar PV capacity to 16.1 gigawatts, with another 1.4 gigawatts of concentrating solar power (CSP) capacity.

Solar is proving to be an important and growing source of new generating capacity for the United States. Through the first three quarters of the year, solar represents 36 percent of the new capacity that came on-line, up from 29 percent in 2013 and 9.6 percent in 2012.

“Solar’s continued impressive growth is due, in large part, to smart and effective public policies, such as the solar Investment Tax Credit, net energy metering and renewable portfolio standards,” said Rhone Resch, SEIA president and CEO. “By any measure, these policies are paying huge dividends for America. Every three minutes of every single day, the U.S. solar industry is flipping the switch on another completed solar project, benefiting both our economy and the environment.”

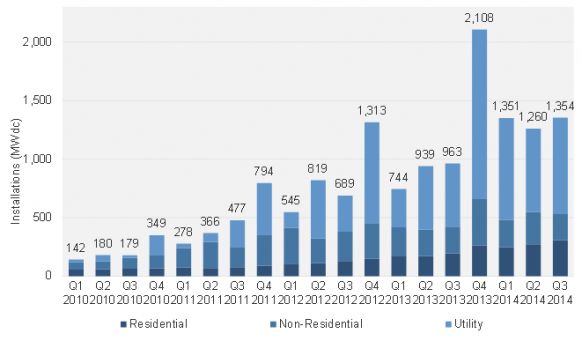

The report tracks installations across three market segments: utility-scale, residential and non-residential which includes commercial, government and nonprofit installations.

FIGURE: U.S. PV Installations, Q1 2010-Q3 2014

Source: U.S. Solar Market Insight, Q3 2014

Historically, the U.S. utility-scale market segment has accounted for the majority of PV installations, and this past quarter continued the trend. The U.S. installed 825 megawatts of utility-scale projects, up from 540 megawatts in Q3 2013. This marks the sixth straight quarter in which utility-scale PV has accounted for more than 50 percent of the national total.

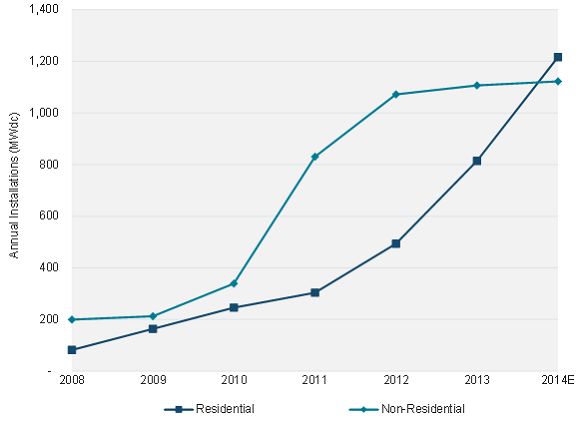

The U.S. residential market exceeded 300 megawatts in a quarter for the first time in history. Impressively, more than half of this total came on-line without any state incentive. Residential continues to be the most reliable market segment, now growing for eighteen out of the past nineteen quarters. GTM Research forecasts it to exceed the non-residential segment in annual installations for the first time in more than a decade.

FIGURE: Residential vs. Non-Residential PV Installations, 2008-2014E

Source: U.S. Solar Market Insight Report, Q3 2014

“Residential solar has become a remarkably consistent, growing market” said Shayle Kann, senior vice president at GTM Research. “By the end of this year, there will be more than 600,000 homes outfitted with solar, and we see no signs of a slowdown next year. By 2017, we expect the residential sector to be the largest in the U.S. solar market.”

The non-residential market continues its struggles of late, due in part to incentive depletion in California and Arizona. Installations in the segment were down 3 percent over Q3 2013. However, GTM Research and SEIA do expect year-over-year growth for the non-residential market.

The report forecasts the U.S. to install 6.5 gigawatts of PV in 2014, a 36 percent increase over the historic 2013.

Key findings from the report:

- The U.S. installed 1,354 megawatts of solar PV in Q3 2014, up 41 percent over Q3 2013, making it the second-largest quarter for solar installations in the history of the market.

- Cumulative operating PV capacity has now eclipsed the 16-gigawatt mark, thanks to four consecutive quarters of more than 1 gigawatt installed.

- For the first time ever, more than 300 megawatts of residential PV came on-line in a single quarter and more than 50 percent of residential PV came on-line without any state incentive.

- 36 percent of all new electric generating capacity in the U.S. through the first three quarters of 2014 came from solar.

- Growth remains driven primarily by the utility solar PV market, which installed 825 megawatts in Q3 2014, up from 540 megawatts in Q3 2013.

- The report forecasts that PV installations will reach 6.5 gigawatts in 2014, up 36 percent over 2013 and more than three times the market size of just three years ago.

- Q1 2014 was the largest quarter ever for concentrating solar power (CSP), due to the completion of the 392-megawatt Ivanpah project and Genesis Solar project’s second 125 megawatt (AC) phase. While no CSP plants came on-line in Q3 2014, Abengoa’s Mojave Solar (250 megawatts) achieved commercial operation in December 2014, making 2014 the biggest year ever for CSP.

*Unless specified otherwise, all PV is reported in MW of direct current (DC) based on array size, and all CSP is reported in MW of alternating current (AC) based on power block size. For more information, see http://www.seia.org/policy/solar-technology/photovoltaic-solar-electric/whats-megawatt

***

The U.S. Solar Market Insight report is the most detailed and timely research available on the continuing growth and opportunity in the U.S. The report includes deep analysis of solar markets, technologies and pricing, identifying the key metrics that will help solar decision-makers navigate the market's current and forecasted trajectory. For more information, visit www.greentechmedia.com/research/ussmi.