West Sacramento, Calif.-based GridSense has been quietly making sensors for the power grid since 1974, which is long enough to have a sense of the 'smart grid' as a work in progress.

That’s to say that much of the world’s power grid today, from generation plants all the way down to big substations, is already pretty 'smart,' if that means having digital communications and automated control systems attached to it. That’s happened over the past 30 years or so.

Nowadays, it's the smaller stuff -- the medium and low-voltage distribution grids that carry power from substations to individual customers -- that remains 'dark' to utility control rooms. A key challenge here has been making systems that are both cheap enough to deploy on this massive distributed scale, and effective enough to make a difference.

GridSense has been moving into this distribution automation (DA) frontier in a big way over the past few years, with new products like distribution transformer monitors and self-powered line sensors -- all at a promised “fraction” of the cost of competing systems.

Facing it are a host of competitors, ranging from smaller coequals such as Sentient Energy or Survalent to large-scale players like S&C Electric to giants like ABB, Siemens and General Electric, all aiming at different combinations of technology that can fit the DA needs of utilities.

GTM Research predicts that the U.S. distribution automation market will rise from $1.75 billion in 2010 to about $3 billion in 2015, outpacing smart meters in terms of money spent. While Europe’s spending has slowed, China’s is set to outpace the United States by far, as it deploys hundreds of billions of dollars to a nationwide grid buildout. That adds up to a lot of room for growth for technologies that can break current price barriers.

GridSense claims some 200 customers globally for its range of devices and services, but it’s also been landing interesting new customers and partners for its newest DA equipment and software. In 2010, it was bought by Sacramento, Calif.-based Acorn Energy, a publicly traded holding company, which has been investing in the company since then to boost sales of its existing products and to bring out new ones, Kent Leacock, Acorn Energy’s senior director of external affairs, said in an interview last week.

So what’s GridSense up to? Here are some recent announcements:

The Transformers

In July, Baltimore Gas & Electric announced it was using GridSense’s TransformerIQ to help monitor volt/VAR optimization (VVO) for its distribution grid. The project features GridSense’s TransformerIQ sensors, which attach to the smaller transformers in the grid to feed back data that helps grid operators keep it in balance.

While the biggest and most expensive transformers in a utility’s mix come with their own monitoring capabilities, there are tens of millions of smaller distribution transformers deployed today that don’t. GridSense’s new distribution transformer monitors can attach to those transformers and then communicate via a host of wireless technologies to keep an eye on their health, Leonce Gaiter, GridSense’s marketing director, said in an interview last month.

That adds up to reduced maintenance and replacement costs, as well as data that can help manage grid emergencies, he said. While he wouldn’t pinpoint the cost of GridSense’s monitors for these smaller transformers, he did say they’re under $1,000 apiece, which he said was quite competitive with existing alternatives.

TransformerIQ has been deployed by a number of utilities, including BG&E, a couple of California utilities, and a big, unnamed Southeastern utility that in June 2011 said it would apply the technology to about 2,000 of its transformers in a big city distribution network, one of the largest deployments of its kind in the U.S. to date. In 2010, GridSense bought On-Line Monitoring, a maker of transformer bushings monitors, to add to its portfolio.

The BG&E project represents a new use of TransformerIQ. Many utilities and multiple smart grid vendors are supplying technology to better manage grid voltage and reactive power for better efficiency (so called conservation voltage reduction (CVR) or volt/VAR optimization [VVO]). But BG&E is hoping it can use less expensive feeder line voltage regulators or capacitor banks to get the job done, instead of more expensive load tap changers and voltage regulators.

The Power Lines

In June, GridSense announced several utility projects testing out new uses for its newer product, the LineIQ sensor. Launched in February 2011, LineIQ is a standalone device that can be clipped onto a power line by a worker using a “hot stick,” or an insulated pole -- a simpler and cheaper alternative to sending workers up utility poles and plugging sensors into existing grid equipment

From there, the device powers itself from the electricity on the line, along with getting power from a solar panel attachment, to do its power measurements and send and receive data via a variety of wireless communications options, Gaiter said.

The ease of installation and self-powering aspects of LineIQ devices sound a lot like the line sensors coming from Sentient Energy. The stealthy startup announced last week that it’s being resold by big smart meter networking startup Silver Spring Networks, in a tightly linked relationship that has Silver Spring radios built into Sentient devices.

GridSense also has work underway with Silver Spring, though it’s unclear if it’s being done at the same level of integration. In June, GridSense announced that “two major utilities” were testing out LineIQ to connect unmonitored substations, as a cheaper alternative to hooking them up via hard-wired SCADA systems. One of the utilities is using Silver Spring’s communications network to talk to GridSense’s gear, and the other one is using smart meter networking from Sensus, Gaiter said.

Indeed, GridSense devices are built to be able to talk to a host of communications, and have worked with Silver Spring, Sensus, Landis+Gyr, and with low-power, long-range, high-penetration wireless startup On-Ramp Wireless in a project with San Diego Gas & Electric to monitor underground power lines, “vaulted” transformers and similar hard-to-reach parts of the grid. To avoid having to replace batteries on these devices, GridSense is developing battery-free systems it’s testing with the DOE and a “major utility in California” -- presumably SDG&E.

Gaiter said that LineIQ has been deployed internationally, with a focus in Australia, where regulations that assess stiff fines for utilities that allow outages to outlast certain limits have boosted investment in DA technologies. GridSense is also testing out new uses of its LineIQ sensors with some partners. In June, it announced it was working with an unnamed California utility to measure the impact of power from solar panels as it enters the grid.

The Software

All of this sensor data can’t actually change the grid on its own. Someone’s got to analyze the raw data to see what it means and translate that into terms grid operators can understand. From there, it can be integrated into grid operations systems, as well as outage management, asset management and other enterprise software the utility has running.

At a municipal utility convention in June, GridSense unveiled its latest contribution to that integration with Grid InSite, a new software platform that promises an inexpensive and easy-to-install grid management architecture that rides on top of its sensor networks.

It’s noteworthy that Grid InSite went public at a municipal utility convention. The company’s press release notes the platform’s usefulness to “both large investor-owned utilities and small cooperatives,” with promises of “flexible hosting options, compatibility with any wireless communication technology, efficient data management, and powerful data access and analysis” at an affordable price.

“Our goal in doing that is to radically simplify, in an almost plug-and-play way, a utility’s ability to add and program devices on its network,” is how Gaiter put it. GridSense has also been integrating its own software into outage management, asset management, grid modeling and automation software platforms from a variety of big vendors in the space.

Distribution management system (DMS) vendors like GE, Siemens, Schneider Electric’s Telvent, ABB’s Ventyx, Alstom and Oracle all have their own plans to manage the grid at a master level. GridSense is more likely to be one part of a broader deployment at big utilities that can afford DMS partners like these. But thousands of municipal utilities, rural cooperatives and other small-scale players can’t afford the hefty capital investment that comes with such a full-scale DMS deployment.

GridSense is just one of the companies targeting the small utility sector. So far this year, we’ve seen Aclara and Calico Energy, ElectSolve and On-Ramp Wireless, Tantalus Networks and others launch platforms promising simplicity of use and low cost aimed at the muni and co-op customer. We also saw ABB acquire Tropos Networks, a former muni Wi-Fi company that’s landed some big contracts with municipal utilities like Glendale and Burbank in Southern California. General Electric has its smart grid as a service platform at multiple municipal utilities, and competitors like SAIC's smart metering service offering and Lockheed Martin’s demand response platform for electric co-ops are also targeting the market.

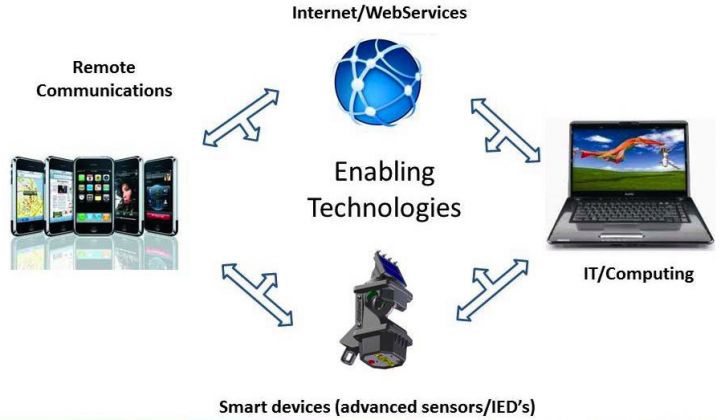

GridSense hasn’t released Grid InSite on a commercial basis yet, but Gaiter said it’s being tested and is expected to launch later this year. Beyond working well with other grid technologies, the next generation should be tuned for use in the modern IT environment, he noted. In other words, “Our goal is to create something as user-friendly as Google Maps, or the Outlook view you see on your server every day,” he said.

Beyond that, “It should show up on your cell phone. It should show up on your control panel, as soon as it happens,” he said -- certainly when it comes to emergencies that indicate a blackout is on the way. GridSense already provides network operations and alerting software for its systems, as well as analytics to do preventative maintenance and fault prediction type work.