In a move that’s sure to shake up the U.S. PV inverter landscape, a large Japanese industrial company acquired a top American inverter manufacturer yesterday.

Yaskawa Electric Corporation, a $3.6 billion Japanese industrial automation firm, bought up Solectria Renewables, a PV inverter producer based in Lawrence, Massachusetts. No financial details were disclosed.

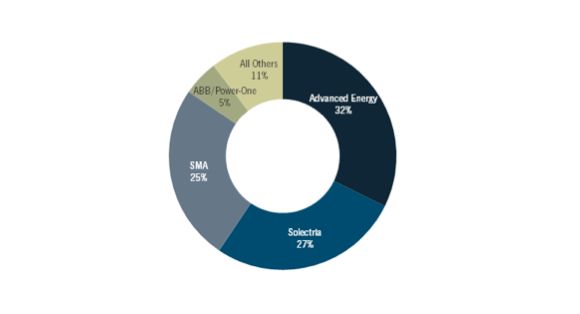

Solectria Renewables was the fifth-largest supplier of PV inverters by megawatt-AC shipments in 2013. According to the U.S. PV Leaderboard Q2 2014, it was the second-largest inverter supplier in U.S. commercial markets in Q1 2014. Yaskawa is a relatively newer entrant into the PV space, ramping up its solar inverter division in response to the post-2012 Japanese FITs. Its shipments have primarily focused on residential and 3-phase string solutions.

On paper, the match looks entirely complementary: two similarly sized PV inverter businesses located in two of the world’s strongest PV markets focused on opposite ends of the power spectrum.

But does it make sense in practice?

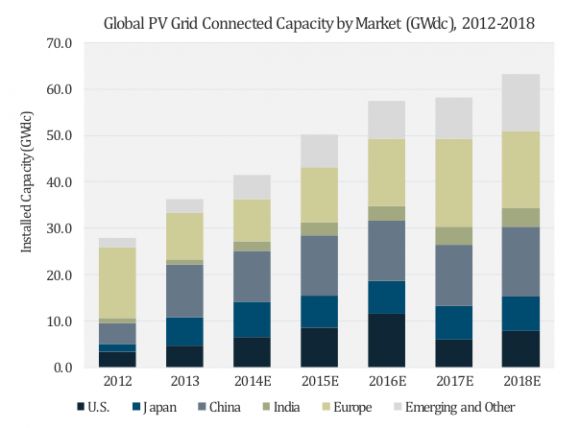

First, let's consider the industry backdrop against which the acquisition is taking place. The Japanese market expanded at a 30 percent CAGR from 2011-2013 and is expected grow another 24 percent in 2014, adding another 7.5 gigawatts. GTM readers know that the U.S. market has also been booming lately, with annual installed capacity reaching 4.8 gigawatts in 2013 and an additional 6.6 gigawatts expected in 2014.

Put another way, if an inverter manufacturer isn't entrenched in Japan or the U.S., it will miss out on one-third of the global PV market from 2014 to 2016. (Although when the ITC phases down after 2016, these two countries will only make up one-quarter of the global market.)

Source: GTM Research

Beyond the top-level figures, these markets are going through a remarkable process of segment shift. Whereas the Japanese market was 71 percent residential in 2011, residential market share fell to just 23 percent in 2013 as commercial rooftop and mega-solar projects started dominating the landscape.

In the U.S., the explosion has come from the opposite direction. More than 50 percent of installed capacity comes from the utility sector, and the residential market is expected to grow by more than 60 percent in 2014. That means both Yaskawa and Solectria are in the right geographies.

However, with Yaskawa’s residential and light-commercial focus and Solectria’s commercial and small-utility focus, both are missing out on a large piece of the growth stories within their respective domestic markets. That brings us to our first evaluation of the deal.

Product synergy: B-

On the surface, the combined product line of these two companies seems like an offering that could address all segments of the PV market. Solectria's focus in the past few years has been on commercial and utility-scale central inverters, with a more recent effort to scale up to medium-voltage utility skid solutions. It has phased out self-manufactured, lower power products and is currently using OEMs to fill out that end of its portfolio.

Meanwhile, Yaskawa has been shipping mostly residential and light commercial solutions that max out at 100 kilowatts. The two companies can learn a lot from each other about building inverters, but integration of the two portfolios won’t be simple.

First, Japanese distributed generation products are an odd fit for the U.S. market, especially given unique anti-islanding standards and a need to address Japan’s split 50 Hz/60 Hz grid. Second, while Solectria’s experience with advanced PV-grid integration features could help Yaskawa scale up the learning curve, Japanese utilities are yet another entity that must be approached on an individual, project-by-project basis, so product adaptation and patience during the learning period will certainly be needed.

On paper, the products fit together, but cross-geography product development will be a medium-term play. Solectria brings experience in navigating utility grid integration, but its experience is not as extensive as other major U.S. and global inverter suppliers -- nor will it necessarily fulfill the needs of a tricky Japanese grid integration process from the get-go.

Yaskawa’s U.S. market entry opportunity: B+

We believe U.S. market entry is the primary motivation behind the deal. While the Japanese market looks great right now, feed-in tariff cuts and increased competition are always on the horizon. In 2010, leading companies SMA and Power-One (now ABB) diversified and doubled down on the U.S. market early, building a strong local manufacturing presence. A few years later, the U.S. market helped both lessen the drop-off in inverter sales as European markets declined.

The U.S. continues to be one of the bright spots in the global market, with a slightly above-average inverter pricing environment (although prices are rapidly declining) and very promising growth across all three major market segments. Yes, the ITC cliff will have an impact, but the market won’t disappear afterwards. At the very least, the U.S. provides a jumping-off point allowing firms to gain a presence in Mexico and other promising Latin American markets.

Yaskawa is late to the U.S. (and the inverter) game and doesn't have the extensive foreign in-field experience that some of its Asian peers do. Certification would have delayed entry for another year, and that would be followed by market traction-building. Essentially, this means that the company would have missed the 2016 party. This acquisition gives Yaskawa a huge jump-start in the U.S., and Solectria is an attractive company to acquire as a family-owned entity (i.e., no high-valuation-seeking VCs) with a claimed profitable status.

On one hand, Solectria has displayed solid growth over the past three years and currently ranks as the second-largest inverter supplier by installed capacity in the commercial market for Q1 2014. On the other hand, the commercial and utility landscape continues to tighten in the U.S. and commercial inverter pricing has fallen 22 percent in the past year.

Even so, large incumbents in the U.S. such as SMA, ABB and Advanced Energy are doubling down on the commercial sector (primarily through 3-phase string inverters -- a product that Solectria white-labels from Chint Power, despite coy denials from both firms), amidst continued low pricing from Asian suppliers like SunGrow and Chint Power.

With duties on Chinese modules adding pressure on BOS pricing, scaling within the U.S. commercial market will require adept navigation of the country's highly fragmented state-by-state demand and its similarly uneven installer landscape.

FIGURE: Leading Inverter Suppliers to the U.S. Non-Residential PV Market, Q1 2014

Source: GTM Research U.S. PV Leaderboard Q2 2014

For Yaskawa, it's better to enter the U.S. now than in 2016. Solectria isn't necessarily in the top echelon of inverter providers globally, but it has had a solid track record of growth in the U.S. market, especially in the commercial segment.

Access to other foreign geographies: B

A major limitation to Solectria’s geographic expansion to date has been its lack of a 50-Hz product line, which has essentially restricted the company to North American and select Latin American markets like Mexico and Brazil. Pre-acquisition, the company had intentions to expand into India and China, but the pricing environment was not conducive to actual investment. With a growing domestic market and the emergence of Latin America in the immediate view, investing in a 50-Hz product was a low priority.

Yaskawa’s global manufacturing base and footprint could provide a softer path toward expanding into foreign solar markets, especially in 50-Hz markets where Yaskawa already has a (non-PV) presence, such as South Africa, India, and perhaps even China. However, these products would still have to be developed before the company could make an entry into these new markets.

The short-term opportunity is geographic expansion, but the acquisition offers upside potential down the road.

Bankability for both parties: A

The bankability move for Solectria is obvious. The biggest reason it has been unable to move into the utility sector has been its status as a private company with a relatively small balance sheet. Solectria has allegedly been profitable (according to the company), but its overall revenues and cash reserves are small compared to much larger public companies operating in the U.S. Being part of a $3.6 billion industrial conglomerate solves the financial bankability issue overnight.

There's a bankability move for Yaskawa here, as well. Some may define bankability only as balance-sheet strength, but there's also a field experience component to bankability, especially for inverter manufacturers.

For example, in the early days of utility solar, U.S. developers used to ask Siemens for bankability reports on its PV inverters. Developers didn't necessarily think Siemens was going to go out of business (that's a story for another time), but they were concerned with how their inverters would hold up in the U.S. desert Southwest in comparison to temperate Germany. Solectria's field experience in the U.S. ensures that Yaskawa’s U.S. plans will not necessarily be held up by its limited PV experience.

The acquisition fills Solectria's biggest need in the U.S. market and gives it the tools needed to be aggressive in today's inverter market environment. The deal also provides instant credibility to Yaskawa in the U.S. market.

Supply chain effect: B

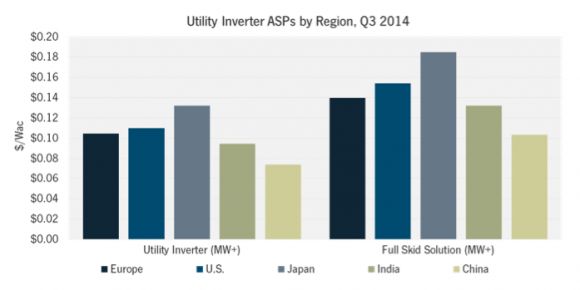

A major concern for inverter suppliers continues to be dealing with an ever-decreasing pricing environment. Although the U.S. market once allowed a sizeable premium, factory-gate inverter pricing has flattened globally.

Source: GTM Research Q2 2014 Solar Subscriber Executive Briefing

A major potential benefit for Solectria is that the acquisition gives it much greater buying power and increased access to global manufacturing. These factors could bring down Solectria's supply chain costs immensely and enable it to stay ahead of future price declines. There's further potential for Solectria's engineers to tap into Yaskawa's expertise in AC drives and other industrial equipment to help with future inverter designs.

While this is a positive result for Solectria, it doesn’t necessarily give either party access to anything that's truly differentiated from their largest competitors.

The overall verdict: B+

Before the deal, Yaskawa and Solectria were both medium-sized, regional providers positioned in strong growth geographies, but threatened by larger incumbents making aggressive moves. This deal fills needs for both companies -- bankability and global supply chain access for Solectria, geographic diversification and high-power solutions for Yaskawa -- and makes them both stronger.

However, the acquisition does not instantaneously create a new global leader; combined shipments for both companies were well under 1 gigawatt in 2013. Thus, the combined entity will still require strong integration and execution to continue its competitiveness in both the U.S. and Japanese PV market.

For companies like SMA, ABB, and Advanced Energy in the U.S. market, the deal offsets balance-sheet advantages in an increasingly crowded commercial and utility sector. As a result, it strengthens Solectria into a competitor that can’t be written off for utility projects that are still in development. While utility market leaders should still be able to point to a more extensive track record of projects and broader suite of utility solutions, competitive pricing will continue to be a challenge.

***

MJ Shiao is the Director of Solar Research for GTM Research; Scott Moskowitz is a research associate with GTM Research.