With earnings season just around the corner, you can expect a surge of articles highlighting the financial results of the usual solar suspects. However, as we wrote last week, a number of lesser-known, yet important, trends are overlooked in most solar coverage.

In this series, we'll highlight some of these less prominent global supply chain trends by sharing a selection from GTM Research’s Global Competitive Intelligence (CI) Tracker. Here, we focus on Shanghai Comtec Solar Technology and its success in the N-type cell market.

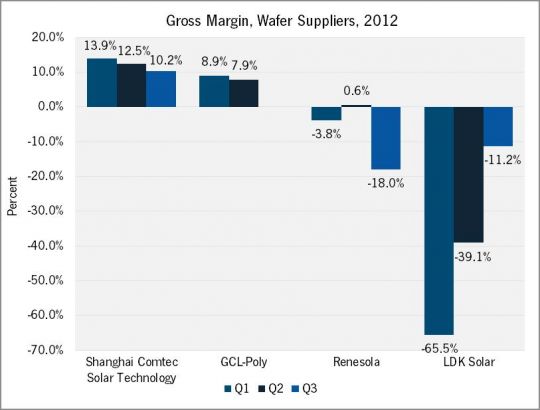

Over the past year, wafer margins were hit particularly hard by global overcapacity and the ensuing decline in average selling price (ASP). Though the second half of 2012 has seen significant stabilization of pricing, most wafer manufacturers (outside of GCL-Poly) have still struggled to sell product above fully loaded manufacturing cost.

Shanghai-based Comtec Solar, on the other hand, has performed significantly better than its peers, reporting gross margins consistently above 10 percent over the course of 2012.

Source: GTM Research Competitive Intelligence Tracker

What sets Comtec apart from its competitors? The company has successfully focused on ramping up production of wafers for high-efficiency (21 percent-plus) N-type cells, where the majority dopant is phosphorus instead of boron as in standard (P-type) cells. Comtec commenced production of its N-type product, called “Super Mono,” in mid-2011 and has been generating strong purchase orders ever since.

Comtec’s focus on N-type product (assuming that it can be produced cost-effectively) not only allows them to command a sizeable price premium, but also means they serve a far less competitive market -- namely, manufacturers producing N-type cells. Right now, the only companies doing so at scale are SunPower, Sanyo, and Yingli, the last of which produces its own wafers. But lest this seem a niche market, all three are major producers: total N-type capacity for these three firms at the end of 2012 was almost 2.5 gigawatts, and for a producer of Comtec’s size (YE 2012 capacity: 600 megawatts), that is more than enough, given that they have almost no competition at the moment.

This brings us to the obvious question: given Comtec’s success, why hasn’t there been more penetration into the N-type wafer space? Why haven’t the Chinese giants -- Renesola, LDK and GCL-Poly -- taken steps in this direction? We suspect that the answer lies at least partly in the small current size of the N-type cell market relative to the capacity of these larger players, with the majority of demand coming from just two cell/module firms. Though many industry roadmaps foresee a transition from P-type to N-type mono eventually, there are significant technical and cost-related challenges involved in doing so, particularly in the area of boron diffusion at the cell fabrication step. And with the balance sheets of most solar companies in fairly poor shape, it could be a while before we see wholesale industry adoption.

Meanwhile, some cell and wafer firms are beginning to make first steps toward commercializing their own variants of N-type technology. Trina Solar announced a research agreement with the Australian National University (ANU) to develop N-type cells in 2011, and Comtec will see competition in the N-type wafer space from Korean firm Nexolon, which increased its mix of N-type and Full Square Mono (FSQM) product to 17 percent of mono-wafer shipments in the second quarter of 2012. Given these developments, it is more than likely that R&D efforts by other large wafer and cell firms have been underway for some time. Going forward, the commercial progress of N-type products certainly warrants close monitoring.

We’ll be covering additional important but less-than-obvious trends about the global PV supply chain next week in Part III. In the meantime, check out GTM Research’s Global PV Competitive Intelligence Tracker.