According to a new report from GTM Research and SoliChamba Consulting, 58 gigawatts of monitored PV will be added to the world’s total in 2016, bringing the cumulative PV monitoring market to 242 gigawatts. In addition to a growing installation base, the PV monitoring landscape is undergoing tremendous change as it integrates into the broader PV software ecosystem, deals with additional regulatory and cybersecurity requirements, and faces challengers from the energy management market.

Now in its fourth edition, the report, Global PV Monitoring 2016-2020: Markets, Trends, and Leading Players, is the industry’s most comprehensive analysis of the global PV monitoring market.

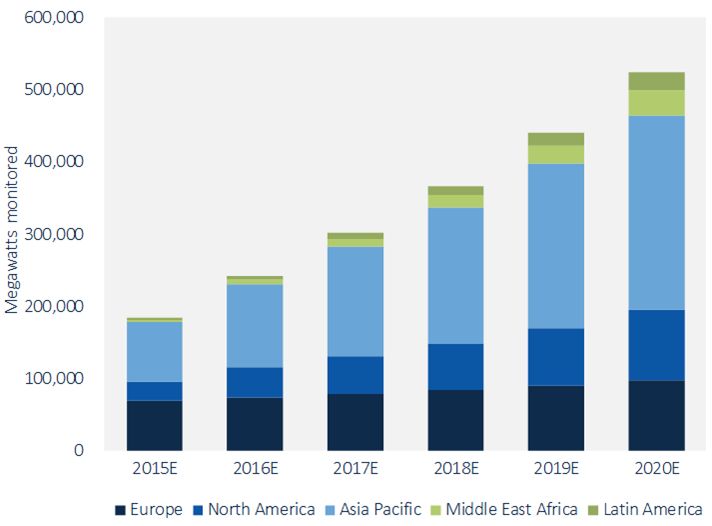

Led by China’s massive utility-scale segment and Japan’s feed-in tariff backed market, the Asia-Pacific region will account for 56 percent of the global total. North America will be the second largest region with 27 percent, followed by Europe, the Middle East and North Africa, and Latin America.

FIGURE: Global PV Monitoring Market, 2015-2020E

Source: Global PV Monitoring 2016-2020

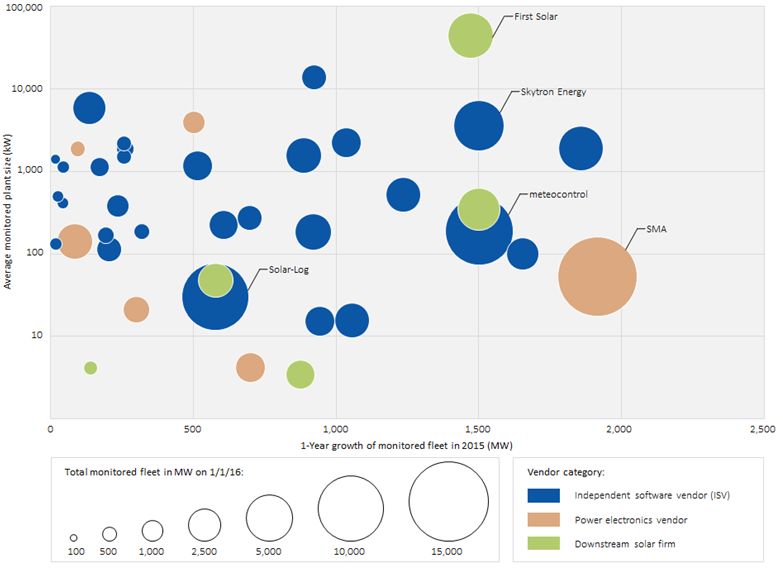

Monitoring vendors are diverse in terms of both geography and business model. The report categorizes vendors in three segments: independent software vendors (ISVs), power electronics vendors, and downstream solar firms. Globally, of the top 10 firms, six are ISVs, two are power electronics vendors, and two are downstream solar companies.

FIGURE: Global PV Monitoring Vendor Landscape

Source: Global PV Monitoring 2016-2020

In 2015, the market experienced significant merger and acquisition activity including BKW’s acquisition of Solar-Log, meteocontrol’s acquisition of iTerra, and Genscape’s acquisition of U.S. residential PV monitoring market leader Locus Energy. The report notes that the PV monitoring market is likely to see similar activity in 2016. In fact, Solarrus Corporation just announced the acquisition of Power Factors this month.

“Monitoring is business-critical for the technical, commercial, and financial operation of PV assets, and investors are now considering bankability as an important factor when selecting a provider, especially after seeing large players in all vendor categories go through financial turmoil, including bankruptcies,” according to the report.

GTM Research and SoliChamba Consulting forecast the global monitoring market to surpass 524 gigawatts by 2020.

For more information, download the free executive summary here.