GE (NYSE:GE) got into the wind business in 2002 when it bought Enron Wind at a going-out-of-business-sale bargain price.

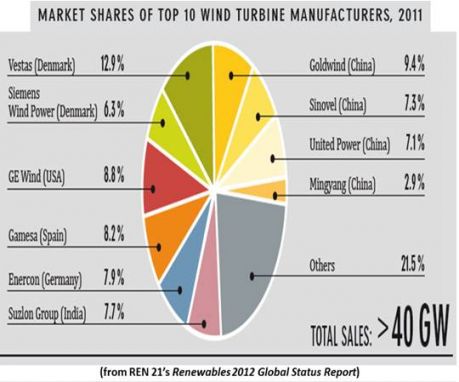

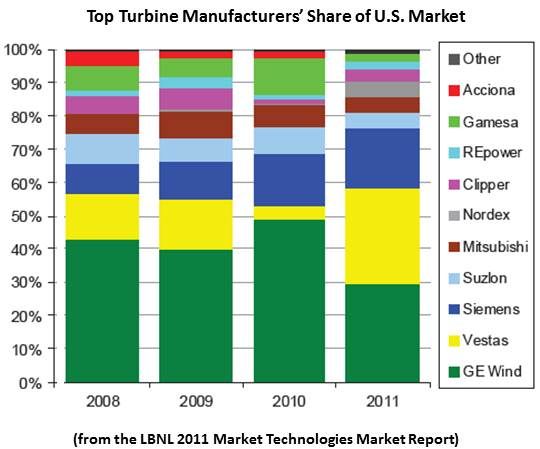

In November 2012, GE installed its 20,000th turbine. GE is the biggest turbine manufacturer in the U.S. and the world’s third largest. More than 3,000 of GE's turbines will be built in 2012, a year in which GE said it will break its previous annual capacity installation record of 3.99 gigawatts.

But in a recent interview, GE General Manager Matt Guyette said that “more than 70 percent of GE’s wind turbine deals so far this year have been overseas.”

The U.S. wind industry is doing everything possible to get turbines in the ground before the December 31, 2012 expiration of the production tax credit (PTC). But because Congress did not extend the PTC for 2013, the industry has pulled back. Plants have been shuttered, workers have been laid off, and developers have set sail for foreign shores.

Some say wind is ready to face life without the PTC, but Capitol Hill insiders expect a one-year retroactive PTC extension to come in the early weeks of the next session of Congress.

But the manufacturing of heavy-duty, high-tech machines like GE’s workhorse 1.6-megawatt and 2.5-megawatt machines requires twelve to eighteen months of lead time. And the hundred-million-dollar or billion-dollar development deals involving thousands of acres of land and twenty-year power purchase agreements with utilities take one to two years to complete.

So GE will be doing business in Latin America, Eastern Europe, the Middle East and the Asia Pacific next year.

GE is hardly alone. Spanish mega-developer Iberdrola (PINK:IBDRY) which, according to industry insiders, has one of the strongest balance sheets in the renewables industry, announced Q3 2012 earnings up 12 percent and said it will slow growth in its U.S. business “until more favorable conditions arise.”

Goldwind USA (PINK:XJNGF), a subsidiary of the Chinese wind giant formed in 2010 to go after the booming U.S. market, is redirecting its project development toward Latin America.

This is the trajectory of the wind market in 2013.