The Greentech Media list of profitable fuel cell companies (TM) has begun to serve as a call for action and motivational talking point at fuel cell companies. Fuel cell CEOs are challenging their firms to join our list of profitable fuel cell firms, which currently reads as such:

Chip Bottone is the President and CEO of FuelCell Energy (Nasdaq:FCEL), one of the fuel cell firms with a real shot of being the first company on that list.

We spoke with Bottone last week and he admits that the "industry has overpromised and under-delivered for a long time."

But he said, "I want to deliver."

FuelCell Energy builds molten carbonate stationary fuel cell power plants deployed at wastewater treatment plants, schools, pump stations, and sites that need large-scale. low-emission baseload distributed generation.

FuelCell Energy has had three consecutive quarters with positive gross margins, revenue that beat expectations, and a strong backlog. Total revenues in the most recent quarter improved to $31.3 million. Product sales and service backlog improved to $184.1 million as of the end of January. The firm has a big 120 megawatt deal with Korea's POSCO Energy, a service agreement with utility Southern California Edison, a joint venture with Fraunhofer IKTS and a partnership with Spain's Abengoa.

Fuel cells were invented in the 1800s, and there are a few fuel cell firms going after the same stationary fuel cell market as FuelCell Energy. They have in common a strong technological focus, a dependence on subsidies, and a tendency to lose large sums of money. Vendors in the large-scale power sector include Bloom Energy and United Technologies.

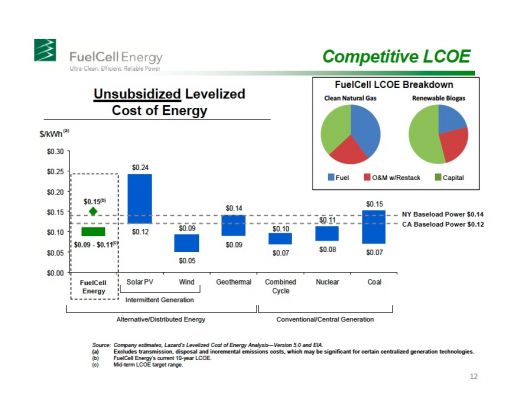

Bottone realizes, "We have to produce grid parity power without incentives," adding "The fuel cell guys need to break out of the wind and solar pack."

The firm looks to get to profitability at a yearly shipment rate of 80 megawatts to 90 megawatts. Production levels are currently at 56 megawatts annually compared to production of 22 megawatts in 2010. The company has a market cap of $179.1 million.

The decline in the price of natural gas -- an input for fuel cells -- is a boon for fuel cell companies. Most of the economic modeling done by FuelCell Energy is for $8 per mmbtu gas, but Bottone notes that every $2 drop in the price of natural gas translates to a penny lower in the price per kilowatt-hour. "At $5 gas, we're at $0.135."

Natural gas is currently much cheaper than that.

Incentives in California and other states, plus the federal ITC, get the price to below $0.10 per kilowatt-hour, according to Bottone, but, in his view, "We have to produce grid parity power without incentives," adding, "I don't want to have a business dependent on incentives forever. The key is to reduce costs -- and that happens with volume."

"We can make a few percent margin at a 56-megawatt run rate," according to Bottone. He sees the company's strategy as getting traction on both U.S. coasts, leveraging the POSCO activities, and entering the European market. "If we can do 210 megawatts a year through our supply chain, we're there," said the CEO. We have to go from 56 megawatts to 90 megawatts to break even" -- and the CEO believes it can be done "with a limited amount of capital."

The cost reduction to get to grid parity mostly comes from scaling up the supply chain. And most of the those improvements come from scrubbing cost out of the fuel stack.

Bottone sees megawatt scale and its lower transaction costs as one of the keys to FuelCell's success. Molten Carbonate Fuels Cells (MCFCs) scale big better than other technologies such as CleanEdge's PEM or Bloom Energy's Solid Oxide Fuel Cells (SOFCs), according to the CEO.

Pricing also favors MCFCs; Bottone pegs residential PEM at approximately $10,000 per kilowatt, Bloom's SOFCs at $8,000 per kilowatt, and Fuel Cell Energy at $3,000 per kilowatt. Bottone notes that FuelCell provides heat and power, while Bloom only provides power.

FuelCell's typical customer uses both electricity and thermal power. That typical customer is a university or municipal waste water plant that needs megawatt-scale baseload and has a good use for the 600-degree F heat (such as producing hot water to diminish boiler load).

There are a few ways to pull in revenue from these power plants:

- The Power Purchase Agreement (PPA) which allows the customer the luxury of no upfront cost.

- The utility model where a PG&E or SCE buys the unit and rate-bases the cost.

- Or an instance where an entity like a university or municipality buys the unit.

Another source of revenue is the 15- to 20-year service agreement, where the customer owns the equipment but FuelCell operates the plant.

Bottone said, "Soon we'll have 100 megawatts out there running." Service revenue is about ten percent of the company's income. That recurring revenue could eventually be 30 percent to 40 percent of the firm's revenue.

Competition for FuelCell Energy are vendors in the 200-kilowatt to 3-megawatt unit size, which means Bloom Energy and United Technologies. But when it comes to megawatt-scale, the CEO of FuelCell Energy thinks he has a cost advantage as the size of the projects grow.

Declining prices, government incentives, cheap natural gas, demand for cleaner power and improving technology have begun to revive the fuel cell industry. In the U.S., fuel cell incentives include a federal tax credit for 30 percent of the cost of a fuel cell. California kicks in another $2.50 per watt. It's still expensive, but grid parity is not far off for this baseload distributed generation resource.

Our list awaits its first entrant.