In 2014, the vast majority of storage projects Greensmith Energy was working on might have best been described as science projects, often dependent on grants or utility R&D budgets devoted to figuring out emerging technologies.

But there was one 20-megawatt project in PJM territory that was unlike all of the others, and not just because of its size. “That was the first project Greensmith ever did in the company’s history that was driven primarily by the financial returns of the project to their customers,” said Risto Paldanius, director of business development for Wärtsilä Energy Storage, Solar and Integration division, who played a key role during the Greensmith acquisition by Wärtsilä in 2017.

It’s a testament to just how much the economics of battery storage and the renewables it supports have improved in less than a few years. Today, potential projects are evaluated primarily on their business case. “If we don’t think the business case is real, we won’t target projects,” said Paldanius. “Close to 100 percent of our projects are commercially driven.”

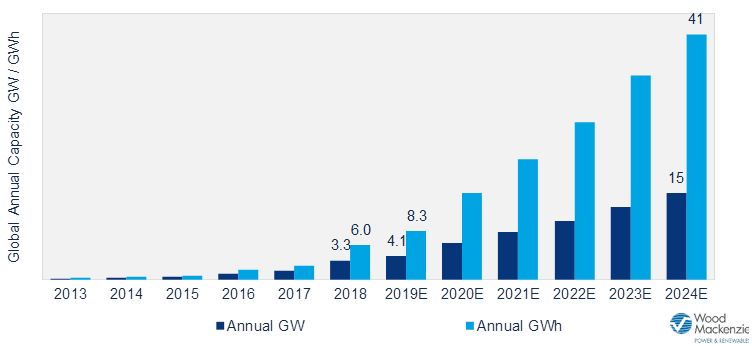

In 2018, global energy storage deployments grew 147 percent year-over-year to reach 3.3 gigawatts, or 6 gigawatt-hours, according to Wood Mackenzie Power & Renewables. That’s nearly double the average 74 percent compound annual growth rate for the industry from 2013 to 2018. In fact, last year’s deployments made up more than half of the total amount of storage deployed in the past five years, “indicating an inflection in storage demand,” Ravi Manghani, WoodMac’s head of storage research, said when the findings were published in April.

There are other signs of a maturing storage market. For example, customers and manufacturers considering a storage project used to insist on a warranty based on a worst-case scenario.

“Today we are talking about fully flexible warranties that are truly based on the system’s actual operational profile. If it’s one cycle per day, you degrade 20 percent, for example, or for one-and-a-half cycles, you degrade 30 percent. This way, system operational cost is based on actual operations and the warranty matches how the asset owner operates the system,” said Amy Liu, manager of applied technology at Wärtsilä, Energy Storage, Solar and Integration.

For instance, Wärtsilä now knows the small, but noticeable, difference in availability in different size systems. For example, a 6-megawatt project could have an average availability of 97.97 percent, while a 10-megawatt system may have a 98.36 percent availability, and a 20-megawatt system could have an average availability of 98.28 percent.

Expanded opportunities to make money

The reason most energy storage projects these days are driven by solid financial returns is because there are more and more ways to generate revenue.

In PJM and other markets around the globe, utilities and independent power producers (IPPs) are increasingly seeing storage as the most economic way to capture payments for ancillary services. Capacity markets and stacked services are also making large energy storage projects financially attractive. For example, Wärtsilä, Energy Storage, Solar and Integration worked with the IPP AltaGas to install and operate a 20-megawatt battery in the wake of the Aliso Canyon gas leak in California.

As a result, AltaGas inked a 10-year capacity contract with Southern California Edison to make 80 megawatt-hours of energy available whenever the utility needs it. “On top of that, they can get more revenue by buying and selling energy in the energy market in California and by participating in the frequency regulation market in California,” said Paldanius. “The main business case is capacity, but there are also added revenue streams.”

Better software equals more revenue

Cheaper batteries alone are not enough to maximize the business case and financial returns of large energy storage projects. Sophisticated energy management software (EMS) is required to automate battery charge and discharge in the most economically optimized way possible.

Wärtsilä, Energy Storage, Solar and Integration approaches this sort of asset optimization by first conducting detailed modeling about how a storage system can take best advantage of market rules in order to generate the most revenue. “Then in the deployment phase, when we control the asset, we’ll do automatic bids into the marketplace to optimize the revenue,” said Paldanius. “That happens with forecasting of prices and then scheduling and bidding of those resources. That is a value that a battery manufacturer can’t offer.”

The importance of EMS to the effectiveness of storage projects is on display on the Caribbean island of Bonaire, which is part of the Netherlands Antilles. Earlier this year Wärtsilä, Energy Storage, Solar and Integration deployed its Greensmith energy management software, called GEMS, along with a 6-megawatt/6-megawatt-hour battery storage system to supply electricity to the island’s 19,000 residents.

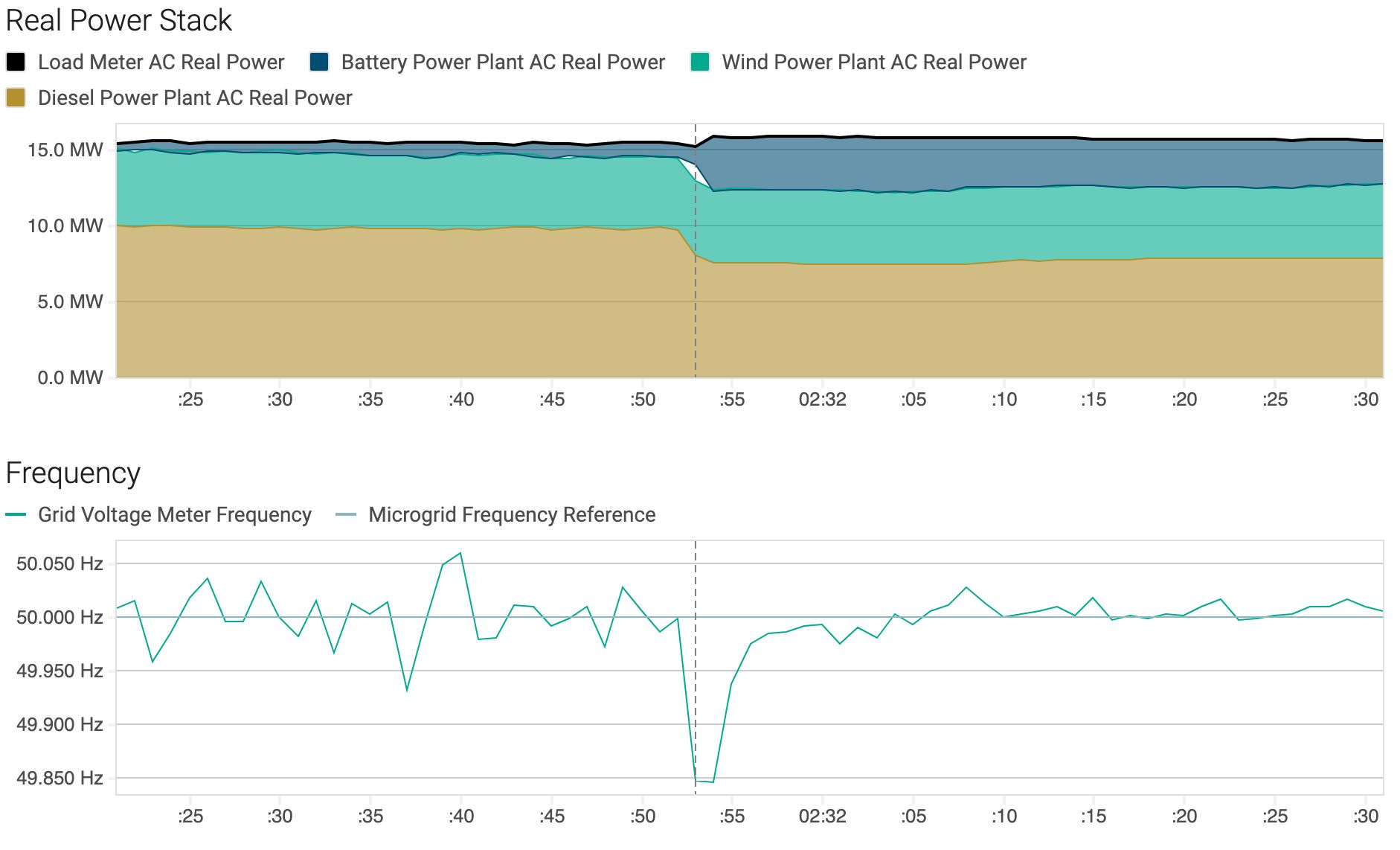

One of the main aims of the project was to increase the deployment of renewable energy. Before the project began, Bonaire was meeting the island’s load — which averaged between 12 and 15 megawatts — with a combination of a 14-megawatt engine power plant burning heavy oil and 11 megawatts of wind. To ensure adequate reserve power that could be quickly ramped when the wind wasn’t blowing, some of the engines had to operate continuously.

“In many cases, they had enough wind such that they had to curtail it to keep the engines at minimum load,” said Paldanius. “Now the energy storage system provides the bulk of reserves on the grid, and that allows them to run wind without curtailing.”

In the example below of how the system operates, when one of the five running engines suddenly tripped offline, it disconnected from the grid and no longer provided power. This caused a sharp drop in frequency and a drop in voltage, due to the sudden increased load strain on the other running engines and batteries. Because of the fast response time of the inverters, the energy storage system (ESS) almost immediately increased its power output after the engine trip by 2.4 megawatts to make up for the lost generation. The quick power injection from the ESS also allowed the grid to quickly stabilize and recover frequency and voltage back levels.

Since the system began operating in March, renewable penetration has increased from between 15 and 25 percent to 33 percent and the island is looking at adding more renewables.

It’s a model Paldanius sees working for grids around the world, including in North America. “Here we have 3 percent of peak power allocated to spinning reserves from thermal plants,” he said. “It doesn’t matter what fuel those plants burn or the make or model of the plant, in just about every case it would be cheaper to have battery storage because it can respond as fast or faster and has lower capex and opex costs.”

--

Now in its fifth year, the Energy Storage Summit will bring together utilities, financiers, regulators, technology innovators, and storage practitioners for two full days of data-intensive presentations, analyst-led panel sessions with industry leaders, and extensive, high-level networking.